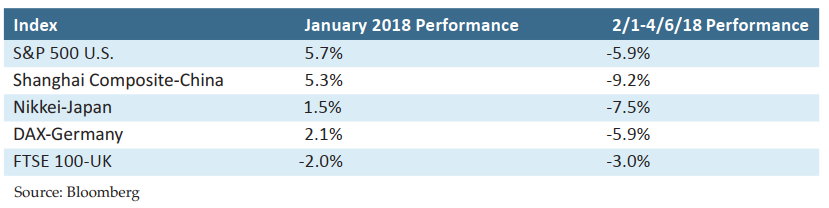

Stock markets around the world started off 2018 with a bang as investor euphoria mixed in with a dose of TINA (There Is No Alternative) sent stock prices soaring through the end of January.

This seems like a distant memory now, as reality has set in and markets around the world sold off after January. Here is the performance of the major stock markets for these two periods for a US $ investor.

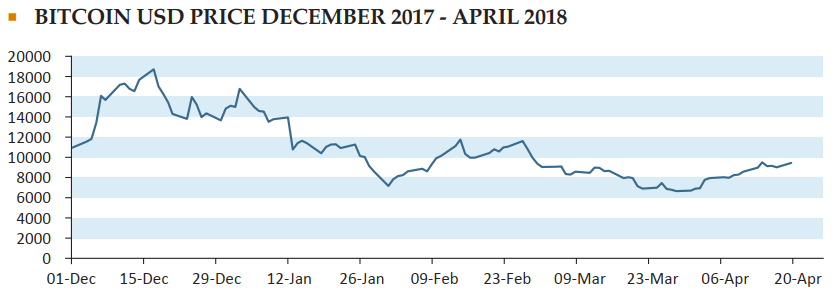

Investor complacency is understandable given the steady, nine-year upward march of stock prices and at some point, it is reasonable to expect a correction, or worse. This has been an uneasy rally for many investors, built on the back of unsustainable monetary easing and the related corporate borrowing to buy back stock at inflated prices. In some ways, the current U.S. stock market environment has similarities to the 1996-2000 dot com bubble. Instead of the heavy breathing surrounding internet-related companies, cryptocurrency has been this period’s poster child for speculative activity. Bitcoin advanced in excess of the stock market during 2017, but that run now appears to have ended, with the cryptocurrency declining 65% since it peaked on December 18, 2017.

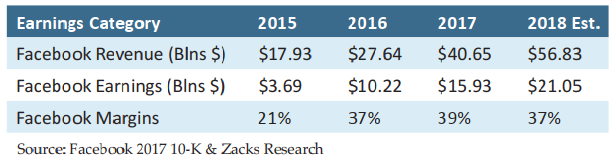

Technology stocks have been the clear performance leaders during the rally and with good reason. Companies like Facebook, Alphabet (Google) and Amazon have incredibly scalable businesses and in the case of Facebook and Alphabet, incredible profit margins. Here are the revenue, earning and margin numbers for Facebook over the last three years. It is almost unprecedented to see companies with Facebook’s revenues and earnings growing at these rates.

For comparison, average U.S. companies have revenue growth of 5-6%, earnings growth of 10-15% and profit margins in the 13-15% range.

There appears to be trouble looming ahead for Facebook and similar companies that until recently, were able to operate with unfettered free access to user data. Users traded privacy in exchange for really cool services offered by the tech titans. In the end, we don’t know how this is going to play out. Facebook at 22x earnings looks like a bargain if it is able to escape the current crisis. People do have short memories and shorter attention spans.

Some Things to Think About

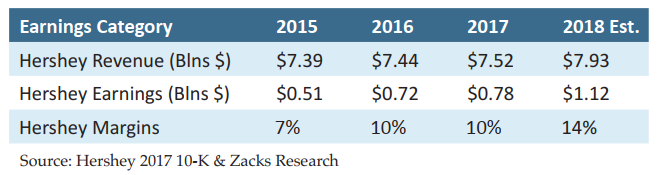

Stock prices are high, but not stratospheric. There is a major difference between today’s market and the internet bubble market of early 2000. During the internet bubble, tech and telecom stocks had stratospheric valuations with average PE ratios of over 100. Non-tech/telecom stocks were very cheap. This time around, major tech stocks with the exception of Amazon and Netflix are not trading at high PE multiples. And the non-tech stocks are trading at very high prices relative to their growth rates. Here are the revenue and earnings for Hershey, the chocolate manufacturer. Compare these to Facebook’s numbers mentioned earlier.

Facebook trades at 21.8x 2018 earnings and Hershey trades at 18.4x 2018 earnings. Which company would you rather own? I believe Facebook has some serious challenges ahead and while I am not recommending Facebook, the differences between the businesses are stark. There really isn’t a rational investment reason to pay 18.4x earnings for a company like Hershey which is not growing and has been making what I believe to be ill-advised acquisitions in an attempt to buy its way out of its current dim prospects.

The Federal Reserve has been increasing interest rates for over a year. Historically this has been very bad for stocks and other assets like real estate. Note that both the tech/telecom crash from 2000-02 and the financial crisis crash of 2008-09 were preceded by the Fed increasing interest rates.

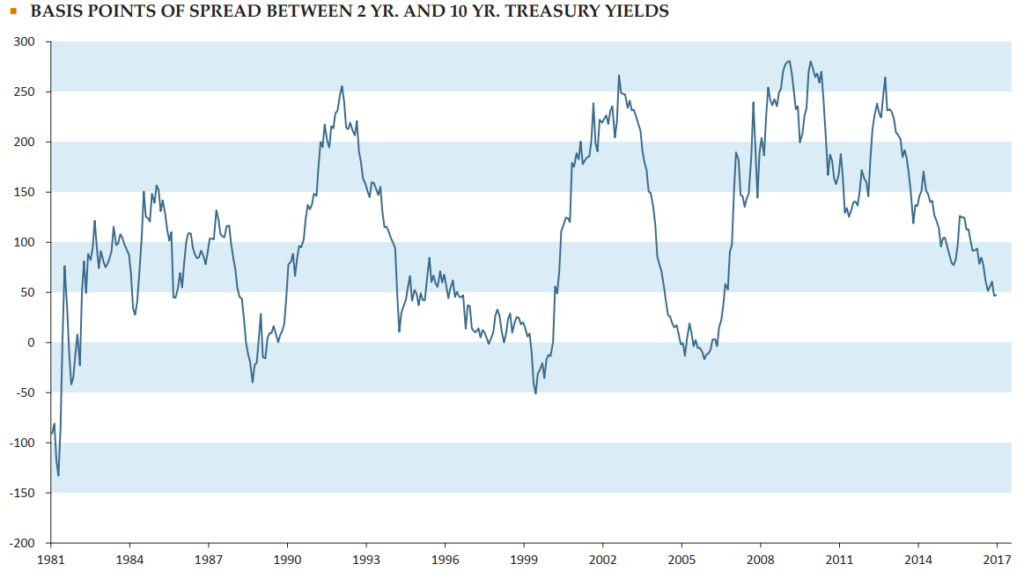

Many recessions and the related bear markets are preceded by an inverted treasury yield curve. This is the interest rate difference between the ten year Treasury bond and the two year Treasury bond. The normal relationship is the ten year bond should have a higher interest rate. When instead the curve inverts, the two year bond will have a higher interest rate. The curve has not inverted yet but it is moving in that direction.

One of the downsides of being an investor is the uncertainty and risk associated with bear markets. There are always things to worry about and the financial media has a bias towards accentuating the negative since it attracts traffic. The reality is that if you take a long term view (which we highly recommend), asset prices in general, increase. We like to instead view future market prospects through the lens of probabilities. Given today’s facts: (increasing interest rates, high asset valuations, more than normal political uncertainty) we think the probability of having a roaring stock market is on the low side. So we should be more careful. Things will change as they always do but this is what we think today. Freestone’s diversified investment approach, which includes assets other than stocks and bonds, is designed with a goal of weathering the storms of bear markets and the uncertainty associated with being an investor. It is not perfect, since nothing is, but we think it is an intelligent strategy for the facts that we face today.

Important Disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or philanthropic giving strategy, and you should not make any financial planning or giving decisions based on the information in this article. The intention of this article is educational and it is intended only to discuss a few limited aspects of philanthropic giving using general examples that are not specific to any specific person. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is in a different situation and has different items to address, and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor and a lawyer regarding options specific to your needs.