Stock markets around the world continued their advance during the second quarter, although the U.S. Stock market is starting to labor after a 6+ year rally that started in March of 2009.

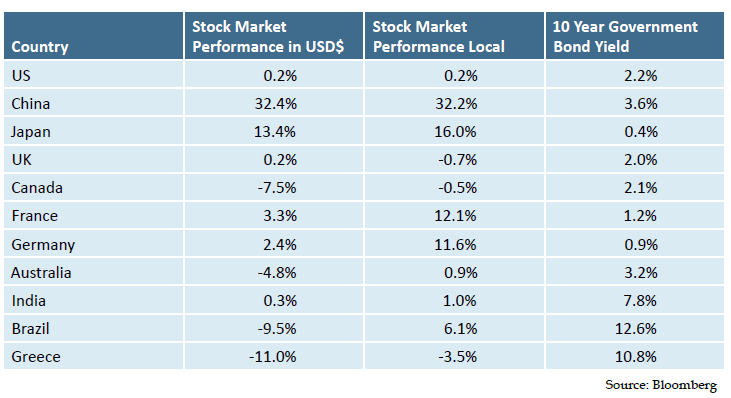

The U.S. Dollar lost steam but is still up approximately 20% over the last eighteen months. This is an important factor for U.S. companies since it is estimated that 40% of the S&P 500 company revenues come from non-U.S. dollar sources. A 20% rally in the dollar has a deleterious impact on U.S. company sales and earnings. Here is how stock markets around the world have performed through the first half of 2015 in both U.S. $ and local currencies along with the 10 year government bond interest rates in each country. The order is based on the size of the stock market in each country. Greece isn’t in the top 10, but given what is happening, I included Greece at the bottom of the list.

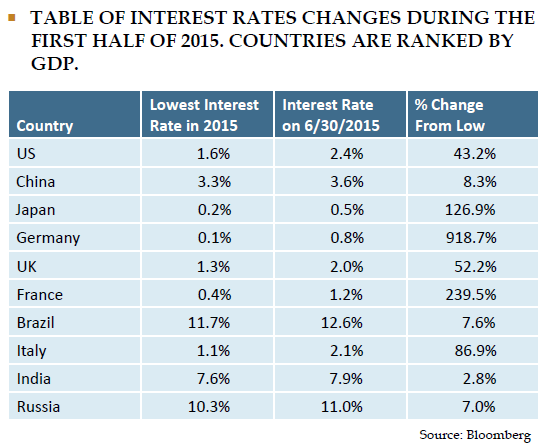

For several years we’ve believed that interest rates could not go any lower and we’ve been mostly wrong. We’ve also believed that when interest rates started increasing, we would be in a situation where the bond markets would move independently of Central Banks’ attempts to manipulating interest rates and keep them low. Maybe that is starting to happen now. As the second quarter ended, we saw interest rates around the world begin to increase even though most of the G7 nations are in the early to mid-stages of Quantitative Easing (QE). Below is a table showing the coordinated increase in interest rates. The rates remain very low, however. this is worth watching closely. If interest rates increase significantly, it should be a large negative for asset prices including bonds, stocks and real estate. We believe this is big news that is currently being ignored by the media due to more interesting stories in Greece and China.

Hedge Funds

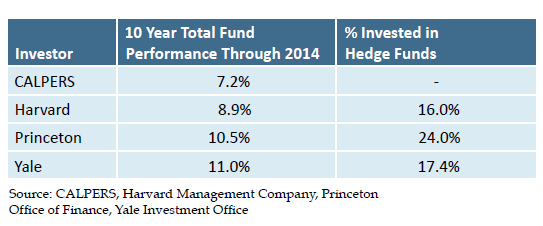

During the U.S. bull market that started in March of 2009, the S&P 500 has performed much better than hedge funds, as measured by HFRI Equity Hedge index. In a purely definitional sense, hedge funds would be “hedged,” meaning you generally would not expect a long-short equity fund to keep pace with stock market indices during bull markets. It also means that a properly aligned hedge fund should tend to outperform stock market indices when stock markets are declining. Rightly or wrongly, one common measure used by investors to evaluate prospective investments is past performance. Institutional investors are not immune from this backward–looking way of evaluating investments. In September 2014, the California Public Employees Retirement System (CALPERS) announced that it was going to exit all of the hedge fund investments held by its $298 Billion pension. The announcement caused ripples in the investment world since CALPERS is a very well-known and large institutional investor. Many university endowments also have large allocations to hedge funds and we study how many of them invest because they have been relatively successful over time. We believe the CALPERS investment board consists mostly of financially inexperienced political appointees while the investment committees of the major university endowments are staffed by some of the best and brightest minds in finance. Here is a comparison as of the end of the 2014 fiscal year:

I think CALPERS is making the rearview mirror mistake of moving out of hedge funds at just the time being hedged makes sense. In fact, depending on the circumstances, in many cases the prudent investment approach is to ADD to investments that have under-performed and reduce exposure to investments in asset classes that have performed well.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.