“The best argument against democracy is a five-minute conversation with the average voter.”- Winston Churchill

The world is in a rebellious mood. Signs of rebellion appear to be everywhere with terrorist attacks; Donald Trump and Bernie Sanders are visible symbols representing the foul mood of the world’s citizens. Britain’s recent vote to exit the European Union (EU) shocked investors around the world. When you think about it, however, the EU seemed doomed to fail from the beginning. Locking the arms of nations as disparate as Sweden, Germany, Britain, Spain, Italy and Poland – after spending countless centuries attacking each other — has always seemed to be a stretch.

Investors dislike uncertainty, and Brexit promises to create an abundance of uncertainty over the next couple of years. The stock markets seem fragile to us, coupled with already high valuations and volatile currency movements around the globe. Over the last six months, we’ve written about the low expected returns for most traditional investments over the next ten years; the large decline in stock prices on June 24th is typically how low expected returns manifest themselves. Instead of many years of 1-3% returns, we could have -15% years followed by +18% years. We believe the significant volatility will ultimately reflect low overall returns.

That’s why we like to remind you periodically that investing for most of us is a marathon, not a sprint. The breathless media had a field day with Brexit – they want you to watch! But for us, as we run our investment marathon, the current volatility changes very little. Uncertainty continues to increase as we wait for the next shoe to drop in Europe, likely in the form of additional referendums to withdraw from the EU. In turn, economic activity at the margin could decrease; it could also serve to keep interest rates lower for longer. Part of the distraction of investing in stocks is frequent brain damage from paying attention to volatile world events! As always, a patient and disciplined approach is best. Many of our internally managed strategies are experiencing good performance this year, and we continue to focus on the things that we can control.

Social Media: The Tool of Rebellion

Social media is playing a major role in fomenting and accelerating anti-establishment movements on every continent. As an old guy who refuses to use Facebook, I am prone to underestimating the power of social media, but I cannot ignore the role that social media has played with the Arab Spring, Brexit and Donald Trump’s ascendance.

Barriers to entry for political participation have now been reduced to the click of a button: a “like,” a “retweet,” and a digital signature on a petition is all it takes. I’m afraid that it brings up some troubling issues:

- With the ease of participation, it is a small distance between apathy and participation;

- Given the social dynamics of humans, a movement that is gaining momentum might be enough for a chain reaction, creating a juggernaut;

- Mobilizations can now be launched without leaders, just enough early participants to get the momentum going.

How thoughtful is the support if it is so easy to give? Based on this, it seems like we are in for consistently high turmoil and an anarchistic approach to collective decision making.

Energy is Energized

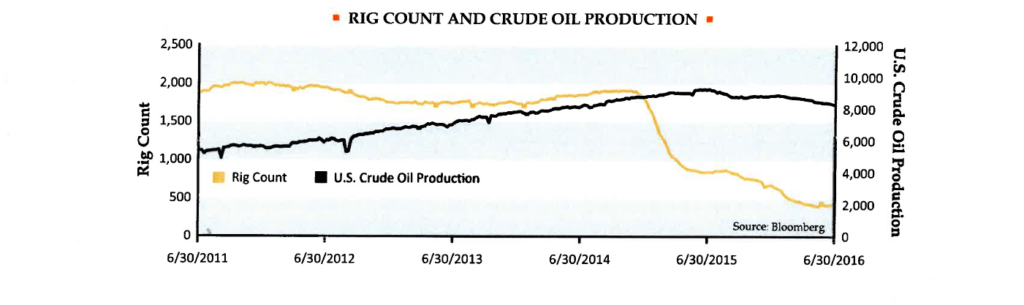

In an investment climate where good values are hard to come by, we have believed for a while that energy is one area where good deals still exist. Demand for oil and natural gas continues to increase steadily even as alternative energy is trumpeted by the media. Supply continues to shrink as most producers cannot turn a profit at current prices. The U.S. produces about 10% of the world’s oil and natural gas, and the number of active drilling rigs has collapsed by 80%. (See chart below.)

There is a time lag between the moment when drilling rigs are removed from the fields and production declines. First off, existing wells continue to produce, albeit at declining levels, over time. The operators then move a reduced number of drilling rigs to their most productive fields. Inevitably, however, production starts to fall off, and that is what we believe we are seeing now. The chart above shows U.S. oil production. Among other things, this chart illustrates the time lag: the number of active drilling rigs declined precipitously in the first quarter of 2015, but oil production didn’t begin its decline until the 3rd quarter of 2015.

Global oil production has also started to decline, and we are also seeing rebellion-related supply shrinkage in Nigeria and other nations due to terrorist activity. With energy markets, a very small imbalance can result in severe price swings, and so far in 2016, oil prices have rallied 32% and natural gas is up 24%. We have invested in energy-related securities in a few of our strategies and continue to look at the best way to take advantage of the low prices.

Ignoring the Noise

Events like Brexit, the upcoming United States presidential election and daily reminders of ISIS are inevitable challenges to investors. New media is more intrusive and focuses on the immediate and short term. Successful investing, however, is a long term endeavor, and it is important to keep that in mind as you click through various news sources. Overall, many of our investment strategies are having a decent year in 2016 so far, and we are fortunate to have the opportunity to work for you to manage your wealth.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.