When you hold one stock that represents a large percentage of your net worth, it is known as a concentrated stock position. This generally occurs when you are invested in a company that experiences tremendous success, or work for a company that issues shares of its stock as part of its compensation plan.

If you hold your entire position and the stock continues to do well, you could earn even greater gains – but the risk of loss could be devastating. What do you do?

The Context of a Financial Plan

A financial plan can help put your concentrated stock position into context by understanding the impact that price fluctuations could have on your wealth. By first defining your minimum goals and understanding the size of the concentrated position (including unvested shares, options, etc.), you can clearly define the true impact of the position on your lifestyle. For example, if your financial plan shows that you will need $5 million in investment assets at retirement, and your concentrated stock position is worth $10 million, then you know that you can lock in your goal by selling half of your position now. The other half of the position will maintain all of the upside potential, as well as the downside.

Another method of analysis is upside versus downside modeling. In many cases, additional upside would not result in a lifestyle change (i.e., the stock value increases from $10 million to $13 million), whereas the downside would result in a lifestyle change (i.e., the stock value decreases from $10 million to $5 million). It is important to see the potential impact of each scenario, and be comfortable with the possible outcome.

There are many examples of the founders or early employees of some of the most successful companies (e.g., Microsoft, Amazon, Starbucks) selling a portion of their position at or soon after an initial public offering. These companies have performed well, and these individuals have missed out on some of the additional upside to capture these gains. In contrast, people who held concentrated positions at Enron, Washington Mutual or Fannie Mae likely did not think their company stock price could go to $0. Nor did the wave of tech companies that were going to “change the world” in the late 90s. No one (not even the founder or CEO) knows what the stock price will do over time, so focus on the impact on your life, and be realistic about what you can accept.

For a more in-depth understanding of how your concentrated stock position fits into your financial situation, download our free guide,“Programming Your Financial Future”.

Risk Reduction Strategies

Once you determine the potential impact of your concentrated stock position and what you are willing to accept, there are a few strategies you can use to mitigate your risk, while also being mindful of tax implications. Following is a discussion of a few of those strategies.

Selling shares:

If you own vested shares outright you can simply sell to raise the amount needed to cover your comfort level. A Client Advisor can assist you in a review of your concentrated position and help you determine both when and how much to sell from a tax impact standpoint. If you own shares that are not yet vested, a Client Advisor can also help you formulate a strategy as those shares vest.

If you are an insider or subject to trading windows, you will have to first be cleared to trade, be in an open window, or utilize what is known as a “10b5-1 trading plan.” If available to you, a 10b5-1 trading plan allows you to enter trade orders during a trading window specified by the company. Once entered, that trade can be completed even after that trading window is closed.

Hedging shares:

Based on your unique situation, you may be willing to accept some downside, but only a certain portion (e.g., 30%). You may be equally comfortable with giving up some of your upside. If this is the case, an options hedging strategy may be appropriate. Options consist of “calls” and “puts,” which give you the right to either buy or sell shares at a specified price. In order to hedge a concentrated stock position, you can purchase a “put” on a publicly traded company, giving you the right to sell shares at a set price, even if the stock goes much lower. For example, if you own a put at $50 and the stock price drops to $20, you are still able to sell your shares at $50 using the put. This can be especially useful if you are comfortable with some downside, but your financial plan shows that your lifestyle would be greatly impacted if the share price were to drop below a certain price.

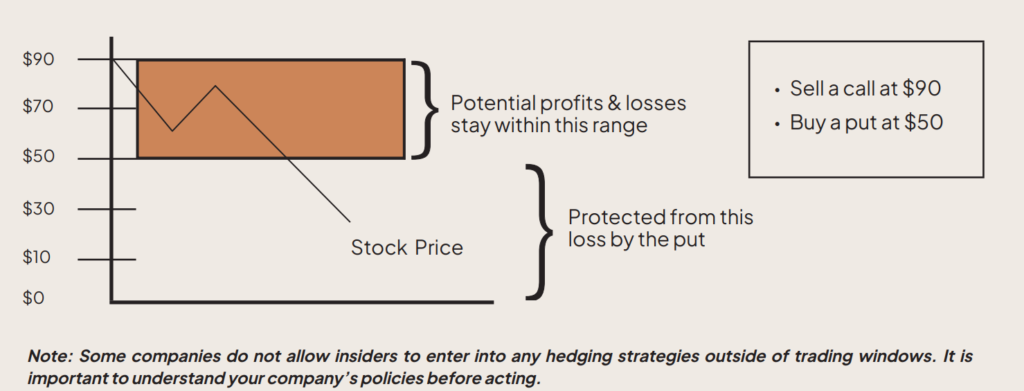

Because puts require frequent renewal (typically every 12-18 months), and can be expensive, you may benefit from another strategy called a “no-cost collar.” In this strategy, you would buy a put while also selling a “call,” so that the cost of the put is offset by the sale of the call. Note that the costs may not perfectly offset one another, but the cost of buying the put is typically greatly reduced. Selling a call means you are selling someone else the right to buy the stock from you at a specified higher price. For example, if the stock price was $70, you might buy a put at $50, and at the same time, sell a call at $90. This means that you are protected from a fall in stock price below $50 (that would be your maximum loss), while your capped upside is $90. So, if the stock price increased to $100, you would not participate in the gains above the $90 call price. A benefit to this strategy is that you may take part in some of the upside, while mitigating potential losses if the price falls below the put price. This is a complex strategy, and each case is unique, therefore we strongly recommend speaking with a Client Advisor to determine if this might be appropriate for you.

No-Cost Collar

Exchange Fund:

Depending on the shares you hold, you may be able to utilize an exchange fund. In this case, a financial institution will create a fund targeting a specific size and blend of stocks to be contributed. You then contribute some shares of your concentrated positions, which are pooled with shares of other stocks contributed by other investors, creating a diversified fund. Once the fund reaches its target size and blend of stocks, it will close to new investors. In exchange for shares contributed, each investor will receive a proportional number of units of the diversified fund. Since no sale occurs, this strategy not only diversifies your portfolio, but should also allow for the deferral of capital gains tax until the fund units are sold. These funds are typically illiquid, can lock-up your assets for seven years or more and generally are only open to individuals who satisfy certain requirements, including net worth and investible asset requirements.

Summary

Trying to determine “the” time to sell is impossible. Instead, you should understand the impact that a variety of outcomes can have on your overall financial plan, and decide what is acceptable to you. Completing a comprehensive financial plan will help put this in to context. An options hedging strategy may give you the best trade-off of acceptable downside and upside on some of your position. An exchange fund may be a suitable alternative if you qualify and if the company shares you hold can be accepted. The decision to sell is not about your view or belief in the company, which is why you see diversification stock sales by founders and CEOs. If you are fortunate to have a large concentrated stock position, the only question now is how much of the potential additional gain are you willing to give up in an effort to protect yourself from significant losses?

Important Disclosures:

- This article contains general information and our opinions and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article.

- All investment activity, including risk reduction strategies, involves risk of loss, including complete loss.

- This article speaks only as of the date indicated. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information in this article or advise you of any change in such information in the future.

- Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results.