The United States officially entered a recession in late-February as a result of the COVID-19 global pandemic. The negative impact of the coronavirus is unique in terms of its speed and depth, but economists predict a return to pre-coronavirus Gross Domestic Product (“GDP”) towards the end of 2021.

- OVERVIEW: The United States officially entered a recession in late-February as a result of the COVID-19 global pandemic. The negative impact of the coronavirus is unique in terms of its speed and depth, but economists predict a return to pre-coronavirus Gross Domestic Product (“GDP”) towards the end of 2021.

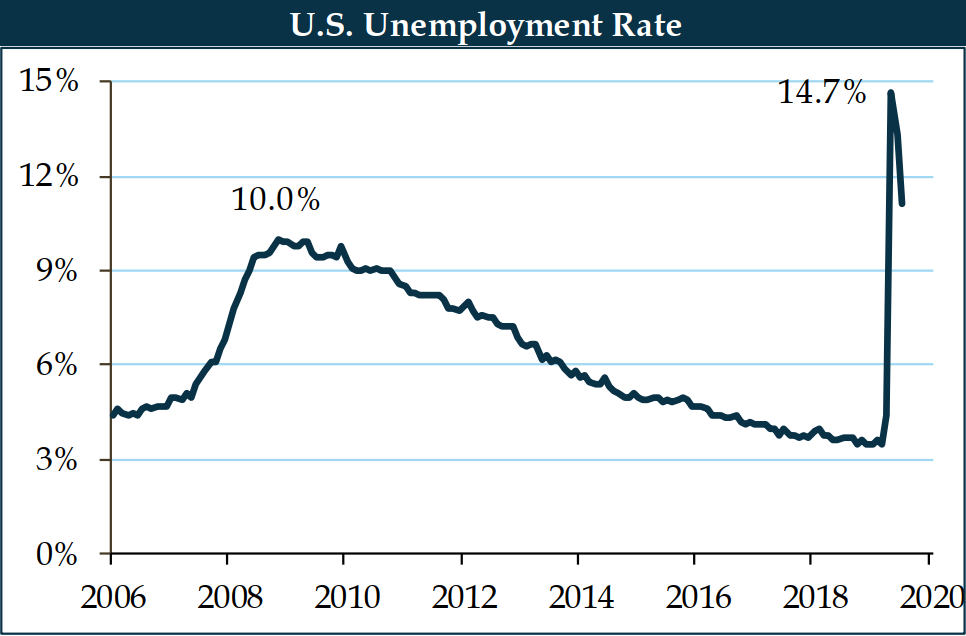

- LABOR MARKET: The domestic unemployment rate set a record at 14.7% as nearly 20.8 million American jobs were lost in April. The spike is not expected to return to normal in the near-term as economists think the unemployment rate will remain elevated through year-end.

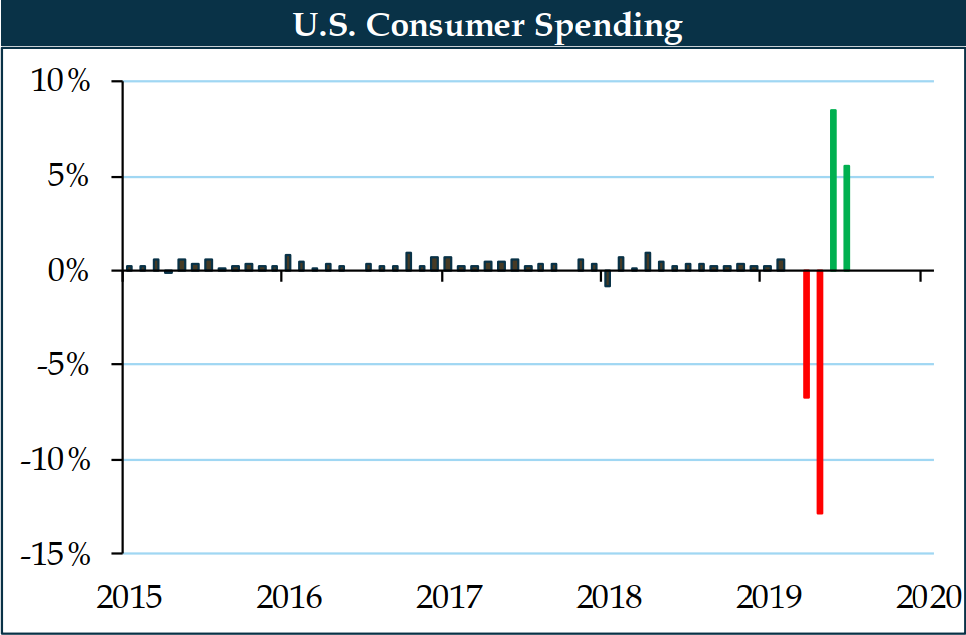

- CONSUMER SPENDING: As a result of government-imposed shutdown measures, consumer spending fell heavily in March and April, but has since staged an impressive comeback.

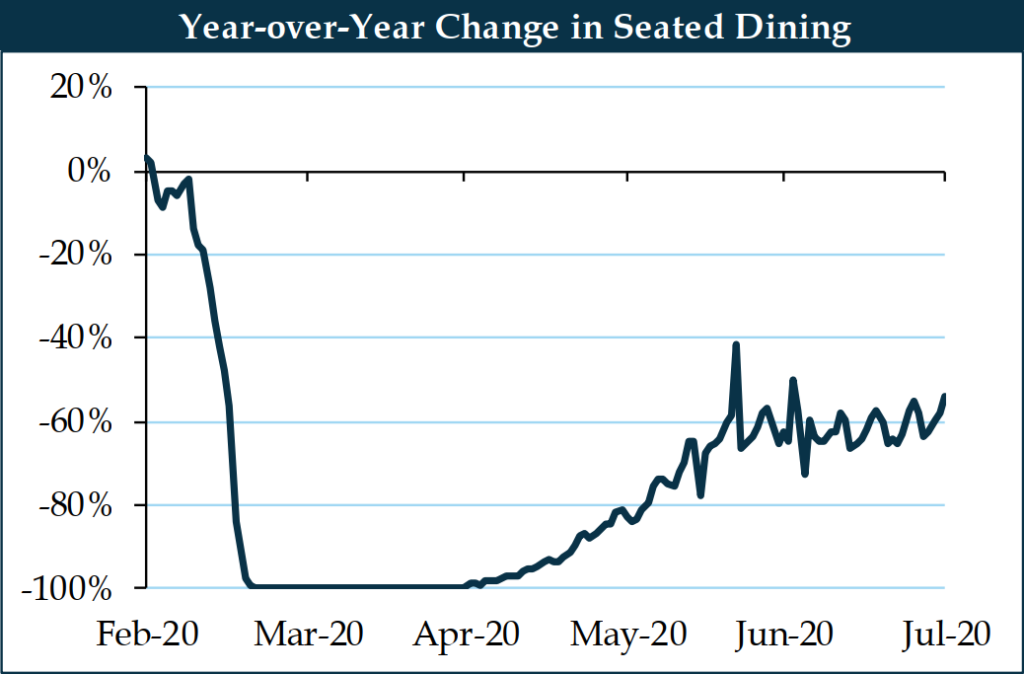

- BUSINESS ACTIVITY: Businesses benefitted greatly from return to work policies towards the end of the quarter and rising individual spending, but activity remains depressed compared to pre-coronavirus levels.

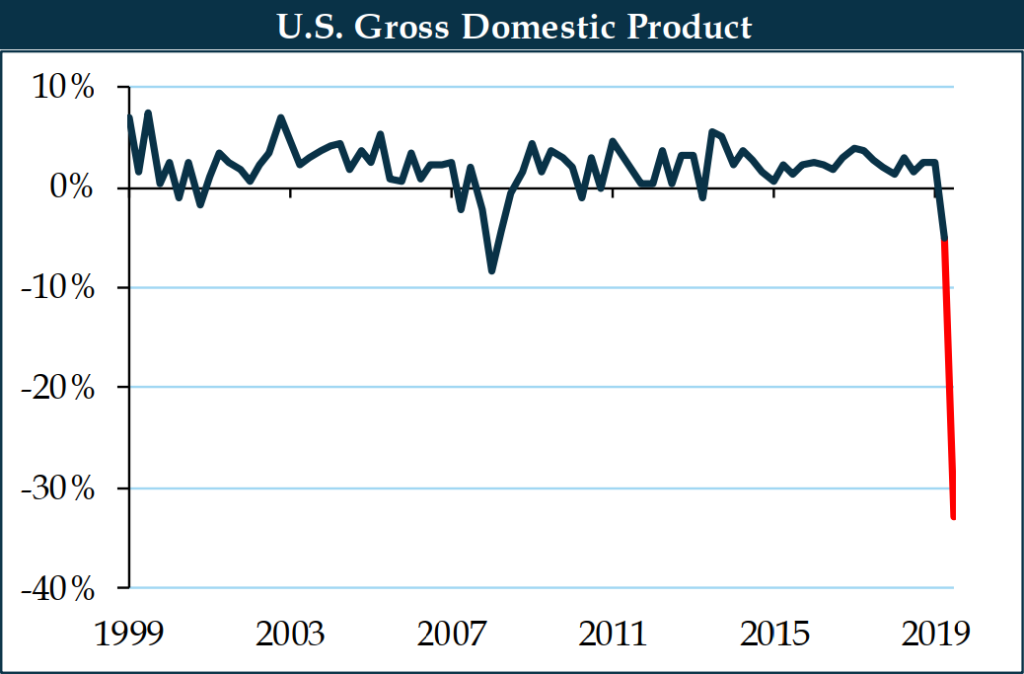

- ECONOMIC GROWTH: U.S. GDP posted its worst quarter since the second World War as economic growth fell at an annualized pace of 32.9%.

- FEDERAL GOVERNMENT STIMULUS: Senate Republicans and House Democrats continue to debate the next coronavirus relief package. The packages differ by approximately $2 trillion in size but share many of the same core principles and themes.

- PRESIDENTIAL ELECTION: It is still too early to tell who the President of the United States will be in January, but economists and market followers believe the composition of the Senate will be an important factor in policy decisions going forward.

- THE ROAD AHEAD: Similar to most of 2020, the outlook for the remainder of the year is cloudy and will largely depend on the outcome of November’s presidential election and the forward path of the COVID-19.

Overview

On June 8th, the National Bureau of Economic Activity declared the U.S. economy had officially entered a recession in late-February due to the COVID-19 global pandemic. The announcement marked the end of the longest expansion in recorded history — dating back to 1854 — as economic activity came to a screeching halt during the second quarter of the year. To date, over 20 million individuals around the world, including roughly 5.2million Americans, have contracted the coronavirus. According to data from the John Hopkins University of Medicine, the coronavirus has claimed an estimated 750,000 lives globally with 166,000 American lives lost. The rapid spread of the disease led to a flurry of actions by both federal and state governments in an attempt to stimulate economic activity.

The coronavirus’s impact was felt in many aspects of the country’s economy and financial markets as unprecedented data was seemingly released on a daily basis. Economically, the COVID-19 outbreak led to a record decline in economic growth as U.S. GDP fell at an annualized pace of 32.9% in the second quarter after falling at a 5.0% annual pace during the first three months of the year. Furthermore, roughly 40 million U.S. workers filed for unemployment benefits and the unemployment rate spiked to a record-setting 14.7% in April. U.S. equities, as measured by the S&P 500 Index, plummeted roughly 33.9% in 23 trading days and spot prices for West Text Intermediate (WTI) crude oil went negative for the first time in history.

The devasting impact to the domestic economy is unique in terms of its speed and depth per economists. However, economic data unveiled towards the end of the quarter look promising. As an example, consumer spending fell a historic 12.6% in April before rebounding to 8.2% in May. It appears the reopening of the domestic economy has done some good but has also led to a resurgence in new daily confirmed cases of the coronavirus in several states.

The country has adapted to a “new normal” over the past few months. However, significant uncertainty remains as we head into the second half of this historic year. The road ahead will likely be driven by two factors: politics and the path of the coronavirus.

This report intends to review several drivers of economic activity in order to evaluate different areas of the market. This report does not intend to make predictions about global economies or financial markets.

Labor Markets

The 50-year low U.S. unemployment rate of 3.5% seen in February of 2020 will likely not return for several years per economists as the COVID-19 pandemic left many Americans jobless. Notably, J.P. Morgan Asset Management Chief Global Strategist, Dr. David Kelly, estimates the unemployment rate could stay above 10% through year-end.

One measure of the labor market, initial claims for unemployment benefits, skyrocketed to 6.9 million towards the end of the first quarter and has since declined. Although, the number of filings has fallen over the past few weeks, the data is still elevated when compared to historic averages. In short, nearly 44 million Americans filed for benefits during the spring months. There exists some positivity in the data, as research groups estimate that between 60% and 70% of unemployed workers reported they were on temporary layoff or furlough, rather than permanent job loss. The previously mentioned range could suggest that many will return to their positions as the economy continues to reopen from coronavirus-imposed shutdowns over the next few months.

Consistent with the data provided in the previous paragraph, the U.S. unemployment rate spiked to a record setting 14.7% in the first month of the second quarter as the domestic economy lost an estimated 20.8 million jobs. The American economy was preparing for another material round of job losses in May and June with the Dow Jones consensus calling for a decline of nearly 8.3 million in May alone. However, with the reopening of select states, the U.S. posted two consecutive gains of approximately 2.7 million and 4.8 million jobs in May and June, respectively. As shown in the chart below, the unemployment rate drifted down to 11.1% as of the end of June, still above the levels experienced in the depths of the Global Financial Crisis in 2008-2009.

Slowly but surely, Americans are going back to work, leading to improvements in consumer and business activity.

Consumer Spending

The initial bounce back in consumption has been impressive, but the recent resurgence of the coronavirus and the ongoing need for social distancing measures, might mean the recovery further ahead will be slower.

After falling by nearly 20% over March and April, consumer spending staged a remarkable comeback, as illustrated below. Since the April low, consumer spending has rebounded an average 7.1% over May and June.

Economists argue the strong initial rebound reflects astonishing fiscal support, coming in the form of additional unemployment benefits from the federal government. As part of the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), the federal government extended weekly $600 checks in unemployment assistance and provided a one-time payment of $1,200 to qualifying individuals. The path forward is especially muddled.

Absent another stimulus package from the federal government, the $600 checks are set to run out during the third quarter, which may cause another decline in consumer spending. Another hurdle that economists are following closely is a trend in higher precautionary saving as households have begun holding onto more cash due to coronavirus-related fears. Consequently, the personal saving rate set a record high 33.5% in April before sliding to 19.0% in June. Despite the month-over-month decline, individuals are saving at their highest rate since 1959.

Business Activity

The overarching theme of material declines followed by significant upticks also made its way to business activity. Both the ISM’s Manufacturing and Non-Manufacturing Indexes have returned to growth mode after major pullbacks earlier in the second quarter. After falling close to 14.7% in April, retail sales reported a record 18.2% gain in May as people returned to traditional brick and mortar shopping, and their favorite bars and restaurants.

Another measure of business activity, year-over-year change in seated diners according to Open Table followed suit. As seen below, restaurant dining fell 100% year-over-year towards the end March and most of April, but has retraced some of the decline. Despite the quick recovery, seated dining is still down 54.2% compared to last year, suggesting there is still a long way to go.

As mentioned so far in this report, there has been a bit of a seesaw effect, where the economy experienced record drops early in the second quarter followed by a sharp upward recovery. However, the implications of the coronavirus on domestic growth were profound.

Economic Growth

The International Monetary Fund projects the global economy will shrink 4.9% as a result of the COVID-19 outbreak, representing an approximately 1.9% downward revision from their April forecast.

Unfortunately, the pessimism came to fruition as domestic growth, measured by U.S. GDP, contracted at a 32.9% annual rate during the second quarter, representing the steepest decline in more than 70 years of recordkeeping, as portrayed below. It is important to remember that this is an annual number and when looking at the reading quarter-over-quarter, domestic GDP fell 9.5% or roughly $1.8 trillion.

Economists are forecasting a bounce in the third quarter of roughly 20.0% annualized, but since the data is starting from a lower point, this material improvement won’t even retrace half of the second quarter’s loss. After reviewing recent developments in consumer spending and business activity, as well as uptrends in hotel occupancy data and the number of people using Google’s navigation application, economists don’t think the U.S. will experience another down trend in GDP. The consensus is calling for a slow and prolonged economic recovery with GDP returning close to pre-coronavirus levels during the final quarter of 2021.

Federal Government Stimulus

Senate Republicans and House Democrats are going back and forth on another stimulus package. House Democrats proposed the Health and Economic Recovery Omnibus Emergency Solutions Act (“HEROES Act”), calling for a roughly $3 trillion package. Senate Republicans countered the bill when they unveiled the Health; Economic Assistance; Liability Protection; and Schools Act (“HEALS Act”), which would provide $1 trillion in coronavirus relief.

It is the opinion of many economists that another stimulus package is necessary to tide the economy over into the new year. The two relief proposals vary in size with each other and when compared to the first quarter’s CARES Act, but also share certain core principles.

Importantly, both bills call for the same stimulus check maximum payment amount of $1,200 to qualified individuals. The HEROES Act extends $600 per week in unemployment benefits while the HEALS Act targets an initial $200 per week. The two proposals also address the Paycheck Protection Program expanding its scope, accessibility and guidelines for small business owners in need of relief.

Whether either stimulus package passes into law is unclear at this point in time and many political followers anticipate the federal government will come to an agreement before the presidential election in early November.

Presidential Election

As of the writing of this report, betting odds predict there is a 60% chance that former Vice President Biden is elected and 40% odds of a President Trump re-election, which is reasonable per J.P. Morgan Asset Management. Assuming the odds are representative of the eventual outcome, it will be important to follow which party will control the Senate going forward.

A divided government should make policy changes slightly more difficult while a Democratic sweep could lead to an unwinding of certain President Trump initiatives. Many economists believe a Democratic sweep will lead to higher taxes on individuals and businesses in an attempt to reduce the sizeable burden of debt the country has amassed in order to curb the economic effects of the coronavirus. It is estimated that public debt to GDP could be as high as 82%, which equates to roughly $17.4 trillion by the end of 2021.

The Road Ahead

Dealing with the COVID-19 outbreak led to heightened uncertainty over the past few months for many economic actors, including the government, businesses, and individuals and families across the country. While it might seem that the worst of this historic moment is in the rearview mirror, the road ahead is particularly cloudy and ambiguous.

The consensus across market commentators and economists alike is that the second half of the year will be driven by politics and the eventual path of COVID-19. From a political standpoint, the President of the United States elected in 2020 and future Senate members will have to govern and implement the next best steps as it relates to containing and eradicating the coronavirus, thus shaping the direction and speed of the eventual recovery. The path of the coronavirus is unclear, but data over the past few weeks suggests a resurgence in confirmed cases as the economy reopens. The catalyst will likely come in the form of a COVID-19 vaccine, but as has been the case for most of the year, the release date and implementation program of a vaccine remains unknown.

As always, we thank you for entrusting us with your capital.

Important Disclosures: This document contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this document is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this newsletter. While we believe the information in this document is reliable, we do not make any representation or warranty concerning the accuracy of any data in this document and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this document are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This document speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this document constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.