- OVERVIEW: The United States economy bounced back in the third quarter of 2020 after contracting in the first and second quarters. The result was driven by both consumer and business behavior.

- CONSUMER ACTIVITY: Consumer spending and optimism rose during the past few months. A renewed sense of confidence in the current macroeconomic landscape appeared to take shape despite the rising number of confirmed cases of COVID-19.

- BUSINESS ACTIVITY: Businesses benefited from the improved consumer outlook with spending on capital goods up year-over-year. Many businesses expect to increase capital expenditures over the next six months rather than making additional cuts.

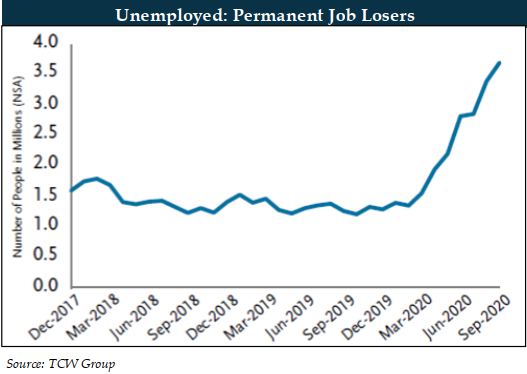

- LABOR MARKET: The domestic economy recovered just over half of the jobs lost during March and April as the unemployment rate drifted down to 7.9%. However, it seems the comeback is slowing down as many of the jobs lost have transitioned from temporary to permanent.

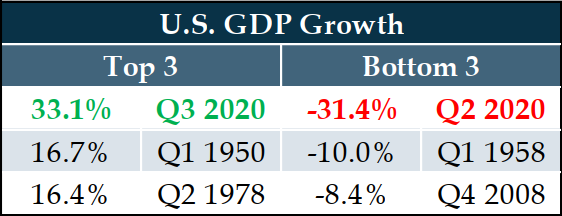

- ECONOMIC GROWTH: U.S. Gross Domestic Product posted its best quarter since the first quarter of 1950 as the economy grew at an annualized pace of 33.1%.

- LONG-TERM OUTLOOK: Uncertainty remains at large as we head into the final weeks of 2020 and into the new year. Many economists and market commentators anticipate that the result of the presidential election and successful release of a COVID-19 vaccine will be the two main catalysts to a full economic recovery.

Overview

The United States economy rebounded sharply in the third quarter of the year after posting two consecutive quarters of declining growth, as measured by Gross Domestic Product (“GDP”). On October 29, the United States Department of Commerce reported that the domestic economy grew at a 33.1% annualized pace, the strongest quarterly gain on record. The result was driven by a resurgence in consumer and business activity as most states began to relax coronavirus related restrictions on nonessential businesses to some extent. The impact of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) and the Paycheck Protection Program cannot be understated, as both measures injected an unprecedented amount of capital into the economy.

American consumers and businesses are conducting their affairs with a refreshed sense of optimism about the next few quarters, despite the continued rise in confirmed cases of the coronavirus. As of November 1, an estimated 9.2 million Americans have contracted the virus compared to the roughly 2.6 million individuals as of the end of the second quarter. Unfortunately, COVID-19 has claimed the lives of over 223,000 Americans.

The virus’ impact on the labor market is profound. Nearly 22 million Americans lost their jobs as companies aimed to reduce their payroll costs in lieu of increased economic uncertainty. Since the end of April, the labor market has recovered just over 11 million of the jobs lost. However, layoffs that were initially deemed temporary are now transitioning to permanent.

U.S. equities, as measured by the S&P 500 Index, took a turbulent path to new record highs over the past few weeks. The S&P 500 is now up just over 1% YTD through the end of October while recovering ~46% since its March 23 low.

The long-term outlook for the domestic economy projects a return to 2019 GDP levels at some point during the second half of 2021, which is largely contingent on the successful release and distribution of a coronavirus vaccine.

This report intends to review several drivers of economic activity in order to evaluate different areas of the market. This report does not intend to make predictions about global economies or financial markets.

Consumer Activity

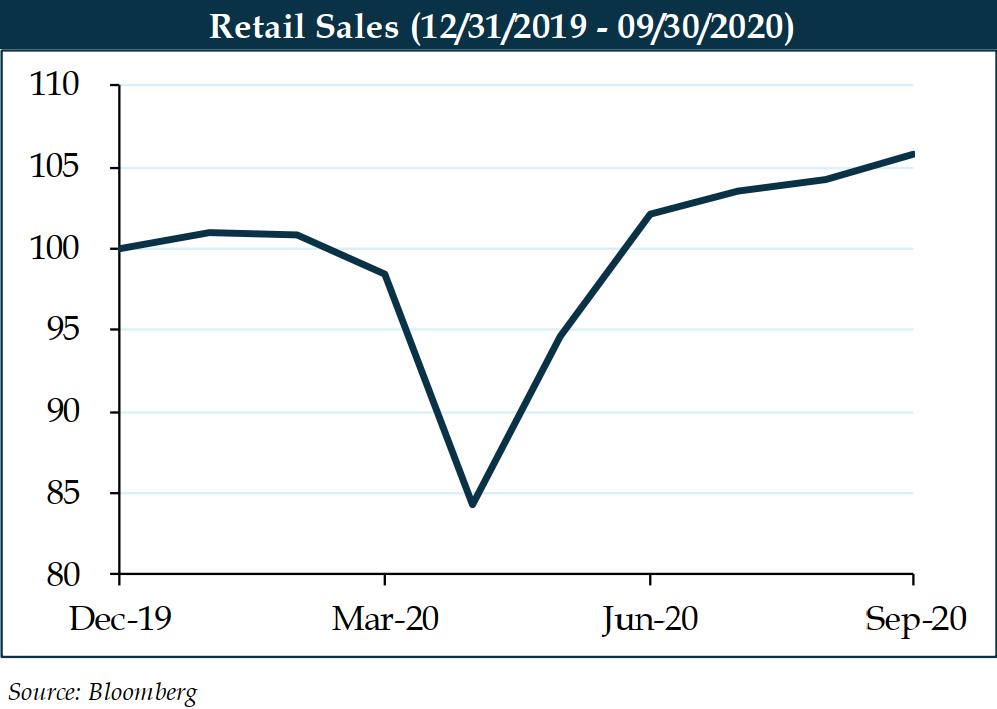

To some economists’ surprise, personal income and consumer spending actually rose in recent months amidst a recessionary macroeconomic environment. Despite a meaningful pullback in the early months of the pandemic, retail sales have grown through the end of the third quarter, as shown in the chart below.

The impact on consumer’s wallets is two-fold. First, during the initial onset of the pandemic, consumer savings rates reached historic levels, setting an all-time high of 33.6% in April 2020. Savings increased with little ability to spend as stores and restaurants were shuttered in preparation for the ambiguous months ahead. However, in recent months, the personal saving rate has drifted down to 14.3%, which is closer to its long-term average of 8.9% dating back to 1959. Second, personal income has increased during the past few months. The surprising phenomenon is being attributed to the one-time payment of $1,200 to qualified individuals coupled with increased federal unemployment benefits.

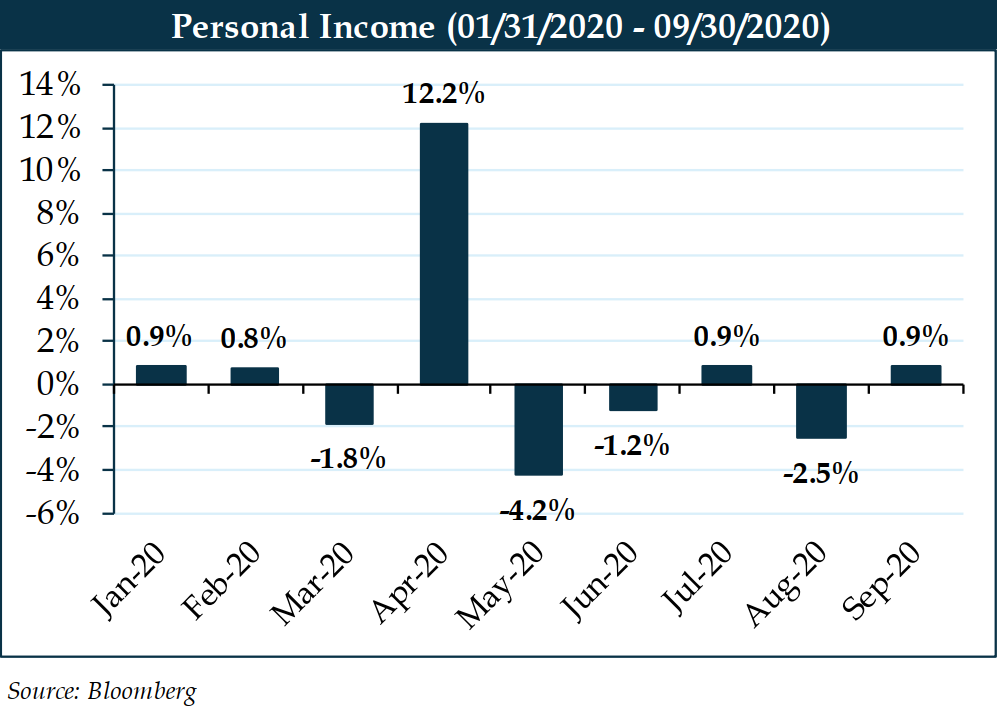

As shown above, the expiration of the federal $600 weekly unemployment assistance at the end of July had a direct impact on personal income levels in August. As a result, personal incomes initially fell 2.5% before climbing back 0.9% in September. Overall, personal income is up 5.3% year-to-date through the end of September.

Business Activity

Domestic business spending is up year-over-year due to the strong growth in software and business services (per the Carlyle Group). The same report cites that twice as many businesses expect to increase their capital expenditure spending over the next six months rather than make cuts. The improved outlook for both small and large businesses is due to the gradual reopening of the economy during the third quarter of the year. The sectors most impacted by the virus (e.g. aerospace and government services) plan to keep their capital expenditures steady over the next two quarters, while sectors with less exposure to the virus (e.g. technology) or industries that have benefited from the pandemic (e.g. health care) plan to either keep their capital outlays steady or accelerate investment.

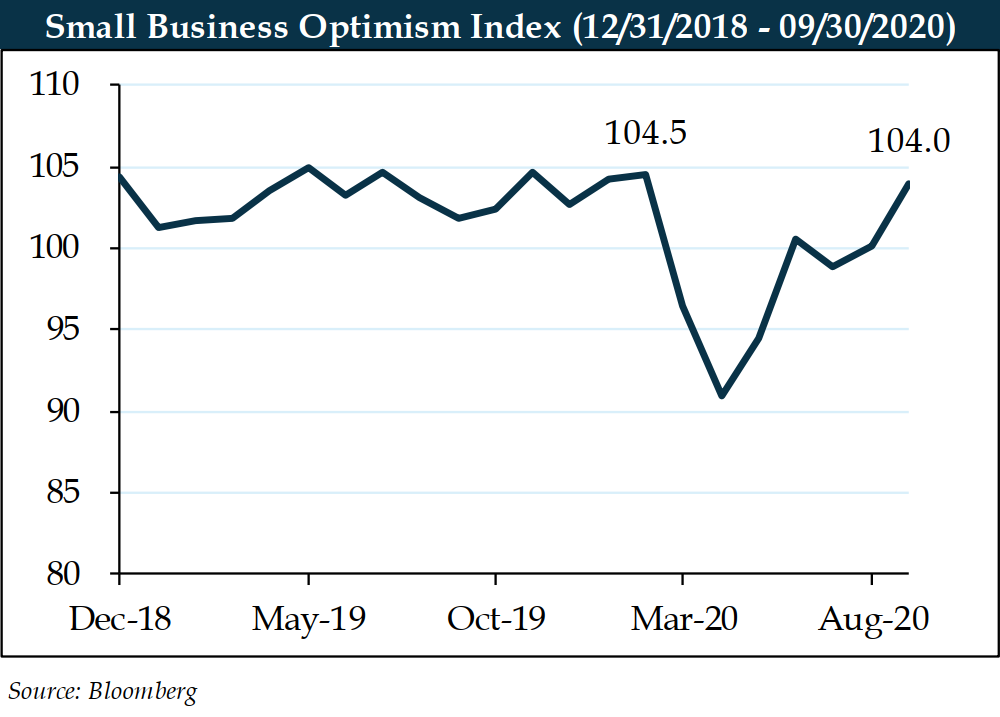

Another metric of business development is the National Federation of Independent Business Small Business Optimism Index. The index provides an indication of the health of small U.S. businesses, which accounts for roughly half of the nation’s private workforce. The index is a leading indicator, meaning it is used as macroeconomic data that typically will outline future changes in the economy. As shown in the chart below, the index has edged up in recent months, suggesting that business conditions and profitability should improve in coming months. The renewed sense of confidence from businesses is a positive indicator and importantly, the measure is near pre-pandemic level.

Labor Market

After the unemployment rate spiked to 14.7% at the end of April due to the loss of 22 million jobs, the domestic economy has staged a meaningful comeback. During the past five months, just over 11 million Americans have found another job while the unemployment rate drifted down to 7.9%. The headline numbers are impressive, but there is another side to the data that is troubling economists.

The labor force participation rate fell to 61.4% at the end of the third quarter to its lowest level since March 1976. Economists argue the fall is mostly due to people leaving the labor force. Another metric of the situation, the employment to population measure is down 4.4 percentage points year-over-year.

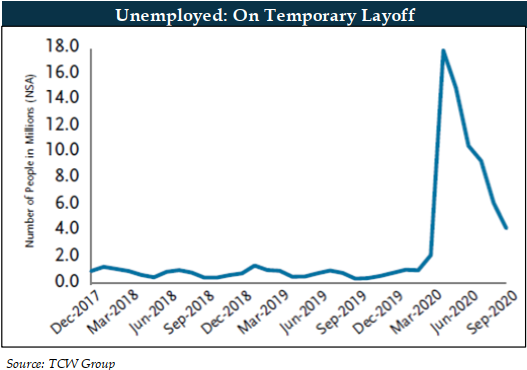

At the beginning of the pandemic, many companies initially placed their employees on temporary layoff with the hopes of re-hiring staff once virus concerns subsided. However, it generally takes time for employers to truly understand the impact of an economic contraction on their business prospect. In some cases, employers realized they can conduct their operations at reduced staffing levels. As companies started to experience the changed realities of their businesses in a COVID-19 environment, many individuals’ job losses transitioned from temporary to permanent. The following two charts provide a visual representation of recent developments:

According to the U.S. Department of Labor, the number of long-term unemployed (i.e. people out of work for 27 weeks or more) increased to 2.4 million towards the end of the quarter. These workers have exhausted their 26-week limit on state unemployment benefits, meaning they will no longer receive any assistance from their home state. Without a steady stream of income, Americans are suffering as shown by a recent survey taken by the U.S. Census Bureau. The August survey found that 22.3 million adults admit they cannot afford to adequately feed their families, up from 18 million in March.

Economic Growth

The U.S. experienced two record setting quarters in 2020. The second quarter marked the worst economic contraction while third quarter results revealed a historic surge in economic growth. The table below outlines the best and worst swings in U.S. GDP since the end of World War II. Growth during the third quarter was fueled by increased consumer activity, which accounts for about 68% of GDP. Personal consumption increased nearly 41% as shoppers began returning to stores. The bar and restaurant industry resumed limited business activity with COVID-19 restrictions on capacity in-place throughout most of the nation.

The headline number is remarkable, but it is important to keep in mind that it still leaves growth 3.5% below its year-end 2019 level. Without another stimulus package and with coronavirus infections steadily on the rise, Pantheon Macroeconomics estimates that the domestic economy will grow at an annualized pace of 4% during the final quarter of this turbulent year.

Long-Term Outlook

It feels as though 2020 has been the first part of the COVID-19 story. There is normalcy in some places, but day-to-day life is still far from its pre-pandemic “normal” in many parts of the country. The question on everyone’s minds seems to be, what does the new normal look like?

Economists and market commentators alike are hopeful that 2021 provides some sort of answer to this imminent question. The path forward is largely dependent on the release and successful deployment of a COVID-19 vaccine, and the possibility of an additional coronavirus relief stimulus package. It is expected that the outcome of the 2020 presidential election will have a significant impact on both items. As of November 7, it appears that former Vice President Joe Biden will be inaugurated on January 20, 2021 and with his presidency will come different policies and strategies to deal with the COVID-19 global pandemic. Despite the forthcoming change of political party in the White House, the general consensus is that the pandemic may have permanently altered consumer trends, preferences, and activities.

As always, we thank you for entrusting us with your capital.

Important Disclosures: This document contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this document is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this newsletter. While we believe the information in this document is reliable, we do not make any representation or warranty concerning the accuracy of any data in this document and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this document are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This document speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this document constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.