Now more than ever, characterizing economic activity in the United States is challenging. COVID-19 remains a persistent threat, but the deployment of several vaccines should lead to an eventual economic recovery.

- ECONOMIC GROWTH: U.S. Gross Domestic Product contracted in 2020, representing the worst yearly decline in economic growth since World War II. Economists believe that pent-up consumer demand and a service sector recovery may lead to modest growth in 2021.

- LABOR MARKET: After hitting a trough in April, the U.S. unemployment rate gradually improved throughout the year, but ultimately went backwards in the last month of the year as COVID-19 infections and deaths rose steeply.

- INFLATION: Per J.P. Morgan Asset Management,the pandemic and a collapse in oil prices placed downward pressure on already low inflation. Although the consumer price index is not always an accurate measure, there is a chance that inflation moves higher over the next few years.

- ECONOMIC METRICS TO FOLLOW: Home prices surged in 2020 as mortgage rates were, and remain, low and available inventory shrank. Some economists believe this trend will continue, but there is still much debate. Some sectors have been hit particularly hard by the pandemic, but it is unclear whether virus pressures will create long-lasting change.

Overview

There is no simple way to describe economic activity in the United States. Travel, tourism, and social expenditures (e.g., spending at bars and restaurants) remain far below their historic norms, while industrial and business services output continue to improve year-over-year. Under these circumstances, it is important to focus on the road to recovery while being cognizant of the historical impact of the COVID-19 outbreak.

As we head into 2021, the macroeconomic landscape remains mostly unchanged, although there is some light at the end of the tunnel. The last few months have brought some degree of resolve to the country. The United States elected, and inaugurated new President Joseph Robinette Biden Jr. and a COVID-19 vaccine was developed in under 12 months. The speed at which the vaccine was brought to market is arguably one of the greatest medical achievements in history. The previous modern medical record for vaccine deployment was achieved in the 1960s for the mumps. It took four years to develop.

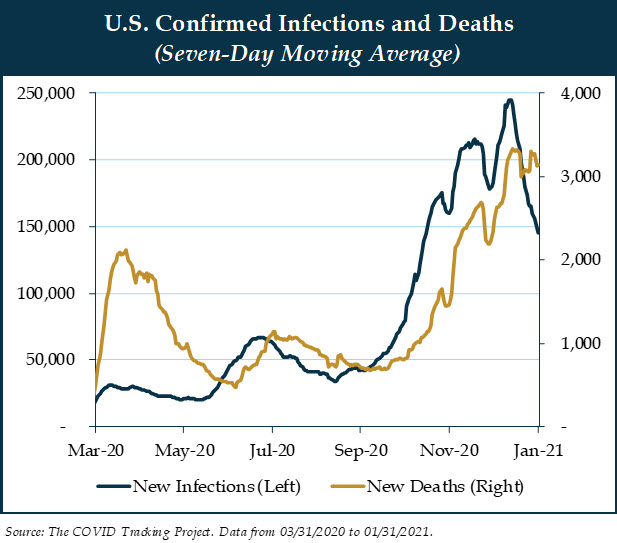

Some of the individuals reading this report may have already been inoculated, but in large part the pandemic is a continuing risk to economic forecasts. As of January 31, 2021, nearly 26 million Americans have been infected by the virus, resulting in roughly 434 thousand fatalities. Confirmed infections of COVID-19 are spreading at a furious pace, increasing roughly 31% year-to-date through the end of January. As shown in the following chart it appears that after spiking and retreating during the summer months, the pandemic has worsened. Some epidemiologists believe confirmed cases of the coronavirus might remain elevated during the first few months of 2021 until vaccine deployment reaches a significant portion of the U.S. population.

According to J.P. Morgan Asset Management, the approval of several COVID-19 vaccines should allow for the immunization of roughly 150 million Americans during the first half of the year. At this point in time, life might return to normal in the fall or towards year-end.

Economic Recovery

The domestic economy has only partially recovered from the initial collapse. This past year was historic as the U.S. experienced both the worst and best prints of Gross Domestic Product (“GDP”) on record. After surging 33.4% during the third quarter, U.S. GDP moderated to a 4.0% annualized pace during the last three months of the year. Unfortunately, performance in the last six months of the year does not reverse the initial decline in growth.

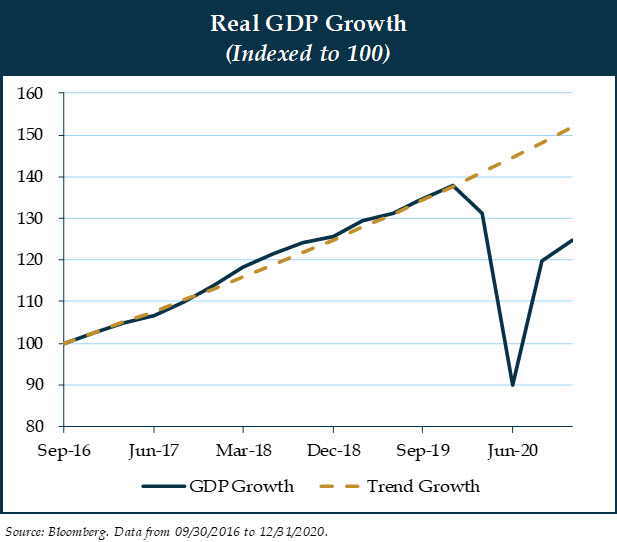

Between the third quarter of 2016 and the end of 2019, U.S. GDP grew at an average pace of 2.5%, suggesting that the current state of economic growth is below its recent trend. The graph below showcases the dichotomy between expected growth in GDP and actual performance. Over the course of the last few years, actual performance was roughly in-line with its trend. However, economic growth fell below expectations as the coronavirus spread across the country.

Economists suggest there is a fundamental, yet simple reason U.S. GDP is below its trend line. First, the country’s growth is heavily reliant on consumption and the service industry. Coronavirus related lockdown measures led to a material decrease in personal consumption while also forcing service-oriented business to close their operations for an extended period. There is an argument to be made that the slowdown in economic growth is related to the inability of service sector businesses to conduct their typical business functions.

Economists expect U.S. GDP to grow at a single-digit pace during 2021 as the pandemic places further pressure on businesses and consumers. On the commercial front, the COVID-19 outbreak should continue to limit operations due to capacity constraints and stay-at-home orders that are still prevalent in many states. Individuals are eagerly anticipating the next round of stimulus, which should hopefully come from President Biden’s proposed $1.9 trillion package. Per economists, persistent restrictions on businesses and a delay in getting fiscal support to Americans will likely moderate growth in 2021.

There is an upside case, however, where the successful rollout of several COVID-19 vaccines might lead to a surge in growth given pent-up demand and supply in the sectors that have been most obstructed by the virus. This potential increase in economic activity might only occur later in the year once a material portion of the American population is vaccinated.

Labor Market

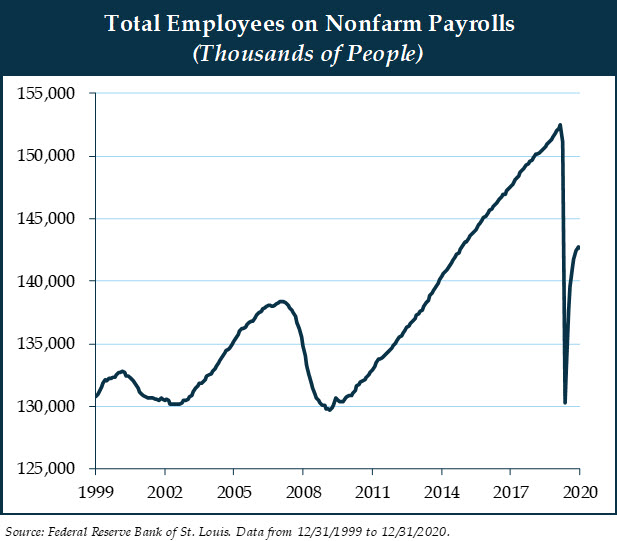

Since the depths of the COVID-19 pandemic, domestic employers steadily added jobs between May and November. Over the past few months, economists were concerned that the pace of job gains was slowing since much of the employment decline was felt in pandemic sensitive sectors. The leisure, hospitality, travel, retail, and food industries struggled to add jobs as their businesses remained under COVID-19 capacity constraints and forced closures.

In the last month of the year, the labor market recovery took a step backwards. In connection with the rise in confirmed infections of the virus, the U.S. reported that 140 thousand jobs were lost in December 2020. This was the first month of job losses since April 2020. December’s unemployment report highlighted an interesting dilemma across gender. While men gained 16 thousand jobs during the month, women accounted for 156 thousand lost jobs. Since February, women have lost roughly 1 million more jobs than their male counterparts.

The following chart showcases total employees on nonfarm payrolls, which is a broad measure of the number of domestic workers in the economy. According to the Federal Reserve Bank of St. Louis, this reading accounts for roughly 80% of the U.S. workers who contribute to GDP.

After making consistent gains since the bottom of Great Financial Crisis, the metric plummeted before staging a comeback throughout 2020. Generally, the measure can provide some insights into the current U.S. macroeconomic landscape since it shows the number of jobs either added or lost in any given month. As the metric increases, economists argue that businesses are hiring, suggesting that businesses are expanding. In the case of COVID-19, it could mean that businesses learned how to handle capacity constraints and slowly added employees back to their payrolls.

The outlook for jobs is a tale of two stories. On one hand, renewed and persistent pandemic pressures on the service industry might delay the eventual recovery. On the other hand, as the vaccine is rolled out throughout the nation, service sector jobs could be poised for a healthy recovery in coming months.

Inflation

Inflation, as measured by the Consumer Price Index (“CPI”), has been low over the last few years. The COVID-19 recession and a collapse in oil prices triggered a further drop in an already low inflation environment. History shows that inflation is usually at its lowest point after the end of a recession. However, the additional costs of functioning during a pandemic and the potential uplift in economic activity could put upward pressure on inflation in coming years.

The CPI is an inexact measure and is often criticized by economists. While the CPI is a convenient method used to calculate the cost of living and the relative increase or decrease of prices over time, it is still based on a fixed basket of goods. For example, there is the issue of substitution bias given that the prices of goods and services change from year to year and they do not all move by the same amount. In theory, consumers make purchases depending on the relative cost of one item compared to the other. Since the basket of goods and services used to compute CPI is fixed over time, it might not always imitate a consumer’s preference for an item that experienced a small change in price from one year to the next versus a product that had volatile price movement. To put it simply, if the price of apples jumps to $20 in one period while the price of oranges remains fixed at $3, a consumer should purchase more oranges during the given period and fewer apples. This phenomenon of people substituting the purchase of lower cost products for higher priced items is not accounted for by the CPI.

Inflation may increase due to the two factors outlined at the beginning of this Inflation section. Inflation is psychological as much as it is monetary. Naturally, rising prices of goods and services can be felt in our day-to-day activities and negatively impact the average individual’s wealth. As the above chart outlines, the expectation is that the inflation rate will increase over the next five years.

Economic Projections

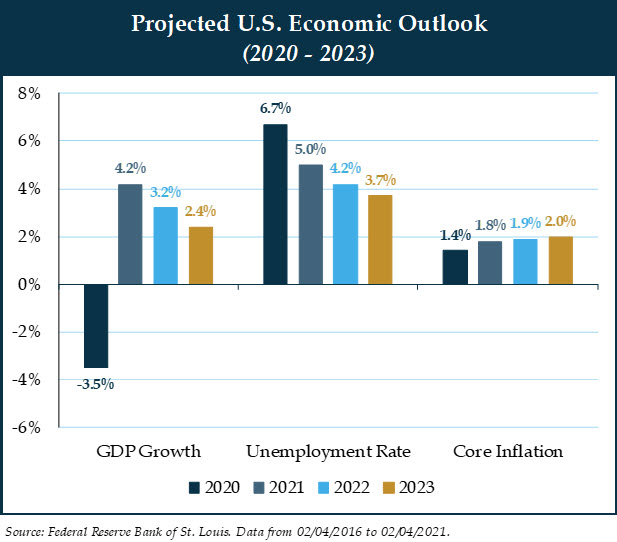

As this is the first Economic Outlook of the year, tying together the last three sections holistically outlines where the country may be heading. The ensuing bar graph portrays that the COVID-19 pandemic had a material negative impact on all three metrics.

In terms of economic growth, U.S. GDP contracted 3.5% in 2020, marking the worst decline in 74 years. As the vaccine is distributed across the country, GDP should return close to its recent trend line over the next few years.

The unemployment rate stood at 6.7% as of year-end 2020 and economists anticipate jobs will gradually be added back to the economy. In short, it might be several years before we reach February 2020’s unemployment rate low of 3.5%. The service sector’s recovery will be a key component to follow as the year unfolds.

The Federal Reserve announced their “average inflation targeting” program. This regime will keep the Federal Funds Rate low until inflation is at or near 2%. As previously mentioned, rising inflation is a potential risk to the economy. The expectation is that the inflation rate will rise in coming years.

Economic Metrics to Follow

The U.S. housing market outperformed expectations during the last year despite all the COVID-19 turbulence. Home prices rose 9.2% year-over-year in 2020, representing the largest annual gain since February 2014. There are three factors contributing to the rise in home values: (i) record low mortgages rates, (ii) a wave of individuals aging into homeownership, and (iii) a decline in available inventory. It will be interesting to see if this trend continues. Some of these three influences will persist in the new year, suggesting that home values should continue their upward trend. However, the counterargument exists that sellers have delayed listing their homes until pandemic concerns subside. An increase in homes on the market (i.e., supply) should, in theory, lead to a decline in home prices.

An unfortunate reality of the pandemic is that some industries have been hit disproportionally harder than others. The first few that come to mind are (i) travel (airlines, hotels, cruise ships), (ii) entertainment (restaurants, bars, movie theaters), and (iii) some areas of commercial real estate (retail, hotels, offices). These three examples could face some medium to long-term financial hardship and delay the overall economic recovery. If we could flip a switch, like a lightbulb, and end the pandemic today, how would these industries pick themselves up?

People are traveling across the country, but are COVID-19 cleanliness measures here to stay? Some economists argue there is bottled-up demand across the American populous to get back into restaurants and bars. People want to go eat with their friends and family, but will we see the return of paper menus or are digital menus here to stay? Freestone team members have successfully been able to conduct their daily operations from the comfort of their homes, but is that the best way to collaborate with colleagues? When it comes to retail, the pandemic arguably accelerated already existing trends. Americans are comfortable with the idea of online shopping but trying on one’s favorite clothes at the mall still seems plausible.

Danish philosopher, Soren Kierkegaard, claimed Life can only be understood backwards; but it must be lived forwards. The decade is off to a murky start, but there is light at the end of the tunnel. Historians will have the benefit of hindsight when they write about 2020 and the years to come, but all we can do is take a deep breath and keep moving forward. One step at a time.

As always, we thank you for entrusting us with your capital.

Important Disclosures: This document contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this document is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this newsletter. While we believe the information in this document is reliable, we do not make any representation or warranty concerning the accuracy of any data in this document and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this document are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This document speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this document constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.