- OVERVIEW: Ongoing trade disputes and the approaching presidential election capture media attention and generate headlines. Although these risks pose a threat to the U.S. economy, consensus among economists and market commentators holds that current economic data is positive and there is little indication of a near term economic downturn.

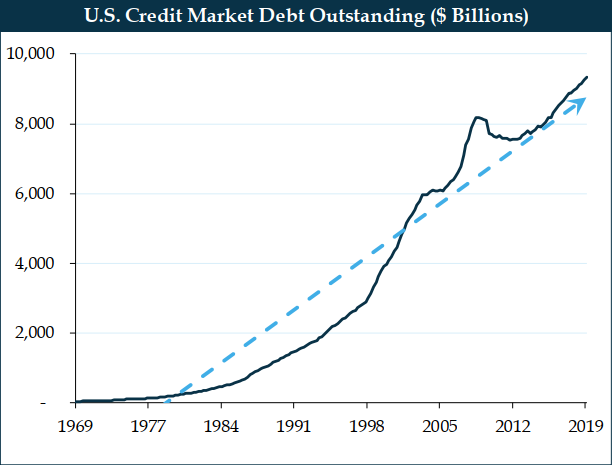

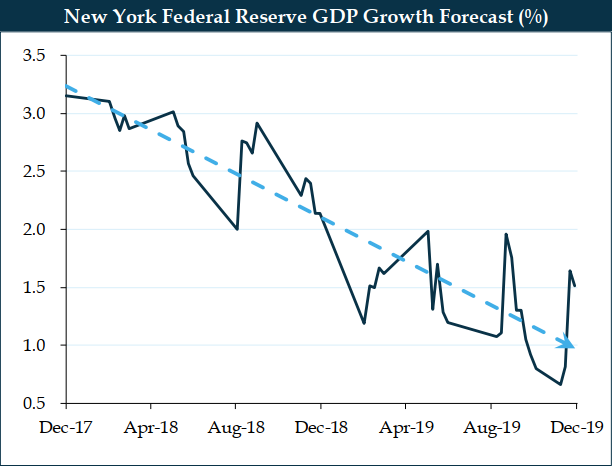

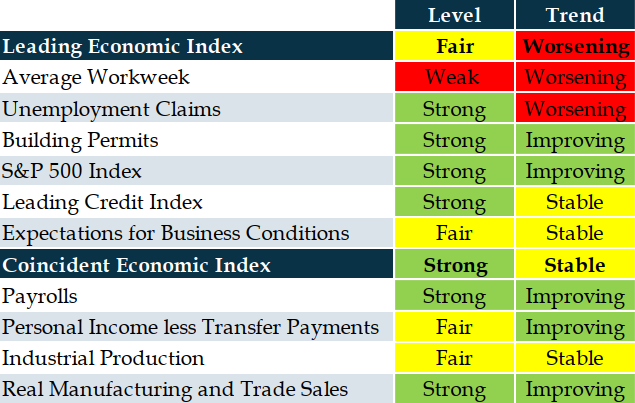

- ECONOMIC LEVELS & TRENDS: The U.S. is in a high debt environment both at the consumer and corporate level. Elevated debt levels typically result in more modest GDP growth. Despite heightened levels of debt and lower GDP forecasts, both the leading and coincident indicators remain strong.

- LABOR MARKETS: The U.S. unemployment rate fell to a 50-year low of 3.5% in Q4 2019. Economic research suggests the rate could trend upwards as the pace of employment growth slows.

- MONETARY POLICY & INFLATION: Economists do not anticipate a change in the Federal Reserve’s policy rate throughout 2020. At the Fed’s first meeting of 2020 on January 29th, the central bank did not deviate from expectations. Despite accommodative monetary policy, inflation remains stable, averaging roughly 1.8% over the last decade. Monetary policy appears to have inflated asset prices with the S&P 500 Index up 256.4% over the same time period.

- POLITICAL TURBULENCE: The U.S. presidential election occurs on November 3rd, 2020. Many political commentators, investors, and economists believe differences in policy between President Trump and his potential Democratic replacement are substantial. The heightened uncertainty could have an outsized impact on consumers and businesses throughout the year.

- LONG-TERM OUTLOOK: Recent economic data is positive. Stock markets are at record highs, the unemployment rate is at record lows and monetary policy is stable. The economic outlook for 2020 is bright. However, developments in U.S. and China trade relations, coronavirus, the approaching presidential election, and disruptive technologies could alter the shape of the economy.

Overview

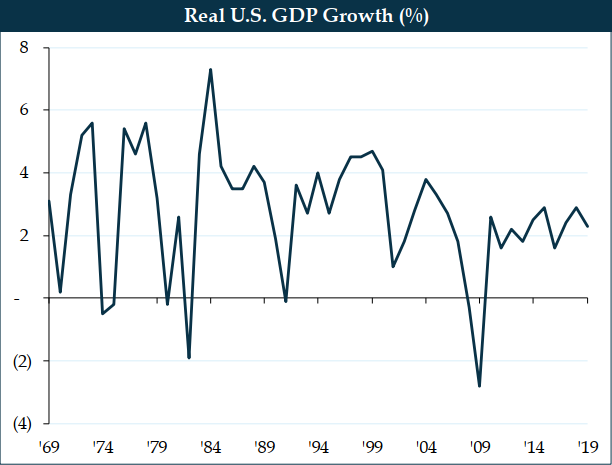

Despite the record long expansion dating back to June 2009, optimistic expectations for the U.S. economy remain. For the first time in our country’s economic history, we’ve experienced an entire decade without a significant recession or even mild pullback. To be sure, the past decade was far from ordinary. The global economy suffered a tremendous blow from the financial crisis, triggering unprecedented central bank policy. Many economists and investors keenly track headline news, such as the ongoing trade war between the U.S. and China, negative interest rates in many developed international nations, and the looming presidential election in November.

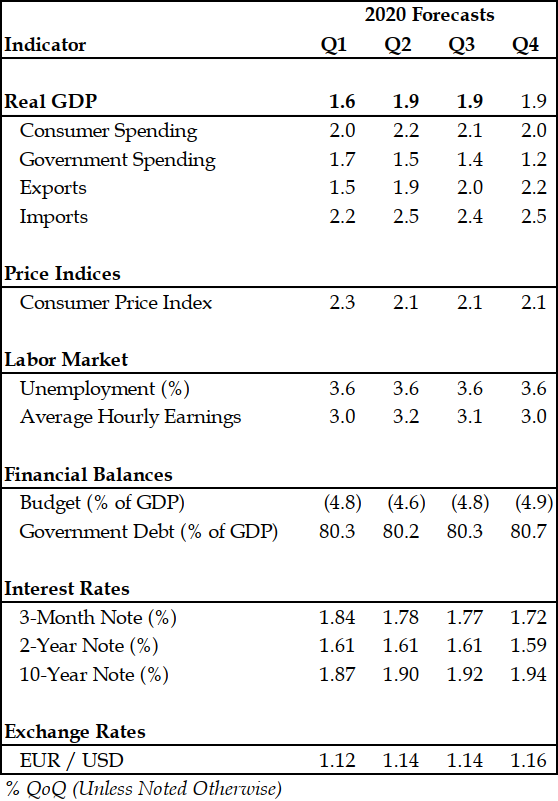

While these events carry the capacity to impact the lives of many Americans, current underlying economic data is strong and does not suggest a downturn in the near term. In the short term, market expectations are that the record long expansion will continue, with real GDP growth close to the economy’s 2% potential rate, unemployment remaining near or slightly above its current 3.5%, and core inflation within the Federal Reserve’s 2% target. However, headline risks pose potential obstacles to both economic confidence and further expansion. The outlook over the next few years appears especially muddled, largely due to the fact that the outcome of the upcoming U.S. election could result in a wide range of monetary policy regimes, leaving significant uncertainty about what to expect going forward.

This report intends to review several drivers of economic activity in order to evaluate different areas of the market. This report does not intend to make predictions about global economies or financial markets.

Economic Levels & Trends

Charles Schwab’s Chief Investment Strategist, Liz Ann Sonders, claims that “when it comes to the relationship between economic fundamentals and the stock market, better or worse matters more than good or bad.” The latter part of her statement is apparent; we are in a high debt environment, which historically translates into lower forecasts of GDP growth as shown in the charts below. At first glance these underlying economic data points suggest caution, but let’s also examine the former part of her theory.

As shown below, both the leading and coincident indices for the U.S. economy portray (in some instances) improving data points despite more than a decade of conservative expansion. Some leading indicators have started to show weakness, suggesting a degree of caution is warranted, but the data are still above the warning zone per economists. Coincident metrics are stable and portray a similar story, indicating that a recession is unlikely in the short term.

Labor Markets

The U.S. unemployment rate, one of the most closely followed economic data points by investors, economists, and politicians, fell to a 50-year low at 3.5% in Q4 2019. Our nation now has more than one job for every unemployed person, resulting in added pressure on wages as employers look to retain talent. But how low can unemployment go? An article by Capital Economics, an economic research consultancy group, suggests this level of unemployment won’t be sustainable throughout 2020. Their economic research anticipates new job growth to slow below 100k per month in the coming months, which should push the unemployment rate higher.

Fewer people of prime working age are out of the labor market because of health or family complications, due to a decline in fertility rates and the lessening impact of the opioid crisis, both trends that should persist over the next few years. The labor force rose by an average of 120k per month in 2019, and as employment growth starts falling below 120k per month, the unemployment rate should edge higher. Typically, a rise in the unemployment rate first appears in a modest increase in jobless claims. As shown in the table above, low unemployment claims indicated economic strength in recent years. As employment growth shrinks and jobless claims increase, the expectation is that the unemployment rate will begin to rise back towards 4%, still well below its 9.93% reading on the last day of 2009.

Monetary Policy & Inflation

The Federal Open Market Committee expects the Federal Reserve to leave its Federal Funds policy rate unchanged during 2020 at 1.75%. In fact, during their first meeting of the new year, the Fed did leave the policy rate unchanged as expected by most economists.

The past decade saw the central bank implement quantitative easing (“QE”). QE is an initiative by which the Fed purchases mortgage-backed securities or U.S. Treasury bonds, increasing liquidity in the flow of capital in an attempt to make it easier for businesses to borrow money. The Fed implemented QE as a way to achieve better financial conditions over the period during and after the financial crisis that began in 2008. Central banks turn to QE when they believe that further reductions in their policy rates are either not possible or unhelpful. Despite QE, inflation has been flat, averaging 1.8% over the past decade as shown in the graph on the following page. Many believe this low inflation period is due to shifts in demographics and improvements in technology, partially offsetting the Fed’s unusual monetary policy stance.

Ray Dalio, billionaire founder of the world’s largest hedge fund Bridgewater Associates recently stated that “cash is trash” and investors should place their hard-earned money in equities rather than searching for safety in savings accounts. Another survey conducted by Bank of America concluded that money managers currently hold the least amount of cash in their portfolios since 2013.

As shown below, asset price inflation, as measured by the S&P 500 Index, has far outpaced traditional economic inflation over the last decade. The trend has been increasingly obvious in recent years as inflation remained relatively stable while the S&P 500 Index marched forward to new record highs, supporting Dalio’s claim.

Although tariffs could place upward pressure on inflation, the signing of the Phase One Deal between the U.S. and China, and weaker economic growth, are expected to keep inflation stable over the next year. In today’s economic environment, it appears that interest rates and inflation remain trapped near zero and that cash may no longer be king.

Political Turbulence

The idiosyncratic event with the most potential sway over economic forecasts is the upcoming U.S. presidential election. Polls and political commentators anticipate a tight race with Moody’s Analytics projecting a re-election of President Trump in November. Moody’s forecast assumes that Trump’s approval rating and the U.S. economy remain stable, and no atypical events occur in voter turnout. The President’s approval rating seems steady, but negative impacts from the trade war on the economies of key swing states, such as Michigan, Pennsylvania and Wisconsin could be a weak point for a Trump re-election. Also, turnout for the 2018 midterms could point towards a higher than usual Democratic turnout when it comes time to head to the polling stations in November.

A Trump win could lead to a doubling down of current economic policies, including additional tax cuts, increased government spending, continued trade tensions with China and other nations and the potential for tougher immigration policies. The case for a Trump re-election is that voters remain pleased with current economic policy and will vote for more of the same initiatives.

A Democratic presidency might see economic policy undergo a profound turnaround. The minimum belief by economists and policy analysts is a reversal of the Trump tax cuts for wealthy and higher income Americans, and much looser immigration restrictions. A Democratic president may move to end the ongoing trade disputes and pursue more aggressive tax increases on the wealthiest Americans to finance an expected expansion of social programs. The composition of the next U.S. Congress will decide whether these potential policy changes end up as law.

Given outsized differences in economic policy between Trump and a possible Democratic successor are blatant, uncertainty and turbulence surrounding the presidential election are likely to have an outsized impact on both consumer and corporate behavior throughout 2020. Although the outcome of the election will flow through to the economy in the near-term, the eventual decision made by Americans will be even more important for the economic outlook in 2021 and subsequent years.

Long-Term Outlook

Over the course of the next few years and even decades, many expect that technology will lead and reignite productivity growth, lifting the economy’s potential growth rate. Technology could more than offset the ongoing impact of the aging American population and declining employment growth. Newer technologies, such as the iPhone, have improved leisure time but haven’t had the same material impact on productivity, while cutting edge technologies like artificial intelligence and autonomous vehicles could provide a genuine increase in labor productivity over the next decade.

Equity markets are trading at record highs, unemployment at record lows, and it appears the Fed’s current policy remains unchanged. Unsurprisingly, Americans are hopeful for 2020, but it is always important to keep economic indicators in mind and remember that good times don’t last forever. The economy, like life,“unfolds forward”, but is only understood backwards. Only the coming days, months and years will paint the true picture of the American economy.

As always, we thank you for entrusting us with your capital.

Important Disclosures: This newsletter contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this newsletter is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this newsletter. While we believe the information in this newsletter is reliable, we do not make any representation or warranty concerning the accuracy of any data in this newsletter and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this newsletter are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This newsletter speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this newsletter constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.