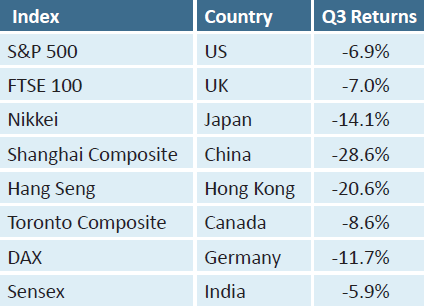

During the third quarter of 2015, stock markets around the world declined and the heavy breathing of the financial media was palpable.

In today’s world of instant and constant communication, the correction was big news and was an easy way for the financial media to attract “page views,” “clicks” and “traffic”. We look at the correction as something that was long overdue and not surprising. This is what stock markets generally do. The S&P 500 peaked on May 21, 2015 at 2,131 and on August 25th, closed at 1868 for a peak to trough decline of 12.4%. This was the first correction (>10%) since the 17.3% decline in the S&P 500 in July and August of 2011 after Quantitative Easing #2 ended.

73 Years of Stock Market History

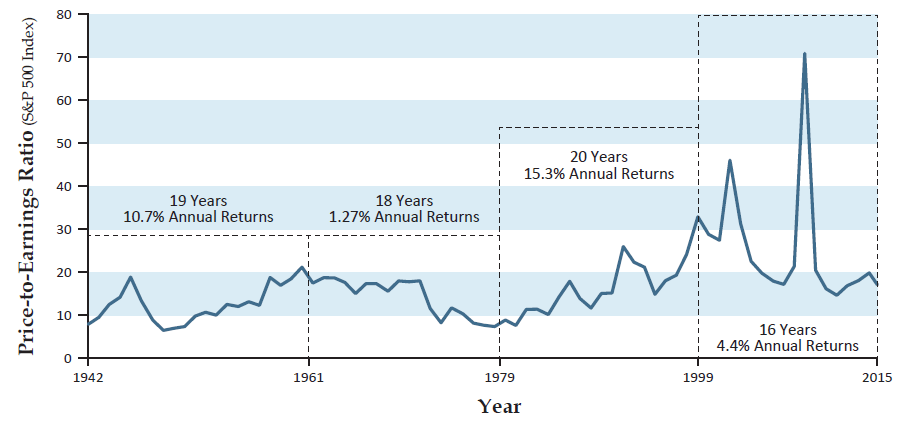

Many investors don’t realize that when you buy a stock, you are buying a share of an operating business and you are the “owner” of the business, albeit a really small owner. You are paying a price today to receive your share of the future cash flows and value of the business. The most commonly used measure to value stocks is the Price Earnings ratio, or “P/E.” Throughout this piece we use the S&P 500 to represent U.S. stocks and the U.S. Stock Market. The P/E ratio represents the aggregate price of the S&P 500 divided by its weighted average aggregate earnings. Historically, U.S. stocks as measured by the S&P 500 have traded on average at a P/E of 15 which means you are paying 15x the annual earnings of a company to purchase a share of stock. For example, a company that earns $1/share would sell for $15/share. In a low inflation, low interest rate world, like we have today, stocks will tend to trade at higher P/E ratios. Currently the S&P 500 stocks are trading at a P/E of 18x, which is what you would expect. The numbers fluctuate dramatically over time:

1942-1961 (19 years): After World War II, P/E ratios expanded rapidly as the U.S. economy experienced a robust recovery. P/E ratios started at 7.3x and ended at 22.5x as stocks appreciated at an average annual rate of 16.7%. This was a period of low inflation. The long term return of U.S. stocks has been approximately 10% annually, so a 19 year period of 16.7% returns is fantastic.

1961-1979 (18 years): P/E ratios contracted from 22.5x to 7.3x as stocks earned a below average 6.7% annualized return during a period characterized by much higher inflation and interest rates. In 1981, some money market funds were paying 18% interest for a period of time!

1979-1999 (20 years): Market P/E ratios expanded dramatically from 7.3x to 46x during this period of investor nirvana. Annual returns averaged a whopping 17.8% annually while inflation and interest rates declined during most of this period.

1999-Present (16 years): P/E ratios have contracted dramatically from 46x to 18x. U.S. stocks have averaged 4.4% annually during this period. In addition, during this period, we have experienced the popping of the tech bubble in 2000 and the financial crisis of 2008. This is one of the reasons why investors feel like “they haven’t done so well.” This has been a difficult time to generate meaningful returns. Below is a chart of the historical P/E ratio of the S&P 500 and associated annualized returns across various periods of time.

Looking Ahead:

Many of our clients need to earn 5-6% annual returns in order for their financial plans to “work.” It is human nature to worry when your portfolio is underperforming. Here are some things to remember:

- For many of our clients, investing is still a 20+ year endeavor. It is easy to get caught up in focusing on the short term since the media and Wall Street tend to be short term oriented. Looking at the history of stock market return cycles, we oscillate between periods of above average returns and below average returns. On average these periods last 19 years. We are 16 years into the current period of below average returns as measured by returns from the last significant P/E peak. At some point (probably at the bottom of the next bear market), we believe we will probably enter a period of above average returns. The key thing to remember is that you need to preserve capital now so you can be invested when the next higher return cycle begins. This means staying disciplined with your spending, controlling your emotions and being patient when it is hard to be patient.

- Investing in fixed income isn’t going to help most of our clients right now. With 10 year Treasury bonds paying approximately 2%, you are doomed to fail if you need to earn 5-6% annual returns.

When we founded Freestone in March of 1999, we believed the probability of having high returns from U.S. stocks was highly unlikely. This turned out to be correct based on the performance of the S&P 500 measured from March 1, 1999 through September 30, 2015. In the short-term (under 3 years) we continue to believe that returns are likely to remain low since we don’t have the undervaluation necessary to generate high future returns right now. We also believe that market conditions will not stay like this forever and at some point (we had a window in 2009), we will enter into a period of above average returns. In the meantime, we are focused on preserving your capital and investing in other asset classes that we believe are relatively less correlated to the S&P 500.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.