- OVERVIEW: At the beginning of the year, estimates from economists and investors called for continued economic growth despite an expansion 11 years old and counting.

- LABOR MARKETS: Government officials mandated the closure of many businesses, employed stay-at-home orders, and many Americans lost their jobs. As a result, over 30 million Americans filed for unemployment benefits over the past weeks, materially surpassing past peak levels.

- CONSUMER SPENDING: With businesses closed and stay-at-home orders in place across many parts of the country, consumer spending fell over the last few weeks of March. Economists anticipate this trend to continue until companies reopen their doors.

- ECONOMIC GROWTH: GDP in the first quarter fell 4.8%, largely due to coronavirus-related shutdowns in the latter part of March. Economists believe GDP will fall further in Q2, ultimately pushing the U.S. economy into a recession.

- GOVERNMENT RESPONSE: On March 27, 2020, President Trump signed the CARES Act. The bill is the largest economic relief package in history, totaling roughly $2.3 trillion to support individuals and businesses impacted by COVID-19.

- FEDERAL RESERVE RESPONSE: Chairman Powell took the central bank into unprecedented waters by cutting interest rates to near-zero and pledged trillions of dollars in asset purchases. The Federal Reserve has indicated they do not plan on slowing down anytime in the near future.

- EVENTUAL RECOVERY: Economists continue to debate the shape of the eventual recovery. At this point in time, many estimate a prolonged recovery, largely unknown and dependent on public health and government intervention.

- LONG-TERM OUTLOOK: The COVID-19 outbreak is unlike any past economic downturn, both in terms of origin and economic impact. However, market commentators believe the economy will recover over time.

Overview

At the beginning of the new decade, economists and investors alike called for sustained economic growth. Their predictions included a softening pace due to increasing levels of corporate debt and a lower interest rate environment. Many anticipated the Federal Reserve would leave interest rates unchanged and that a recession in 2020 was unlikely. Nevertheless, the roughly 11-year economic expansion came to an abrupt halt in March as the novel coronavirus spread across the globe. The following information discusses the current slowdown compared to past experiences.

Two major recessions have occurred since the turn of the century. The first followed the dot-com boom’s peak in 2000 and worsened in the wake of 9/11. The second came during and after the global financial crisis that began in 2008. Arguably, both were fueled by errant human decision making, resulting in unsustainable price bubbles. The current environment is unique because it was largely triggered by non-market participants.

The first confirmed case of COVID-19 in the U.S. occurred on January 19, 2020 in the state of Washington. Since then, the virus has infected over 1 million Americans and approximately 4 million people worldwide. As a result, government officials shutdown many aspects of the U.S. economy, materially impacting the lives of most Americans and companies.

Early economic data for March confirmed an unparalleled hit to economic activity from the global pandemic, appearing most prominently in the labor market and consumer spending. As a result, major financial institutions roughly estimate a 40% decline in GDP during the second quarter of the year.

In response, the Federal Reserve (the “Fed”) and other government agencies unleashed nearly every tool at their disposal to ease the economic fallout of the pandemic. The Fed cut interest rates to near-zero while the federal government unveiled a $2.3 trillion stimulus package to help struggling individuals and businesses manage virus-related shutdowns. Eventually, the economy should recover as it has in the past, but the shape or path towards recovery is largely unknown and lacks consensus from governments, economists and investors.

This report intends to review several drivers of economic activity in order to evaluate different areas of the market. This report does not intend to make predictions about global economies or financial markets.

Labor Markets

In an effort to slow the spread of the virus across the country, government representatives forced many businesses to close. Some of the most impacted businesses include restaurants, bars, gyms, museums and other popular local and consumer-focused attractions. Given the forced shutdown, companies both large and small operated with little to no revenue, resulting in mass layoffs.

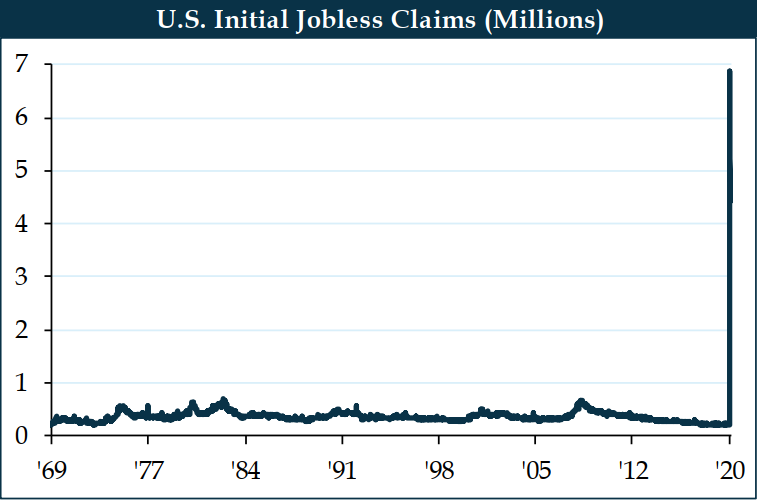

As shown below, an unprecedented surge in initial jobless claims occurred as Americans filed for unemployment benefits. Claims reached an alarming 6.9 million for the week of March 27, 2020, eclipsing the pre-coronavirus peak of 695,000 set in 1982. Over the past weeks, over 30 million Americans filed for unemployment aid. The recent data surpassed the total amount of claims filed during the 2001 downturn, which lasted 36 weeks. The statistic also showcases that recent claims are over 60% of the total filings during the 2008-2009 recession, which persisted for 79 weeks.

Economists predict the unemployment rate will pass 15% early in the second quarter, but noted this economic cycle is unlike any other. A spike in the unemployment rate to more than 15% invites comparisons to the Great Depression, which are likely unsubstantiated given that many unemployed workers should return to their jobs once lockdowns are lifted.

Notably, it is estimated a high proportion of people are furloughed on temporary layoff, meaning they will return to their jobs once virus concerns lessen and employers re-open their businesses. This temporary shock to unemployment should subside with consensus projections calling for the unemployment rate to fall back below 7% by the end of the year.

Consumer Spending

Measures taken to control the spread of the novel coronavirus, including a nationwide closure of most businesses and the implementation of stay-at-home orders in many states, prompted a material decline in consumer spending.

Economic data reveals that consumption fell by roughly 5% annualized during the first quarter with expectations for a further decline over the second quarter. As shown below, the most apparent decline came in retail sales. The reading dropped 8.4% during March, the sharpest month-over-month drop on record as spending at dine-in restaurants, movie theaters and other service providers deteriorated abruptly. The University of Michigan’s Consumer Confidence Index followed a similar path. Unsurprisingly, the index saw its biggest monthly decline on record in April.

Despite weakening consumer spending activity and a fall in consumer confidence, consumption isn’t expected to collapse entirely. Several major components of spending such as housing, health care, and financial services could be minimally affected by the virus and may even receive a modest boost as demand for these services increases. While the initial hit to consumption may be greater than during the 2008-2009 downturn, the impact of the coronavirus may be short-lived and trigger an improvement in consumer spending once social distancing and other restrictive measures are removed. Until those guidelines are removed, economists assume personal consumption will remain at its current depressed levels.

Economic Growth

Even with pandemic-related lockdowns only really starting in earnest during the last two weeks of March, U.S. GDP declined 4.8% annualized for the first quarter. The reading suggests overall economic activity must have fallen precipitously over the second half of March. Despite certain states tentatively re-opening their economies, market commentators estimate a 40% annualized decline in GDP for the second quarter. A recession is defined as two or more quarters of consecutive negative GDP growth, and seems highly likely based on the current trajectory.

Details of the report highlight that business investment declined at an annualized pace of 8.6%. Overall equipment investment dropped by 15.2%, which was led by a 30.6% decline in transportation nationally. This was realized locally here in Seattle, as Boeing already cut production due to ongoing 737 Max aircraft issues and many auto manufacturers shuttered their factories.

Residential investment increased by 21.0% over the quarter, but that is likely because construction was one of the last industries to close and remains an essential business in many states. However, sales of previously owned homes fell in March, which many believe indicates that residential investment may continue to fall throughout the second quarter.

In short, the U.S. economy felt a catastrophic hit within the two weeks of lockdowns going into effect and many market commentators estimate that the next few months may be worse if virus concerns persist. Over the past few weeks, the government unleashed many of the tools they have at their disposal in an effort to bolster economic activity.

Government Response

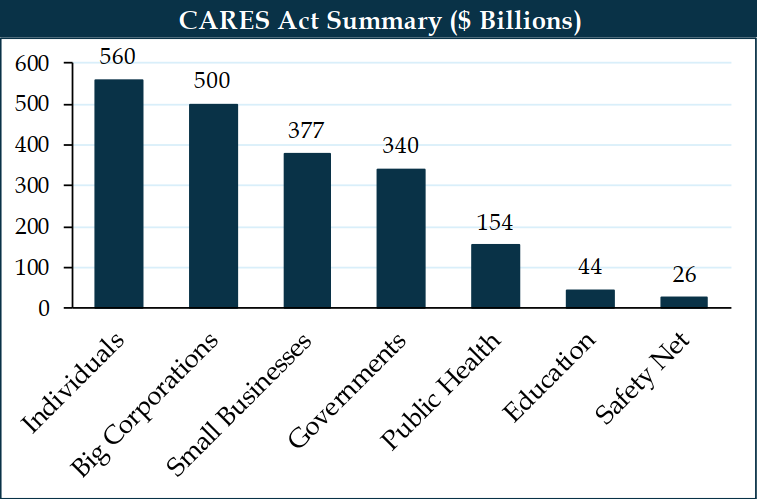

As virus concerns swept through the country, the federal government unleashed an unprecedented amount of stimulus packages and rolled out countless programs. Most prominent was the signing of the largest economic relief bill in U.S. history on March 27, 2020. The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) allocated approximately $2.3 trillion to support individuals and businesses impacted by COVID-19. A chart summarizing the CARES Act funding allocations is summarized below:

The bill included a one-time direct deposit of up to $1,200 to individuals who made less than $75,000 during the 2018 tax year. The program also extended $250 billion for unemployment insurance, providing an incremental $600 per week for four months, in addition to what state-run programs pay unemployed works.

On the medical side, the deal injected roughly $100 billion directly into hospitals to manage the global pandemic and help individuals that contracted the disease. Testing and potential COVID-19 vaccines will be covered by the federal government with no cost to patients.

In order to ease the pain of operating with little to no revenue, roughly $380 billion of CARES Act funding is being devoted to hopefully prevent further mass layoffs while also extending loans to employers so they can cover payroll costs over the next few months.

One of these loans is known as the Paycheck Protection Program (“PPP”), which provides forgivable financing to small business if they keep workers on payroll through the end of June. The program is limited to businesses with fewer than 500 employees, providing credit of up to 2.5 times a firm’s monthly payroll. The program ran out of funding 13 days after opening for applications. Due to elevated demand President Trump signed a follow-on bill, extending an additional $310 billion for PPP loans. As of this report, applications are being filed at a rapid pace as business owners look to borrow funds from the federal government to keep their business afloat during the lockdown.

Federal Reserve Response

Fed Chairman Jerome Powell guided U.S. monetary policy into uncharted territory over the past few weeks by lowering interest rates to near-zero and pledging trillions of dollars towards asset purchases. On April 9,2020, the Fed took actions to provide roughly $2 trillion of loans in an effort to assist households and employers of all sizes, and stabilize financial markets.

Similar to the federal government, the Fed announced the creation of the Main Street Lending Program to ensure that credit flows to small and medium sized businesses. The Fed will offer four-year loans to companies that employ up to 10 thousand workers or with revenues less than $2.5 billion per year. The Fed also expanded the size and scope of the Primary and Secondary Market Corporate Credit facilities to provide liquidity to debt markets and maintain swift functionality. The Fed rebirthed the Term Asset Backed Securities Loan Facility, which was first used during the last recession, providing non-recourse financing to holders of certain AAA rated asset-backed securities collateralized by newly-originated consumer and small business loans.

Furthermore, the Fed stepped in with large scale purchases of various types of bonds mostly in the U.S. The goal is to keep longer-term interest rates like those used for car loans and mortgages low with the intent of keeping purchases affordable for both consumers and businesses alike.

In summary, the Fed focused on supporting market liquidity, restoring normal financial market dealings and preventing conditions from tightening further. Many economists believe the Fed is employing unlimited quantitative easing (“QE”), an economic tool first used in 2008-2009. As of the writing of this report, Fed Chairman Jerome Powell indicated the central bank has no intent of slowing down anytime soon.

Eventual Recovery

As mentioned throughout the report, economic activity is not simply contracting, it is being deliberately frozen in order to prevent the virus from spreading further. There is substantial uncertainty on the evolution of the virus, containment measures and how human beings will react once some degree of normalcy resumes.

Market and consumer behavior will largely depend on the shape of the eventual recovery.

Economists typically use three scenarios to model economic scenarios following a contraction. These models graphically depict a “V-”, “U-”, or “L-shaped” downturn and recovery. In a V-shaped projection, the economy contracts quickly and recovers equally as fast. Regarding a U-shaped model, growth falls at a rapid pace before slowly climbing back to its prior levels. The last case, the L-shape, describes a period where economic activity declines precipitously and remains at lower levels, or a new normal, for an extended time period.

At present, economists believe a “V-shaped” recovery is unlikely since it should take economic actors an extended period of time before they feel comfortable resuming their normal course of business. There are multiple lingering questions: will restaurants operate at full capacity? Will people feel comfortable attending large sporting events or flying across the country? Are protective masks here to stay in our everyday lives? There are no concrete answers for any of these questions, which is why economists believe the recovery will be either “U-” or “L-shaped.” When thinking about the other options, many estimate the recovery will depend equally on public health initiatives and economic policy response.

Effective public health response in controlling the spread of COVID-19 should lead to an uptick in economic activity in the short-term. The quicker the healthcare industry is to respond to the pandemic, the faster we will start to experience a recovery. Unfortunately, the opposite is equally as possible. In the case that the healthcare industry and hospitals fail to curb the spread of the virus, individuals will limit spending which may result in a prolonged downturn.

As mentioned previously, government actors have taken unprecedented steps to save the economy and promote activity. If strong policy response continues and businesses are able to pay their employees and resume normal activity, we should see a rapid reacceleration of economic activity. Economists believe the Fed is doing everything they can and are hopeful this trend will continue throughout the year.

Long-Term Outlook

The COVID-19 outbreak created a period of heightened uncertainty for investors, politicians and economic actors. The freezing of economic activity due to stay-at-home orders resulted in a barrage of poor economic data over the last few weeks. In order to combat the potential fallout, the government and central bank took unprecedented actions, which should have a ripple across the economy in coming months.

Economic downturns have happened in the past and will likely occur again in the future. In the short-term, economists anticipate more pain until the virus is contained or economies start reopening for business. In dire times like the present, it is important to remember that the economy should recover as it always has. However, the ultimate shape and path towards a recovery is largely unknown.

As always, we thank you for entrusting us with your capital.

Important Disclosures: This document contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this document is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this newsletter. While we believe the information in this document is reliable, we do not make any representation or warranty concerning the accuracy of any data in this document and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this document are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This document speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this document constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.