The tech industry is commonly known for their generous compensation plans, primarily in the form of company equity.

Depending on the success of the company, this incentive structure can lead to lasting wealth. As long-term employees and senior executives continue to accrue company equity, it is common to see an investment portfolio with a concentrated position, when one asset comprises more than 10-20% of your net worth. Does this sound like you? For many employees with company equity, that position can be north of 50% of their net worth.

Employees at public companies, especially major tech firms like Amazon, Microsoft and Google, have seen their vested shares surge in value year after year. This is an ideal situation, but it leads to the question of whether and/or when to sell their holdings. There is a level of risk if you chose to hold a concentrated position and our goal is to provide the information for you to plan in a strategic and intentional way. How you handle your vested shares could mean the difference between financial independence or a major headache down the road.

Key Factors to Consider

When looking at your concentrated position, we recommend focusing on two main ideas: risk diversification and tax impact.

Diversification

Diversification is everyone’s favorite investment buzzword, and you’ve no doubt considered it when looking at your concentrated stock position. During the bull market we’ve experienced the last ten-plus years, you may have seen your share price increase. Then, March of 2020, when the stock market plummeted 33% in one month you may have become more aware of how much your net worth moves in lock step with your company’s share price. Even tech darlings like Facebook and Microsoft dropped a similar percentage before snapping back and outperforming in a more digitized world.

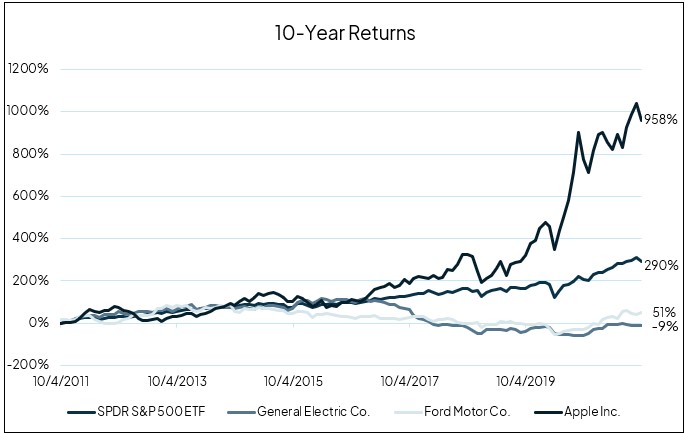

The chart below shows the returns of three blue chip companies, Apple, Ford, and General Electric, against the S&P 500. You can see that their 10-year returns vary greatly, arriving at very different figures after a volatile ride. Apple gained nearly 1000%, while GE actually lost 9% over that time period. The S&P 500, a broad index of high-performing companies, saw less volatility and nearly 300% returns.

While you may work for a strong company with no headwinds in sight, the pandemic showed us a reality of finance: shocks happen. Companies can go from iconic to irrelevant with dizzying speed and it brings to mind the old adage: don’t put all your eggs in one basket.

Concentrating most of your risk, and returns, on one position is at best a stressful road to riches, and at worst a recipe for a spoiled nest egg. The greater the amount of risk you are willing to take, the greater the potential reward. However, you also risk significant loss. One way to assess the level of risk you are comfortable taking is evaluating how the outcome may affect your current or future lifestyle.

Tax Implications

It is important to consider the tax implications of selling your vested shares, and we recommend speaking with a professional about your specific situation. It’s helpful to have a basic understanding of the tax treatment of employee equity so you can have a more informed conversation if you chose to sell a portion of your vested shares.

Restricted Stock Units

RSUs at a publicly traded company are generally taxed as ordinary income when the shares vest. The closing share price at the date of vesting is both used to calculate income tax owed, as well as the cost basis when the employee eventually sells these shares. Once the employee owns the shares, they are taxed as regular stock holdings.

Stock Options

Most commonly, pre-IPO or private companies have structured their compensation approach to include Non-Qualified Stock Options (NQs) and Incentive Stock Options (ISOs).

NSOs are assigned a fair market value when they are granted to you, known as the grant date. As the options vest, you have the right to buy the stock at the strike price (fair market value at the time of the grant). Once the options are exercised, taxes are typically owed based on the difference between the strike price and current market price. The difference in price is taxed as ordinary income at the time of exercise. Once the employee owns the shares, taxation depends on the holding period, like any other stock.

ISOs are similar, but the most important difference is that ISOs may be subject to the Alternative Minimum Tax (AMT), which should be considered when determining whether to exercise. These tax rules are complex, so we recommend discussing your options with a tax professional to ensure you avoid any potential adverse tax ramifications.

How to Handle it:

If you decide to diversify, there are a number of ways to do it.

- Selling All Shares

- The obvious choice, but rarely the best one! Missed future returns and heavy taxes.

- Options and Equity Collars

- Make some money on your shares while protecting yourself from heavy losses.

- Exchange fund

- Diversify without paying capital gains. Partner up with investors in the same boat at a different company, trading some of your shares for theirs.

Our blog post, concentrated stock positions, dives further into these risk reduction strategies if you’d like to learn more.

Know What’s Right for You

There is no one-size-fits-all solution for how to handle a concentrated stock position. You may believe in the company’s future and are comfortable riding out volatility swings. Or may feel a strong sense of pride in your company and your stake in it. You may simply not want to sell.

At Freestone, we believe a financial plan can provide the context you need to confidently keep or sell your shares. Check out our on demand webinar “Concentrated Stock: Understanding the Associated Risks” to learn how a financial plan can provide that context as well as other risk reduction strategies when and if you decide to reduce your position.