In 2024, markets defied cautious growth forecasts, overcame escalating geopolitical tensions, and navigated evolving expectations for Federal Reserve rate cuts to deliver robust returns. As the resilience of the U.S. economy became evident in the year’s second half, three key themes emerged: economic strength, a reshaped Treasury yield curve, and global equity earnings trends. Below, we explore these themes and their implications for portfolio positioning heading into 2025.

Thriving U.S. Economy

While the U.S. economy showed mixed growth signals through the first half of the year, it shook off the doldrums of summer and closed 2024 by evoking parallels to the economic exceptionalism experienced during The Roaring Twenties.

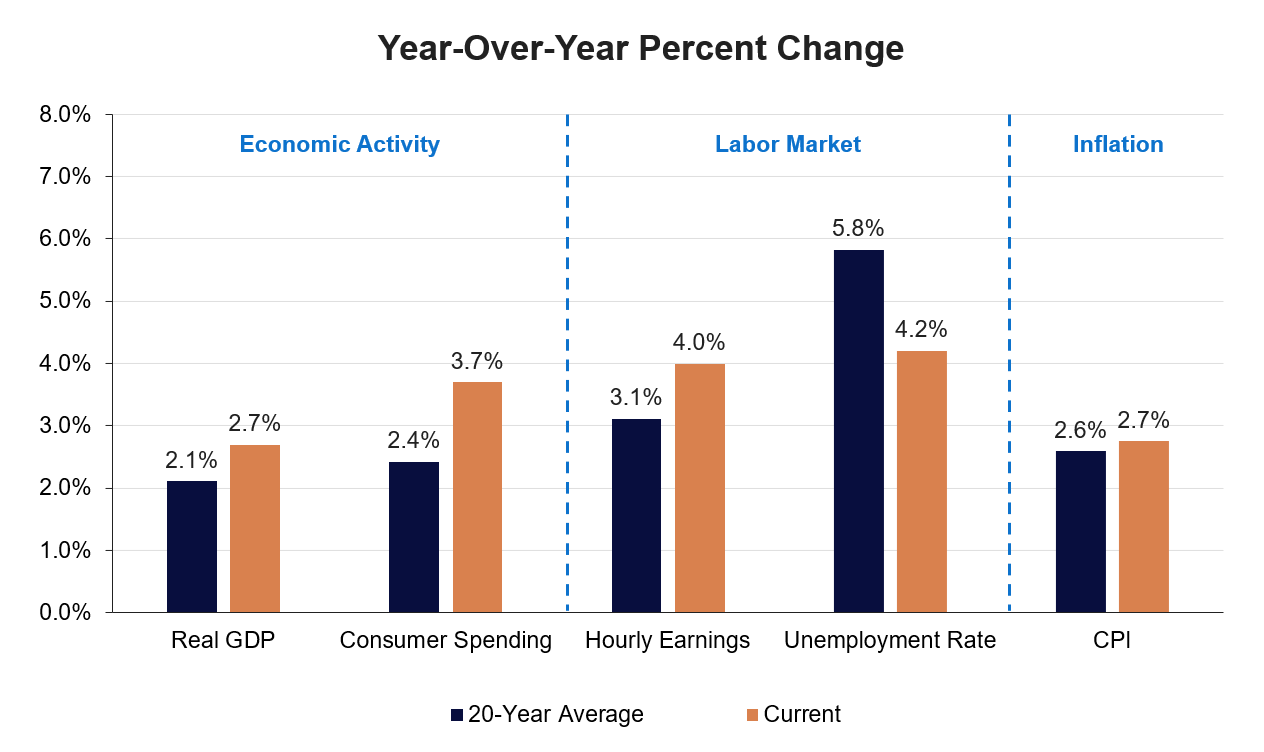

- Economic Activity: U.S. Gross Domestic Product (GDP) surpassed its long-term average, buoyed by resilient consumer spending across goods and services.

- Labor Market: Low unemployment, steady hiring, and plentiful job openings have kept the labor market robust, while strong wage growth supports household finances.

- Inflation: Moderating inflation is roughly in line with its long-term average but remains higher than the U.S. Federal Reserve’s (the “Fed”) 2% target.

Steady consumer-driven economic activity, a healthy labor market, and moderating inflation collectively powered the U.S. stock market to new highs. Stock prices reflect future earnings, not previous events, underscoring that recent gains stem from investors’ optimism that economic vigor will persist. As long as the U.S. economic growth engine remains intact, it can propel the domestic stock and bond markets higher in the years to come.

Reshaping the Treasury Yield Curve

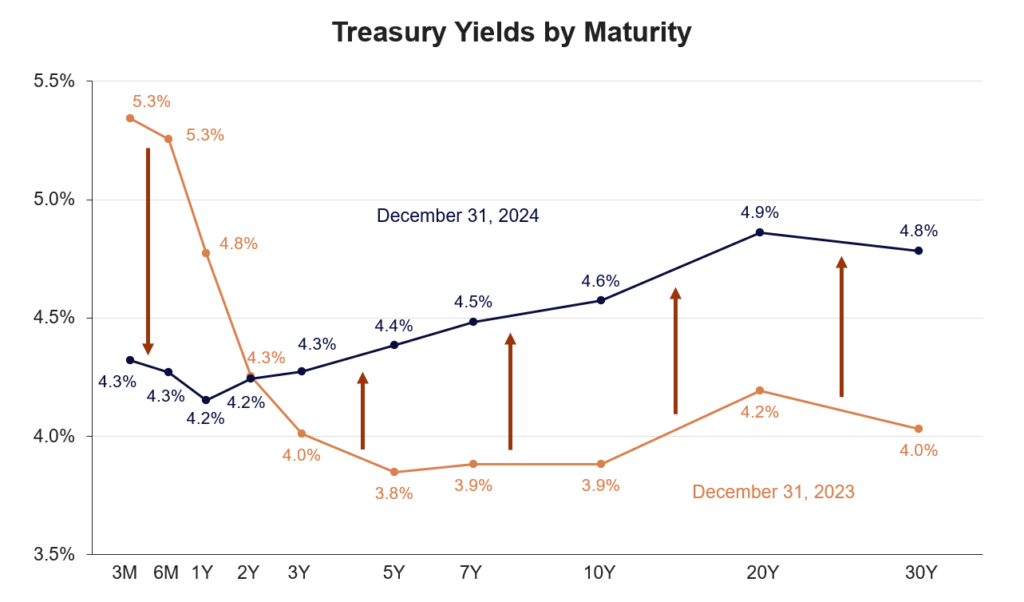

The year witnessed a sharp divergence in short-term and long-term interest rates.

- Short-term rates declined as the U.S. Federal Reserve (“the Fed”) cut their overnight borrowing rate by 1.0%.

- Long-term yields increased on elevating expectations for growth and inflation in the United States.

This dynamic caused the yield curve to “normalize”, with long-term bonds offering investors a higher yield than short-term bonds. Increased compensation for owning high-quality, fixed-rate bonds presents a compelling opportunity for investors looking to shift capital away from lower-yielding money market investments and lock in higher fixed yields.

Comparing Global Equity Earnings and Valuations

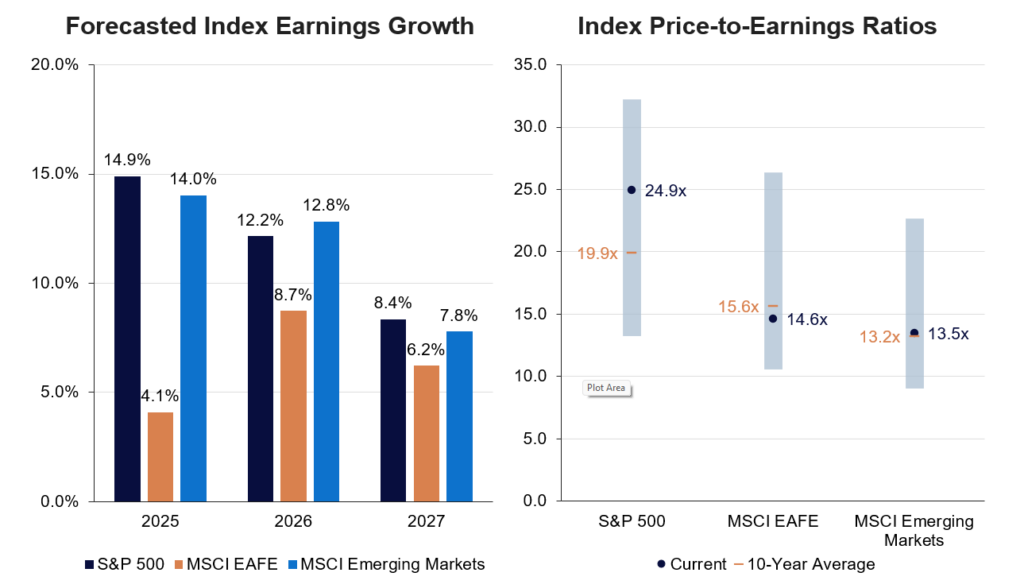

The “Magnificent Seven” stocks in the United States powered global equities higher in 2024.

- While this group of mega-cap growth stocks generated robust earnings, their growth is expected to slow in future years, dragging down the overall earnings growth of the S&P 500 closer to that of international stock indices.

- The S&P 500’s premium valuation remains priced for sustained exceptionalism and stands well above its 10-year average, while international stocks trade in line with their historical average.

If regional earnings growth converges as expected over the coming years, current valuations for international stocks could serve as a compelling entry point for long-term investors.

Looking Ahead

While we can’t ignore that several uncertainties persist — particularly as the nation prepares for a leadership transition in the White House — the underlying strength of the U.S. economy provides a solid foundation for investor optimism. For a deeper dive into how these themes are impacting strategies, our team would welcome the opportunity to discuss how we’re shaping client portfolios to meet their goals and to navigate complexity with a client-centric approach.

Disclosures: All data sourced from Bloomberg. Indices are not managed, and it is not possible to invest in an index. Past performance is not a reliable indicator of future results. This blog post is for discussion and educational purposes only. Nothing in this blog post is intended to provide, and it should not be relied upon for, accounting, legal, tax or investment advice or recommendations.