When it comes to retirement savings, there’s often a choice between pre-tax and Roth accounts. It’s important to understand the differences before deciding how to allocate savings because the benefits vary based on several factors.

When does a pre-tax contribution makes sense?

Pre-tax contributions make sense if someone expects to be in a lower tax bracket in retirement. Since it can be difficult to predict the tax environment in several years or decades, another way to strategize contributions is to look at the current tax bracket. Someone in the highest tax brackets would likely benefit from maximizing pre-tax contributions first. This lowers taxable income now since the taxes are deferred and paid later, when withdrawn. Compared to Roth contributions, pre-tax savings results in a smaller reduction to take-home pay as the taxes are deferred.

As income levels change, it’s important to avoid commingling deductible and non-deductible pre-tax contributions. Comingling deductible and non-deductible pre-tax contributions can make Roth conversions in the future challenging due to pro rata rules.

When does a Roth contribution make sense?

Contributing to a Roth often makes sense while in a lower tax bracket. Typically, this would be someone early in their career who expects their tax bracket to be higher in retirement since Roth withdrawals are generally tax-free.[1] This, coupled with the tax-free growth of the assets, can create a substantial tax-free bucket of money that will not be subject to required minimum distributions.

Often a blend of pre-tax and Roth savings is a good strategy to balance the unknowns of earning potential and tax bracket in retirement.

When does a Roth conversion make sense?

Converting a traditional IRA to a Roth IRA may make sense during lower income or higher deduction years. After retirement and before Required Minimum Distributions (RMDs) begin, when earned income is generally lowest, may be a good time to consider this strategy. Market pullbacks can also create an opportunity for Roth conversions because a larger conversion may be possible with a similar tax impact than would be in a stronger market.

When does a backdoor Roth make sense?

A backdoor Roth contribution is a great strategy to consider when income is above the Roth IRA contribution phase out. An ideal candidate would have no existing IRA balances to avoid pro rata rules[2]. When large IRA balances exist, consider maximizing 401k contributions (splitting with pre-tax and Roth) and making after-tax contributions, if the plan allows.

Modeling savings strategies in your financial plan

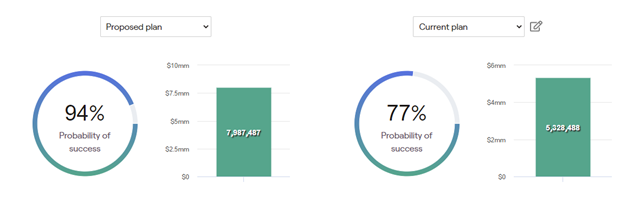

Financial planning software can be a great tool to compare the potential impacts of saving in pre-tax and Roth retirement accounts. Proposed plans that compare various savings strategies show how these strategies affect the financial plan’s probability of success[3].

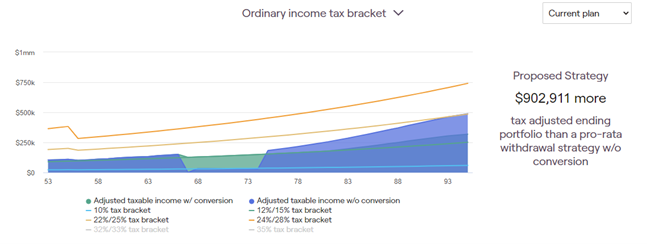

Freestone’s planning software can model Roth conversions as well. The software shows the potential dollar impact of using a conversion strategy.

Examples

| Client #1: Age 65, recently retired with $1M in a managed IRA. | This is a perfect candidate for a Roth conversion while in the window after retirement and before IRA RMDs begin. |

| Client #2: Age 26, employed with a salary of $85K and an inherited taxable account of $250k earmarked for a future home down payment. | This client would be a good candidate for regular Roth contributions. There is a long runway to retirement, allowing the value of the Roth to grow significantly. The tax rate is low today relative to what it’s likely to be later. |

| Client #3: Age 33 and single, jumped from 24% to 32% tax bracket due to a promotion. | This is a good time to split pre-tax and Roth 401k contributions 50%/50%. |

[1] In certain circumstances, earnings from Roth accounts may be taxable if withdrawn within 5 years. Consult a tax professional regarding your situation prior to taking distributions.

[2] These complex tax rules may impact taxation of back door Roth contributions when there are existing IRA assets. A tax professional should be consulted prior to taking any action. [1] These images reflect a hypothetical situation and are intended for illustrative purposes only. Graphs and examples are not based on any current or past Freestone clients.

[3] These images reflect a hypothetical situation and are intended for illustrative purposes only. Graphs and examples are not based on any current or past Freestone clients.

Important disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or tax strategy, and you should not make any financial planning or tax decisions based on the information in this article. The intention of this article is educational and it is intended only to discuss a few limited aspects of pre-tax and Roth savings strategies. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is in a different situation and has different items to address, and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor and a lawyer regarding options specific to your needs.