Now that we’ve passed midpoint of the year, it’s a critical time for high-net-worth individuals to review their financial landscape and ensure their tax planning strategies are on track. July is an ideal month for a mid-year tax check-in, allowing you to make any necessary adjustments well before the end of the year. Here are some essential steps to consider:

1. Estimate Income to Avoid Underpayment Penalties

With the IRS increasing the underpayment penalty to 8%, now is the time for all individuals, especially those that are high-net-worth, to estimate their income for the year. If you have received substantial bonuses, dividends, or capital gains, it’s essential to project your total annual income and adjust your quarterly tax payments accordingly. For example, if your stock options were cashed out as part of a business sale, this should be factored in as new income. Please contact your tax accountant or use IRS Form 1040-ES to help calculate your estimated taxes, and consider the Safe Harbor Rule, which can help high earners avoid penalties if you pay at least 90% of your current year’s tax liability or 110% of your previous year’s tax liability.

2. Manage RSU Payments

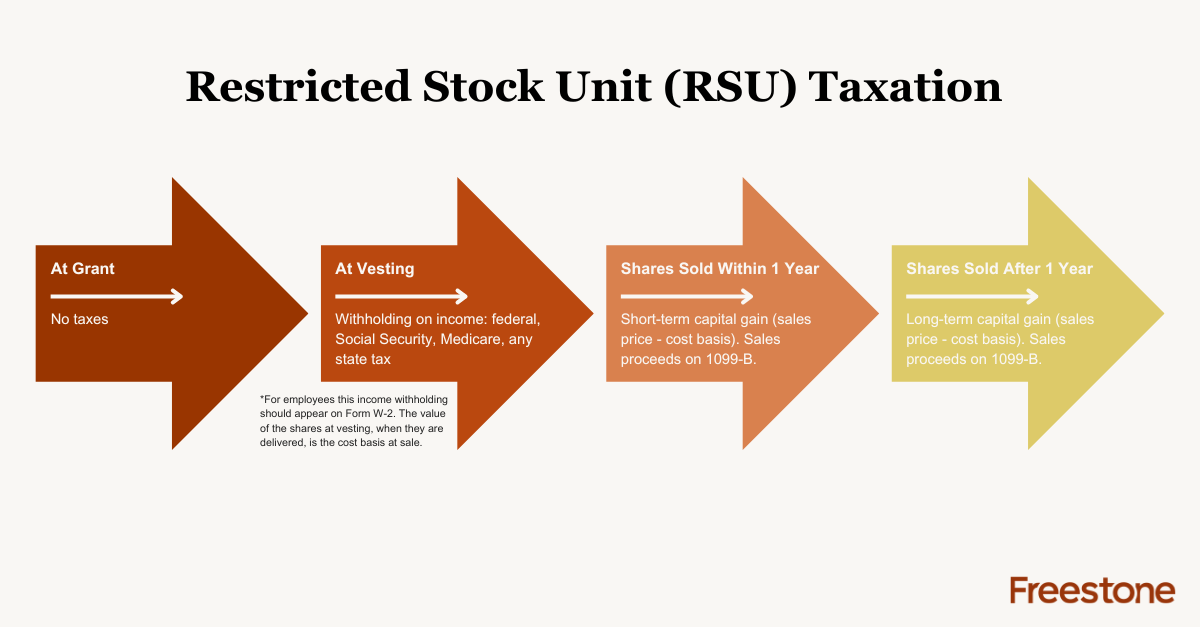

Restricted Stock Units (RSUs) can significantly impact your tax situation. Employees receiving RSUs will need to report any vested units as taxable income, which is determined based on the fair market value of the stock at vesting, less any amount paid for the stock. This income is then reported on the employee’s W-2 for the year. The chart below details the tax treatment of such RSUs:

To ensure you avoid a surprise tax bill, it may be beneficial to consult with your financial planner to determine if selling some shares to cover taxes or adjusting your withholding rates is the best strategy for your situation. For example, if your company’s stock has performed well and your RSUs have appreciated significantly, you might want to sell a portion of your vested shares to cover the tax liability immediately rather than waiting until year-end. Note that your RSUs may be subject to lock-up provisions that should be considered when determining whether to liquidate some of the stock. If this is the case, then you may need to sell other assets to cover the tax.

3. Anticipate Life Changes

Now is a great time to coordinate with your accountant and financial planner to determine whether major life changes will impact your income tax for the year. Some of these life changes include retiring, changing your marital status, the new addition of a child or other dependent, and/or starting a new job that increases or decreases your salary or provides equity compensation. For instance, if you’re planning to retire, it is important to understand how your income sources will shift from earned income to retirement distributions, and how this affects your tax bracket and Medicare premiums, if any. If you just welcomed a child, it’s possible that you now qualify for new tax credits or may need to start paying household tax for your nanny. Marriage can change your filing status, potentially lowering your tax liability, while divorce might involve the division of assets and alimony, both of which have tax implications. Make sure you keep your accountant and financial planner in the loop as to these major life changes so they can adjust your tax strategy accordingly.

4. Diversify and Manage Multiple Income Sources

High-net-worth individuals often have diverse sources of income, including salaries, investments, business income, and rental properties. Each income source has its own tax implications. Freestone recommends that clients work with their tax advisors to conduct a thorough review of all their income streams to ensure they are optimizing their tax position. This may involve tax-loss harvesting, where you sell securities at a loss to offset gains elsewhere in your portfolio, adjusting your investment strategy to take advantage of tax-efficient vehicles like municipal bonds or rebalancing your portfolio to align with your tax goals. Additionally, if you have income from rental properties, ensure you’re keeping accurate records of expenses, as these can be deducted from your taxable rental income. It’s also important to keep accurate records of any improvements made on your rental properties as this can provide further depreciation, which will reduce your taxable rental income. Lastly, keeping track of any improvements made to your residence may assist in increasing your tax basis, which will reduce any capital gains when it comes time to sell the property.

5. Review Gifting

With the current lifetime estate and gift tax exemption of $13,610,000 scheduled to cut in half on January 1, 2026, many high-net-worth individuals have completed or are in the process of completing large gifting projects so assets can be passed to their children or other beneficiaries in the most tax advantageous way. If you have made or intend to make gifts larger than the annual gift tax exclusion ($18,000/person), it is important to notify your accountant so they know a gift tax return will need to be prepared along with your income tax return. Looping in your accountant and financial planner early in the gifting process can also be beneficial as they can advise on different gifting scenarios and valuing the asset for gift tax purposes.

Final Thoughts

A mid-year tax check-in is an invaluable step for high-net-worth clients to ensure they are on track with their tax planning. By adjusting your estimated tax payments, managing equity compensation strategy, anticipating life changes, and diversifying income sources, you can mitigate potential tax liabilities and make informed financial decisions. Consulting with your financial planner and accountant can provide personalized insights and strategies tailored to your unique financial situation, helping you achieve your financial goals and maintain peace of mind.

Stay proactive, stay informed, and ensure your financial strategies align with your long-term objectives. Here’s to a successful second half of the year!

Important Disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or tax planning strategy, and you should not make any financial planning or tax planning decisions based on the information in this article. The intention of this article is educational, and it is intended only to discuss a few limited aspects of complex legislation or complex planning strategies. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is different and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor, a professional tax advisor, or an attorney (as applicable) regarding your specific needs.