Welcome to Freestone Capital Management’s seventh quarterly Economic Outlook.

- Fueled by easing pandemic-related pressures and continued government stimulus, the domestic economy climbed out of the COVID-19 recession during the spring months. U.S. economic output, as measured by real Gross Domestic Product, now exceeds its pre-virus level, with continued moderate growth expected in coming quarters.

- This report will home in on four macroeconomic factors. Firstly, the country’s swift vaccination program and its implications on case counts and fatalities associated with the virus. Secondly, a review of economic output and the elements outlining the nation’s return to pre-virus levels of growth. Thirdly, the labor market recovery is encouraging but far from over. Demand for labor is high given pent-up consumer spending while supply of labor remains low, putting upward pressure on wages. Lastly, inflation was top of mind during the second quarter and this position paper will focus on inflationary drivers and forward expectations.

- While today’s economic outlook looks brighter than it has in the past, uncertainty around the COVID-19 delta variant, labor market complexities, and inflationary pressures are still prevalent. With a renewed sense of optimism in many regions across the nation, it is important to look back on the journey that brought us here and look forward to more favorable macroeconomic trends.

- Thank you for being a reader of this quarter’s Economic Outlook.

Overview

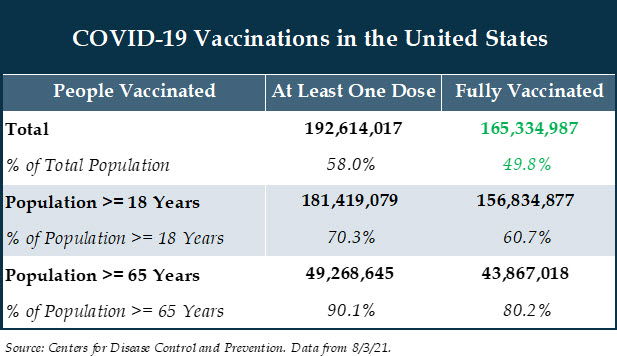

In the wake of a short-lived but deep economic recession throughout 2020 and the first few months of 2021, the U.S. economic outlook is improving. Powered by the easing of pandemic pressures and unrelenting government aid, the economy posted a full recovery during the spring months. Mid-way through the third quarter nearly 60% of the American population received at least one dose of a COVID-19 vaccine, equity markets rallied and home prices surged.

Household net worth is up roughly 17% since the end of 2019. Fiscal stimulus focused on mid-to-lower income households and put money directly in the hands of those most likely to spend it. These factors allowed the most virus sensitive sectors to record a meaningful recovery, contributing to a robust pick-up in Gross Domestic Product (“GDP”) during the second quarter.

The next few quarters will likely face challenges stemming from a variety of issues, including labor market distortions, inflation concerns and supply chain disruptions. Investors are grappling with the notion of what higher inflation expectations mean for equity and fixed income markets going forward. However, as we will explore in this position paper, inflation could be range bound in the near-to-medium term.

Progress Against the Pandemic

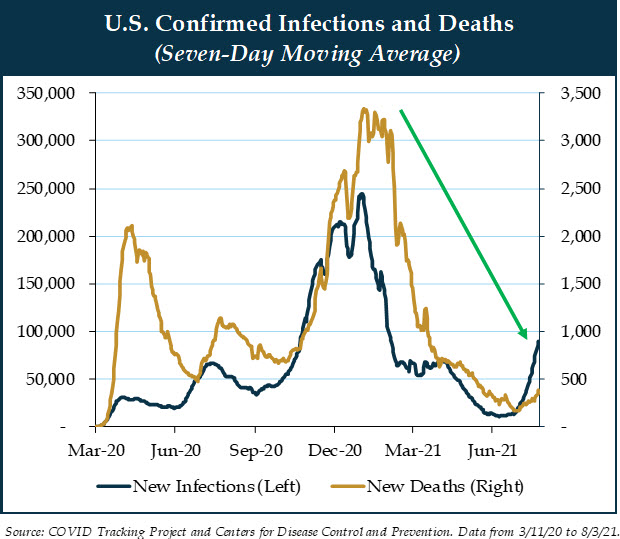

After more than one year of social distancing restrictions and stay-at-home mandates, which proved stressful for many, the country is making considerable progress in combatting (and potentially defeating) the virus. The following chart depicts the seven-day moving average of new confirmed infections and new fatalities across the nation. New cases fell from a daily average of roughly 260,000 in January to 15,000 as of late June.

The effective and prompt vaccination program contributed to declining cases and deaths. As of early August, close to 50% of the population is fully vaccinated. When accounting for the fully vaccinated population and those that already contracted the virus, it is estimated that over 70% of the American populous has some sort of immunity against the coronavirus. With a decline in the rate of inoculations and new variants looming, the country will need to make further progress to eliminate virus concerns.

As of the writing of this report, there seems to be a clear line of sight into a return to normalcy. Growing immunity and an improving macroeconomic landscape should propel the domestic economy in coming quarters.

Peak Economic Outlook

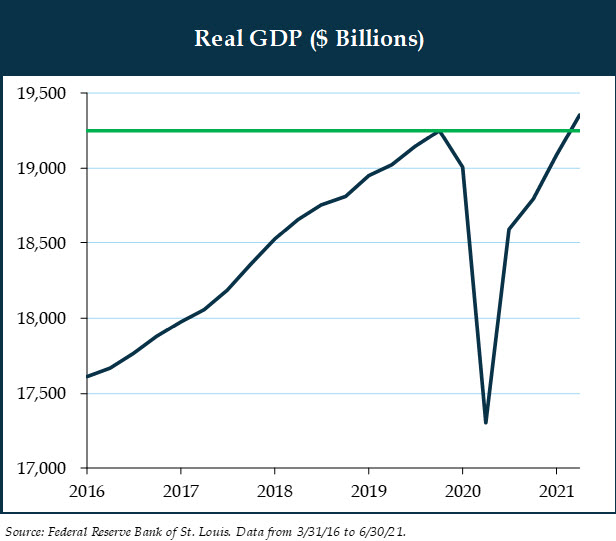

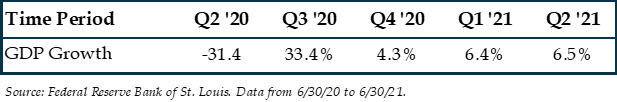

After collapsing in the second quarter of 2020, spiking the next quarter, and moderating during the winter months, economic growth accelerated at a 6.5% annualized rate this spring. A rally in consumer spending both on goods and services coupled with a rebound in business investment pushed real GDP ahead of its pre-pandemic level. As shown in the following line chart, the U.S. is operating at peak economic output.

This past quarter’s result represents strong advances in productivity. Despite the improved outlook, economists anticipate GDP growth will moderate as we head into 2022, tracking towards the 2.5% long-term trend. Growth could slow as the economy will have to keep moving forward without trillions of dollars in government stimulus. The recovery should forge ahead as long as virus cases stay at relatively depressed levels.

Consumer spending, also thought of as the economy’s main engine, soared in the spring by an annualized 11.8%, four times quicker than the historical quarterly increase. Americans acquired plenty of goods such as consumer electronics, but really splurged on the type of services they avoided or were prevented from enjoying during the COVID-19 outbreak. The reopening of the economy fueled spending increases on services, notably at restaurants and bars, vacation travel, and airlines.

Business investment rose approximately 3% as companies embraced the recovery. As examples, they invested hard earned capital towards equipment and intellectual property. Market commentators argue widespread labor shortages and persistent supply chain disruptions prevented employers from investing even more into their businesses.

Looking back on previous recessions is important to put this recovery in perspective. GDP is now above its pre-virus peak, recovering much faster than it did after the Great Financial Crisis. History shows that it took three and a half years for real GDP to recover from the events of 2008-2009. While there is a renewed sense of optimism in the air, the joker in the deck is the COVID-19 delta variant and the effect it could have over the next few months.

Labor Market Disruptions

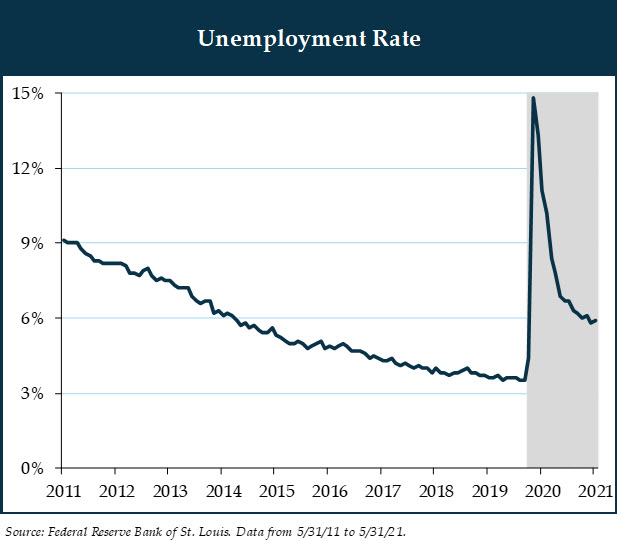

The labor market somewhat mirrored the previously mentioned surge in economic output as the economy reopens. After losing an overwhelming 22 million jobs during the depths of the pandemic, the economy retrieved close to 15 million jobs. This recovery in the labor market, albeit encouraging, is far from complete. Recent jobs reports fell short of projections as evidenced by the recent ADP private payroll report. ADP private payrolls grew 330,000 in July, representing the smallest gain in five months. Job creation lost momentum over the past few months as the unemployment rate remains at a historically elevated 5.9%.

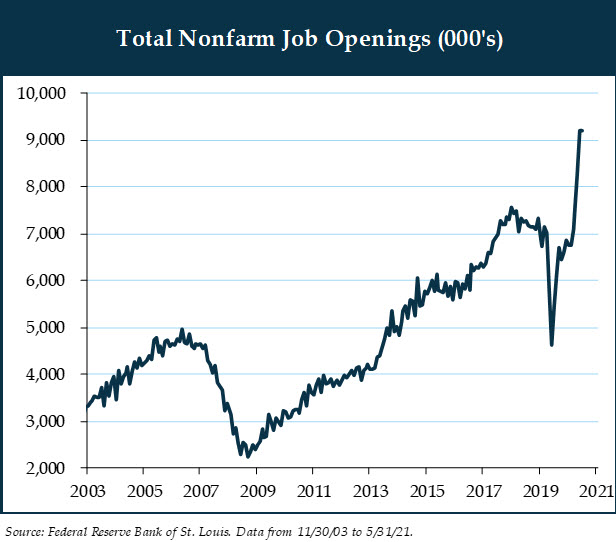

Despite the lackluster data, business owners claim the labor market is tighter than the numbers suggest. Demand for labor is spiking as businesses struggle to keep up with pent-up consumer demand across most industries in the U.S. economy. The graph below outlines this predicament, as there are just over 9 million nonfarm job openings across the country.

The steep rise in job openings highlights the apparent mismatch between the record high number of available jobs and the elevated unemployment rate. Economists argue this shortcoming in job creation is primarily an issue of labor supply. The combination of ongoing unemployment benefits, persistent pandemic worries and early retirements are constraining the supply of labor. Many of these virus-induced factors should retreat over the rest of 2021 as unemployment benefits are scheduled to expire in September, which should reduce some of the labor market disruptions. The unemployment rate could edge slightly below 5% by the end of the year, and between 3.5% and 4.0% by the end of 2022.

Companies are raising wages in response to surging labor demand and a higher cost of low wage hourly workers. When comparing current wages to their 2019 levels, wage growth is up 4.6% and rising compared to the 50-year average of 4.0%. This is important to keep in mind as higher wages might lead to inflation that is less transitory in nature than the Federal Reserve (“Fed”) expects.

Inflationary Pressures

Inflation ticked up in recent months as a spike in consumer spending collided with supply chain issues in major industries of the economy. The recent year-over-year gains in the Consumer Price Index are alarming at 5.4%. However, recent inflation reports are intensified by base effects from the pandemic, indicating that prices are still recovering from a depressed state.

Used cars were a major factor in recent upward inflationary pressures. The average transaction price for a used car in Q2 2021 was up 21% year-over-year. Supply chain distortions, primarily chip issues, should alleviate in the next 12 months as the global recovery continues. In turn, automakers should bring new cars back on the market. This example suggests inflationary pressures might actually be transitory.

At the onset of the pandemic, the Fed took action to support the economy by cutting the federal funds rate to a range of 0% to 0.25%. As part of this aid, the Fed adopted an average inflation targeting strategy, whereby they would aim to achieve inflation of near 2% before evaluating an upward change to the federal funds rate. Current inflation exceeds the Fed’s target, with recent projections outlining two rate hikes in 2023, up from no rate hikes in March of 2021.

The following chart is a measure of anticipated inflation over the five-year period that begins five years from the present. It is a market-based indicator since it combines true expectations for inflation with a risk premium. In short, it outlines the compensation that investors require to hold securities with value that is vulnerable to the uncertainty of future inflation. As shown in the next chart, inflation expectations remain anchored in the 2% to 2.5% range.

Concluding Remarks

While writing this outlook, it became clear that the ice is starting to thaw when it comes to the pandemic. Uncertainty surrounding the delta variant and the waning pace of vaccinations remains, but generally speaking, the economic outlook is brighter today than it has been at any point during the last year and a half – hopefully that optimism is here to stay.

With the summer months slowly but surely coming to an end, as they always do, we should take into account that the strength and tenacity of the domestic economy is unwavering. Economic contractions occurred in the past and will likely happen again in the future. But just like the summer months, slowly but surely economic pullbacks come to an end, as they always do.

As always, we thank you for entrusting us with your capital.

Important Disclosures: Past performance is not a reliable indicator of future results. Please see important disclosures at the end of this document. This document contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this document is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this newsletter. While we believe the information in this document is reliable, we do not make any representation or warranty concerning the accuracy of any data in this document and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this document are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This document speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this document constitute “forward-looking statements” and are subject to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.