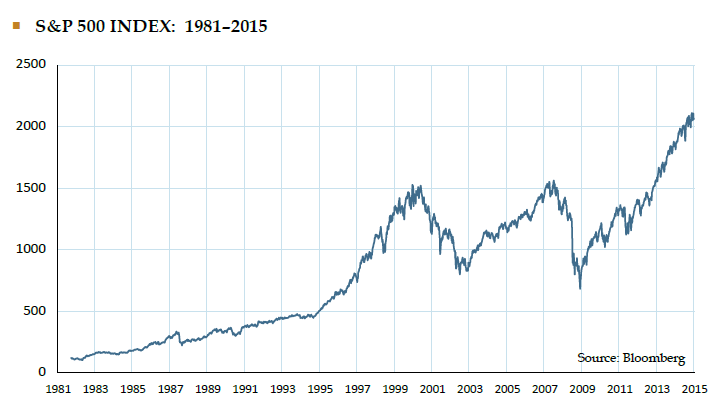

I started in the investment business in 1982 at the beginning of the greatest bull market in U.S. history. The S&P 500 was at 112 (2,079 today), the 10-Year U.S. Treasury Bond was yielding 14% and Ronald Reagan, a former B-level Actor and Radio Broadcaster from California, was serving his first term as President.

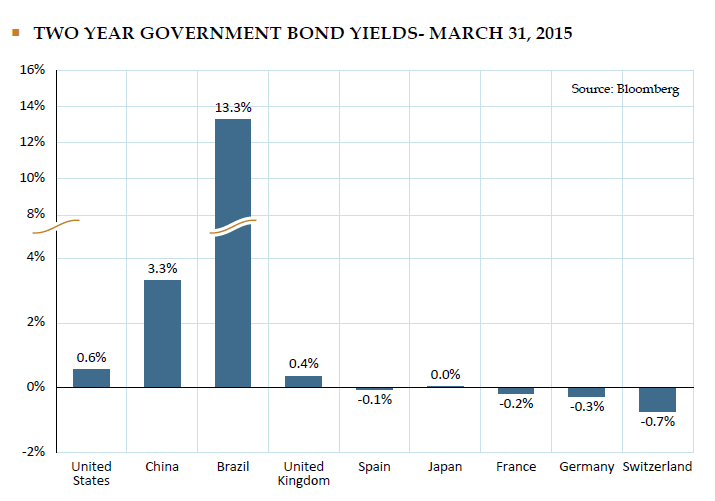

Over the years, I’ve witnessed three bull markets, two large bear markets, Black Monday in 1987 when the Dow Jones Industrial Average declined 22.6% in one day (equivalent to 4,000 Dow points at today’s level), the Asian Financial Crisis of 1997, the Dot.Com bubble in 1998-1999 and the bubble bursting in 2000, and of course, the financial crisis of 2008 where iconic financial businesses (FNMA, Freddie Mac, Countrywide Credit, Lehman Brothers) evaporated in very short periods of time. With all of that said, I would not have guessed that we now have negative interest rates in many countries around the world. This means you pay a government interest to give them your money.

This begs the question why would anyone buy a bond with a negative yield? We believe there are three reasons (but no good reasons) for investing in a bond with a negative yield:

1. Currency speculation: if a bond is denominated in Euros for example, it is a way to invest in a currency other than your native currency. Normally slow moving currencies have recently had wild gyrations.

2. If you expect deflation: If you buy a bond yielding -1%, and deflation is 3%, you generate a +2% “real yield.”

3. The Greater Fool Theory: you expect interest rates to fall further and bond prices to continue increasing as investors continue piling into negative yield bonds. We believe this is occurring now in many European Nations.

A Currency Lesson for the U.S. Investor

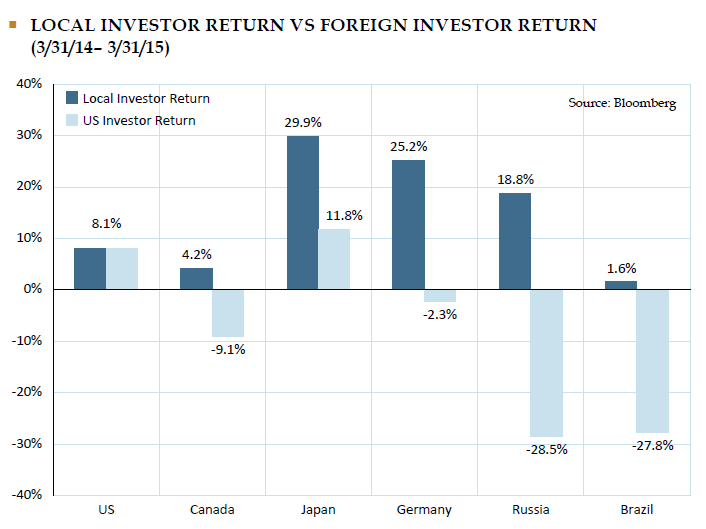

As investors, we know it is intelligent to be diversified among asset classes and also internationally. Over time, diversification can reduce (though not eliminate) risk and also smooth returns. In the short run however, it can have negative effects. Currencies are normally pretty stable and slow moving. The last year, however, has been a nightmare for a U.S. investor investing in European or Japanese stock markets due to the massive strength of the U.S. Dollar. Here is a graph comparing returns over the last year for an investor in the local currency (Euros, Yen etc.) and a U.S. investor.

Over the long term, we believe these trends will tend to balance out and, given the discounted valuations and discounted currencies in many non-U.S. stock markets, we think it is a good time to increase weightings in non-U.S. companies. In mid-2006, we developed the methodology that is behind our All-Cap Core Equity strategy (ACC). From July of 2006 through the end of 2014, ACC earned a net of fees cumulative return of 193.6% vs. the S&P 500 return of 94.4%.[1] Using the same methodology behind ACC, we are introducing our Freestone International Equity Income (FIEI) strategy in Q2 of 2015 which is intended to be a relatively tax efficient, yield generating, non-U.S. Equity investment strategy. We believe FIEI will be an effective way to take advantage of relatively better bargains in non-U.S. stock markets.

We encourage you to contact a Client Advisor with any questions.

[1] Past performance is not a reliable indicator of future results.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.