I think 2017 will go down as one of the most memorable years in recent history. In many respects, I am glad it is over.

A few notable highlights:

- A President unlike any we have ever seen before with a political system that seems unable to deal with the issues that are most important to our future.

- Increased awareness of cryptocurrencies (Bitcoin, Litecoin, Ethereum) create uncertainty for the future of fiat currencies.

- Big data, artificial intelligence and machine learning move to the forefront of business as Amazon, Facebook and Google increase their influence over our daily lives.

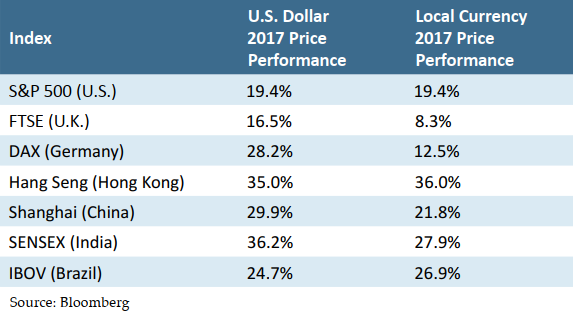

- Stock markets around the world stage impressive rallies.

There is an old Wall Street saying that “The stock market climbs a wall of worry” and 2017 was a good example of this. I started in the investment business 36 years ago and there has always been something to worry about. The U.S. stock market had an excellent 2017, but the real story was non-U.S. stock markets after many years of underperformance relative to the U.S. The U.S. Dollar was weak vs. many of the world’s currencies which enhanced non-U.S. returns for U.S. investors.

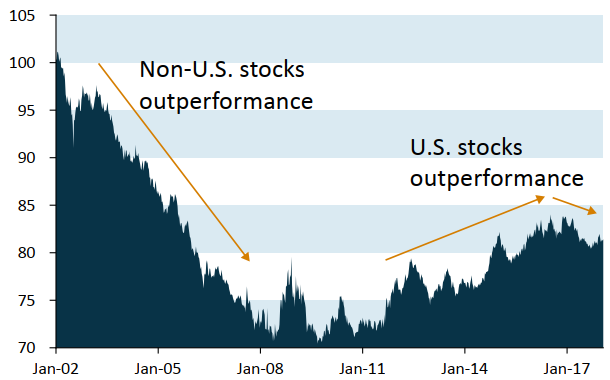

In the graph below, I’ve compared the performance of U.S. Stocks (S&P 500) to the MSCI World Index. From 2002 to mid-2008, non-U.S. stocks outperformed U.S. stocks. From mid-2008 to late 2010, performance was roughly the same. From late 2010 until early 2017, U.S. stocks outperformed non-U.S. stocks. Since early 2017, non-U.S. stocks have outperformed U.S. stocks. In 2016, we recommended that clients’ shift some of their stock market exposure from U.S. to non-U.S. stocks because non-U.S. stocks were less expensive and most foreign countries were behind the U.S. in stimulating their economies with quantitative easing. We think this trend of non-U.S. stocks outperforming U.S. stocks will continue for the same reasons along with the added political uncertainty in the White House.

The Real Impact of the Change in Tax Law

Despite the media hand wringing over the change in the tax law that was jammed through at year-end, the impact on most individual taxpayers will likely be relatively benign. The real story is how much the change in corporate tax rates will be for most U.S. companies and the potential impact on stock prices for 2018. Most companies have not publically announced the impact of the tax rate change, but there have been a few companies that have announced earnings in early January and have provided guidance on the impact.

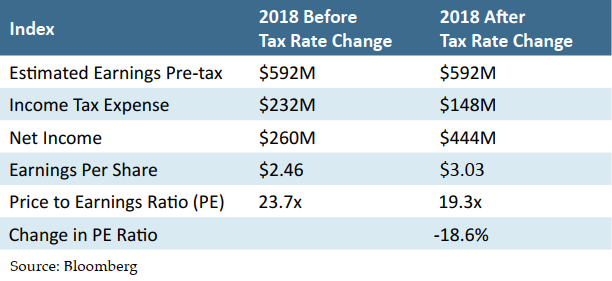

Lamb Weston (LW), a potato producer, reported earnings on January 4, 2018. In its announcement, it also disclosed that its effective tax rate will go from 35% to “mid 20s” in 2018. This makes a major difference in LW’s earnings per share and valuation (price/earnings ratio). Based on publically available information and our own internal calculations, we believe the below chart represents the approximate impact on LW’s EPS and PE ratio.

We can argue whether paying 23.7x for a moderately growing potato producer is too high, but the real impact on the change in tax rules is going to massively benefit many U.S. companies that were paying taxes in the 35% range. One could argue that this could prolong the rally in U.S. stocks a little longer.

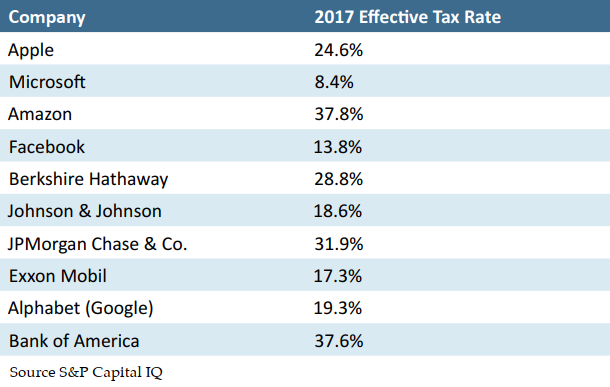

The benefit is uneven depending on how aggressive a company has been avoiding taxes in the past. Here are the 2017 effective tax rates of the ten largest companies in the S&P 500 Index. Keep in mind that starting in 2018, the effective corporate tax rate is 21%.

It appears that many of the largest companies have done an excellent job of avoiding taxes so the tax cut to 21% won’t help them much. Smaller companies tend to pay higher taxes and the lower rate should have a disproportionate benefit.

Looking Ahead

- We continue to believe that equity portfolios should hold a relatively higher weighting of international and emerging market stocks given that both growth and valuations are currently more attractive overseas. While we do expect more volatility in international stocks in 2018, we believe that international stocks are likely to outperform U.S. stocks over the next couple of years.

- We also continue to emphasize broad diversification across asset classes and have become somewhat more cautious regarding global stock markets (especially U.S. stocks) given the following:

- Stretched valuations in stocks, especially in the U.S.

- Rising interest rates as the Federal Reserve plays catchup with short-term interest rate increases

- Signs of a pick-up in inflation which is seldom good for stocks

- Seemingly higher than normal potential for a negative unforeseen events (i.e., turmoil in the Middle East, North Korean aggression, trade war, unexpected policy pronouncements, etc.)

- With the prospect of rising rates, the bond market may become an attractive alternative again. We believe it is too early to invest a lot of capital here, but we believe it continues to make sense to use bonds as a diversifier and risk reducer in balanced portfolios.

Where possible, some clients may wish to keep a little more cash on the sidelines to have capital available if we have a market decline. The good news is that some taxable and non-taxable money market funds are yielding more than 1.0% after yielding zero for most of the last five years.

Important Disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or philanthropic giving strategy, and you should not make any financial planning or giving decisions based on the information in this article. The intention of this article is educational and it is intended only to discuss a few limited aspects of philanthropic giving using general examples that are not specific to any specific person. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is in a different situation and has different items to address, and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor and a lawyer regarding options specific to your needs.