Digital disruption and the rise of robo-advisors have created the difficult task for you to provide value in a crowded space. The rise of online information and constant media coverage instill a sense of confidence that retail investors can invest and garner similar returns, than what you’ve historically delivered. How can you add value to your client’s portfolio outside of balanced-risk allocation? For qualified clients, alternative investments, not REITs or Mutual Funds, but real investments in alternative assets classes, can provide a level of exclusivity and diversification your clients may require. And further niche opportunities, found outside of the large players, can provide bespoke and further customized investment allocation to your HNW and UHNW client portfolio.

In this piece we’ll cover:

- Why Freestone differs in the Alternatives space and how we use it to appeal to clients

- How we choose investment offerings and why they are easier to pitch to clients

Our Alternative Approach

Freestone has sourced and offered alternative investments since our founding. Why? Because it’s what we wanted to invest in ourselves. We tend to pursue tax-advantaged, inflation-aware opportunities with risk-adjusted returns and downside protection. Our private funds can largely be categorized based on two underlying investment philosophies:

- Opportunistic funds: Broad exposure to a set of niche, fragmented and/or often misunderstood asset classes, often produces an “incubation” opportunity for our focused strategies

- Focused strategies: More targeted exposure to a single asset class such as real estate or commodities like Kentucky Bourbon

Finding Diamonds in the Rough

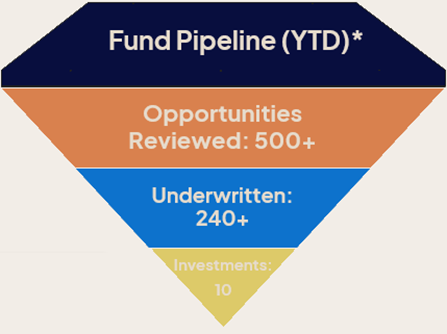

We’ve launched 23 private funds since 2007 and continue to find uncorrelated investment opportunities through our rigorous investment process. In a typical year in the life of our funds, we review over 500+ opportunities and eliminate about half of the opportunities as we move to underwriting, selecting less than 2.5% of the opportunities reviewed.

For illustrative purposes only.

General Partners of the Funds

Freestone and our affiliates serve as investment managers and general partners of the private funds. What that means is we have more control over the investment and invest as close to the end assets as possible. We are able to negotiate better terms for our clients as well as operate under strict and reporting documentation requirements.

Additionally, we only invest in a fund when it makes sense to do so. Unlike larger firms that are required to continually source and offer new investment vehicles, Freestone does not have the same pressures. We allow the opportunities to guide us, opening a fund only if the optics and returns make sense for the client.

Alts—not just sharper tools; a better toolbox

Underscoring our confidence in the investment types offered at Freestone, we only offer alternative investments that our partners find compelling. Alts bring our clients opportunities they would never otherwise hear of or see. We do it because this is where we want to invest our own money. We pursue these opportunities regardless of whether our clients choose to participate.

When we see the investment potential of an opportunity for our clients, we create the structure and mechanism that allows them to participate right alongside us. This shared experience puts us on the same side of the table as a client. As an advisor, this creates a deeper dynamic with the client–knowing we’re in this together. We directly invest alongside our clients, with over $117M employee dollars committed to date.

Joining Freestone is one less risk you’ll have to mitigate

Freestone continues to focus on the client, creating opportunities for our advisors to do their best and most focused work. If you’re an advisor who puts their clients first, and you’d like to learn more about how we approach investments and other business-related initiatives, we want to hear from you. Reach out to start the conversation today.

Like what you read? Sign-up for Freestone Insights for relevant financial planning and investment advice.

Disclosures: The information shown on this page is for discussion purposes only. This page provides general information that is only a summary of certain employment benefits that we believe might be of interest. Information shown on this page is not intended to be relied on for any employment decisions nor is any of this information a guarantee of employment terms. Information shown are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise of any change in such information in the future.