We’re taking a look under the hood to evaluate winners and losers of 2020.

Freestone Insights

Given the wild stock market we have had year-to-date, we are taking a deeper look under the hood at winners and losers in 2020.

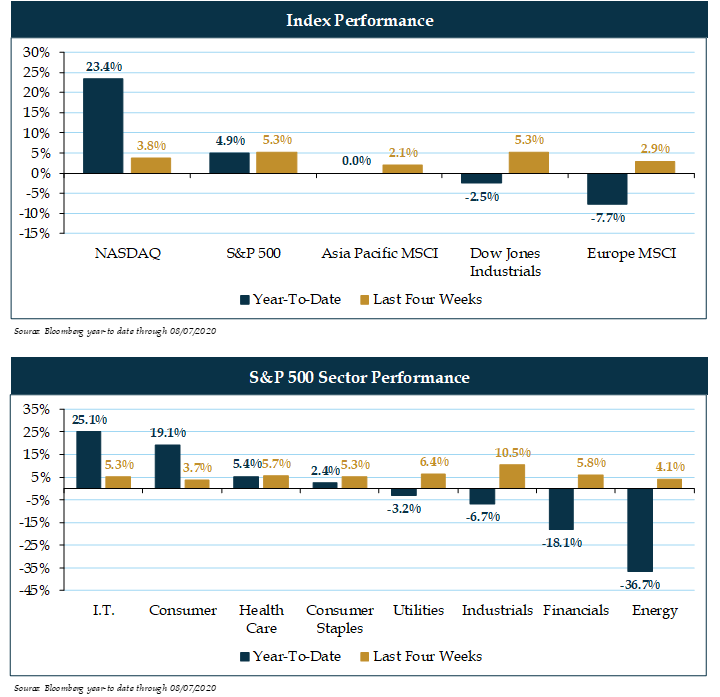

Market Scorecard as of August 7, 2020 in United States Dollars

Most markets around the world are flat to down in 2020. One exception to that trend is the technology-heavy NASDAQ. COVID-19 has been hard on basic industries while many technology business models have been impacted positively. The trend of technology stocks leading has been ongoing for ten years. Over the last four weeks, some of the non-information technology sectors are starting to outperform, perhaps in anticipation of a working COVID-19 vaccination later in the year.

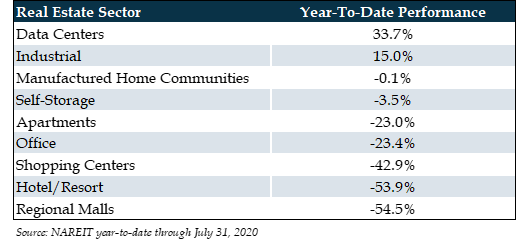

Not All Real Estate Is Created Equal

The old saying for real estate used to be “location, location, location.” Location remains important, however COVID-19 has accelerated trends that were already in place. Here is the year-to-date performance of publicly traded real estate stocks by sector through July 31, 2020.

A recent report has Amazon considering leasing space in large regional malls to position fulfillment centers even closer to consumers, showing that the markets can quickly adapt to find opportunity even in the most dire scenarios.

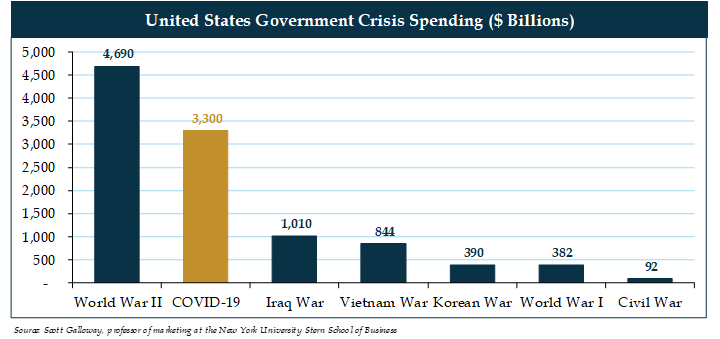

How Will We Pay for the COVID-19 Stimulus?

The U.S. Government has spent $3.3 trillion on the COVID-19 stimulus. To put things in perspective, the table below shows how COVID-19 spending compares to previous government crisis spending, adjusted for inflation.

It seems likely that before we are done, COVID-19 spending will exceed what we spent on World War II, adjusted for inflation. It seems unlikely that we will ever pay down the deficit. We think this is one of the reasons behind the recent resurgence of gold as the concerns of future inflation have increased.

An Early Look at Biden’s Tax Plan

- Corporate tax rates go from 21% to 28%, representing a 33% increase

- Individual maximum tax rate goes from 37% to 39.6%

- Capital gains tax rate goes from 23.8% to 39.6% for taxpayers earning over $1 million

- Elimination of the step up in basis on death

If You Own Low Basis Stock

In the last edition of Insights we mentioned that a Democratic sweep in November’s elections would likely result in the reduction of the currently generous $11.58 million estate tax exemption. Under a Democratic sweep scenario, we would expect the long-term capital gains tax rate to increase from 23.8% to 39.6% for a taxpayer with income over $1 million. If you own low basis stock (e.g., long held shares of Microsoft or Amazon), it might make sense to reduce your position in 2020. Also, on the block is the elimination of the “step up” in basis for heirs of individuals who pass away, which would greatly reduce the value of holding low basis stock for a lifetime.

Connect

See your Client Advisor team to discuss these or other issues that may impact you and your family. We are available by phone or video conference and always look forward to connecting with you.

Important Disclosures: This post contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this post is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this post. While we believe the information in this post is reliable, we do not make any representation or warranty concerning the accuracy of any data in this post and we disclaim any liability arising out of your use of, or reliance on, such information. This post speaks only as of the date indicated. The information and opinions in this post are subject to change without notice, and we do not undertake responsibility to update any information herein or advise you of any change in such information in the future. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Indices are not managed and it is not possible to invest in an index. Portions of this post constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.