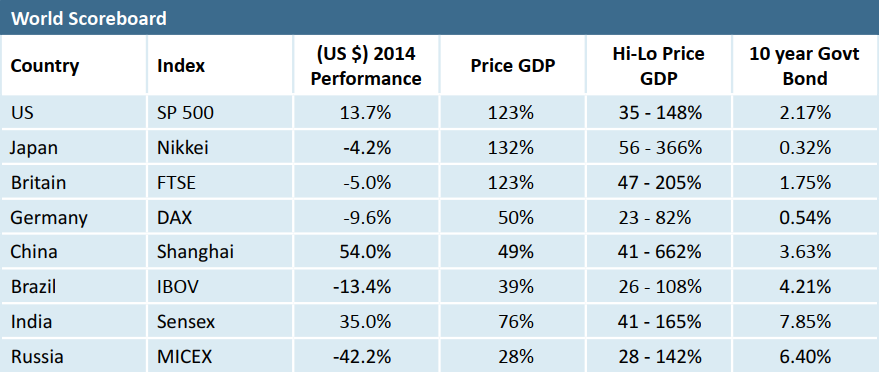

2014 turned out to be a pretty good year for U.S. investors, as U.S. stocks continued the rally that started in the first quarter of 2009. However, worldwide stock market performance was a mixed bag as can be seen from the following table:

We frequently hear about increasing correlation between world’s financial markets, however 2014 was a year where stock market performance was widely disparate. Interest rates are also an area with significant divergences. Warren Buffett mentions frequently that a nation’s total stock market valuation relative to its GNP is the most useful measure of under or overvaluation. Using a similar metric, of the countries included in the above chart, the U.S. is one of the most overvalued stock market and Russia and China are the most undervalued. For several years now, the U.S. has been viewed by investors as a safe haven for investment and prices have been bid up relative to the rest of the world.

We believe bubble-like activity appears to be occurring again in certain real estate markets as historically low interest rates have encouraged developers to get back into the pool. In New York City, 432 Park Avenue is a 104 unit condo project which has average condominium sales prices near $30 million. At 42 Crosby Street, also in New York City, a 99 year lease on a parking space is selling for $1 million. A real estate bubble in Seattle appears possible as well with cranes dotting the skyline and at least six major new office projects underway in downtown. The last two major office towers completed in downtown Seattle were the Russell Investments Building and 1918 8th Ave, Construction was completed in 2006 and 2009 respectively.

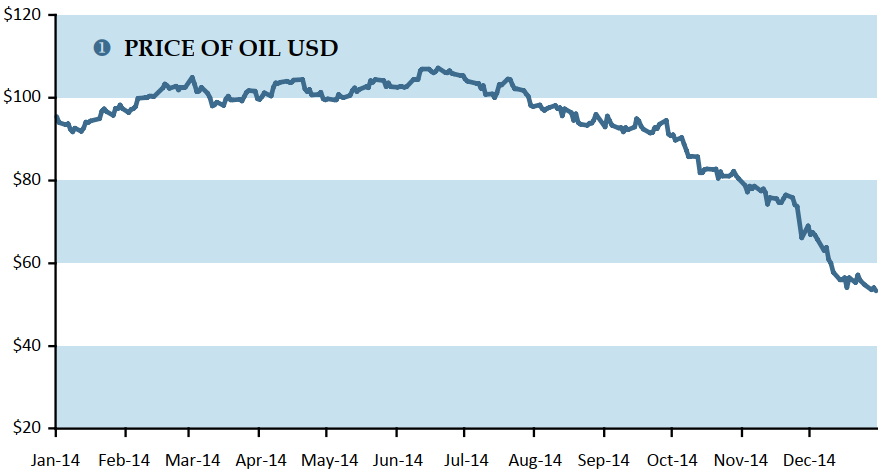

The Two Most Surprising Charts of 2014

As is typical with most large asset price moves, very few experts predicted that oil prices would decline 50%. Forecasts tend to be anchored to the recent past, and that did not prepare the experts for what occurred in 2014.

The large reduction in oil prices will produce winners and losers. We believe China, Japan and India will be big winners and Russia, Venezuela and many Middle Eastern nations will be big losers. It has been a pleasant surprise to see a $2 number at the gas pumps.

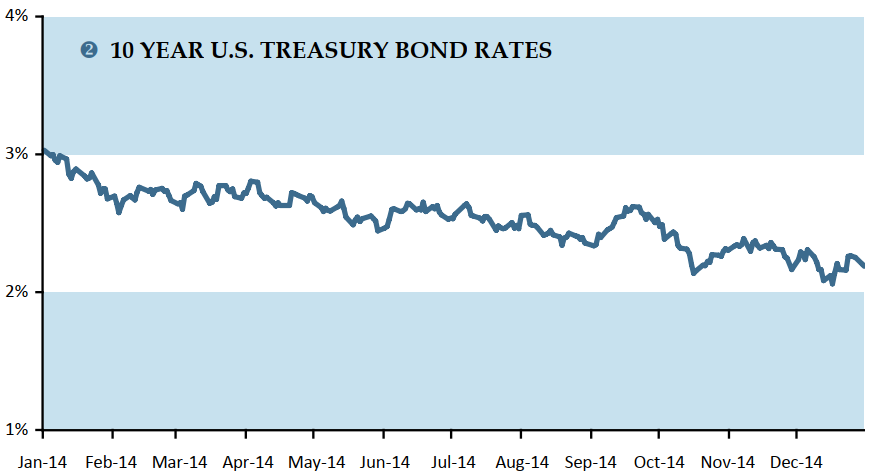

The other big surprise was the continued decline in U.S. Treasury bond rates with the end of QE 3. We have been continually surprised at the persistence of falling interest rates which started in September 1981.

Looking Ahead

We think 2015 will be a good time to be careful with U.S. stocks and to potentially increase exposure to Asian stocks, especially China. Chinese stocks are very cheap on a PE basis and pay high dividend yields, in each case relative to S&P 500, and there is real reform initiatives taking place under President Xi Jinping’s guidance. The Chinese economy is a big beneficiary of low energy prices and household savings have increased almost 50% over the last three years. Interest rates are starting to decline and the Chinese Government appears to be attempting to devalue the Yuan.

We believe values are beginning to surface with the massive decline in oil prices and a larger decline in many exploration and production companies. It is probably too early to make a large investment in the energy sector area, but we are looking closely at opportunities in the sector.

We continue to believe that expected future returns from the traditional asset classes of stocks, bonds and cash will remain in the low single digits until the next bear market. Similar to our beloved Seahawks, we think the best way to participate in today’s high valuation market is to play strong defense and be opportunistic on offense.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.