Understanding the tax advantages related to charitable contributions can help you decide how and when to give.

While there is no wrong way to give, there are different methods that may align with the donor’s personal circumstances to provide the maximum amount to charity while receiving the maximum tax advantages. Here are the six most common giving methods and the tax advantages associated with each.

Cash Donations

The simplest option is to give a cash donation to your charity of choice. Cash donations can be made to public charities, donor advised funds, private foundations, charitable trusts or individuals. Cash donations are ideal for those looking for simple ways to give.

Tax advantages: Cash donations generally provide the highest charitable deduction opportunity with the ability to deduct up to 60% of adjusted gross income when the donation is made to a qualifying charitable organization or entity.

Highly Appreciated Assets

This method allows the donor to transfer an asset, such as stock, to a charity without the need to sell it first. The primary benefit to this giving method is the avoidance of any capital gains tax on the gifted asset. These donations can be made directly to public charities, donor advised funds, private foundations, most charitable trusts or individuals. Careful planning is required for gifts being made prior to a contemplated sale to ensure maximum benefit from this strategy.

Tax advantages: This strategy allows you to support your favorite charitable organizations while avoiding capital gain taxes on the appreciated asset and receiving a charitable deduction. Taxpayers can deduct up to 30% of adjusted gross income through gifting appreciated assets. These limits are reduced for donations to certain organizations, such as private foundations, and are not available for gifts to individuals. In addition, specific rules may apply to interests being transferred to a charitable trust.

Donor Advised Funds

A Donor Advised Fund (DAF) is a charitable giving account funded by contributions of cash or securities, and sometimes illiquid assets. The donor can then make donations from the fund over time. They are fairly easy to administer and generally have nominal fees involved. Above a certain funding level, a DAF may also be managed by an investment advisor. DAFs may only be used to make donations to public charities or private operating foundations. They cannot make grants to private non-operating foundations or to individuals.

Tax advantages: Once a DAF is created, it provides the donor with an immediate tax deduction. This option can be ideal for individuals looking to receive a larger tax deduction in one year due to a wealth creation event such as the sale of a business or real estate. DAFs can also be used as a legacy giving tool for families who want to build a culture of giving. Special considerations may apply to donations of appreciated assets.

Private Foundations

A Private Foundation is a non-profit organization set up by an individual or a business for the purpose of charitable giving. They are typically funded with one large donation that is invested with income being distributed to a charity (or multiple charities) each year. Private Foundations are required to distribute a minimum of 5% of the prior year’s average net assets for charitable purposes each year in order to maintain their tax advantaged status.

Private Foundations can grant donations to any public charity and sometimes to a non-charity if the funds will be used for charitable purposes (although this option requires careful vetting to avoid a tax penalty from the IRS). These entities are more administratively onerous than other charitable vehicles, but Private Foundations may hire staff, reimburse expenses and provide donations directly to individuals in the form of scholarships or hardship assistance. They also allow for more direct operational control for families who wish to have direct involvement in charitable activities.

Tax advantages: Private Foundations, while income tax-exempt, are typically subject to a nominal investment income tax.

Qualified Charitable Distributions from IRA

A Qualified Charitable Distribution (QCD) is when an account owner distributes a portion of an IRA account directly to a charitable organization. This option is only available to individuals aged 70 ½ or older, and is limited to $100,000 per person, per year. Under the SECURE Act 2.0, this amount will be indexed for inflation starting in 2024. QCDs are not taxable to the account owner, and count towards the individual’s Required Minimum Distribution (RMDs) for the year, for those who have reached that age.

Tax advantages: While no tax deduction is available for QCDs, the distributed amount will not be taxed to the account owner. For those taking RMDs who do not need the additional cash flow, this option can accomplish charitable goals while also avoiding tax on part or all of that year’s IRA distribution.

Charitable Trusts

This method allows the grantor of an irrevocable trust to either receive an income stream from the assets held within the trust for a specified time before the remaining assets pass to charity, or to direct a stream of income to a charity for a period of years with any remaining funds then passing to the grantor’s specified heirs. By contributing to a charitable trust, the grantor is eligible for an income tax deduction on the charitable portion of the trust,removes those assets from his or her estate, thereby reducing the size of the estate, and also avoids capital gains taxes on most contributed assets. In addition, while the creation of the trust may involve a gift, the taxable value of the gift is generally reduced by the charitable component. Several types of charitable trusts are available depending on the grantor’s individual circumstances.

Charitable trusts can be beneficial tools but require the engagement of a knowledgeable attorney and tax professional. They are therefore more costly to set up and maintain and will be most beneficial to high net worth families looking to achieve charitable goals as part of their estate planning process and/or for years in which there is a large income tax event.

Tax advantages: A partial charitable deduction and gift tax reduction are generally available for contributions to a charitable trust but require a calculation to be done by a tax professional. Capital gains taxes are avoided for most assets contributed to the trust, and the contribution may help mitigate estate taxes depending on each individual situation. Certain assets such as interests in S-corporations may require special consideration.

At Freestone, our priority is to help you meet your personal and financial goals. We offer a full suite of services to help protect, grow or transfer your wealth, and address all aspects of your financial life. To learn more about how we help our clients focus on what truly matters, check out our approach.

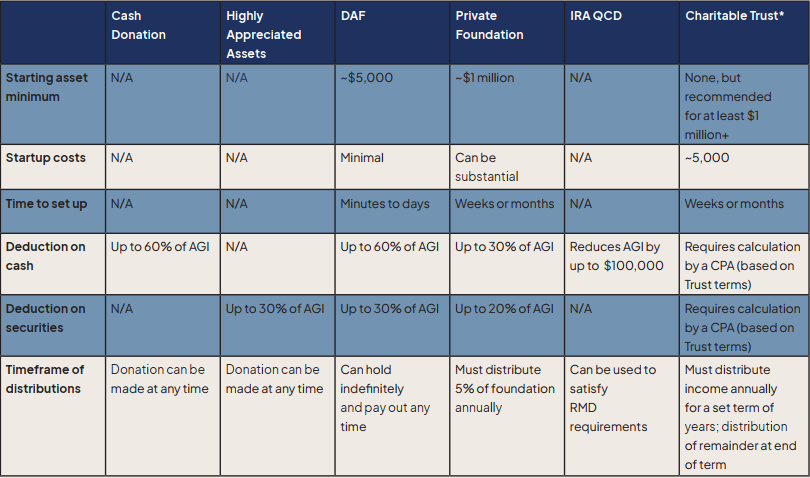

Overview of Donation Options

*Charitable Trusts are the only donation option that allow for a partial interest in the donated property to pass either back to the donor or to the donor’s heirs.

Important Disclosures: The information contained in this document is for informational purposes only. This document is not a complete or comprehensive guide. Nothing in this document is intended to provide, and you should not rely upon it for, accounting, legal, tax, or investment advice or recommendations. We are not making any specific charitable giving recommendations and you should not make any giving decisions based solely on the information in this document. Every person is subject to unique considerations, and the options in this document are not appropriate for everyone. Please consult your Freestone client advisor and a tax professional regarding options specific to your needs.