2016 turned out to be better than we expected with the Standard & Poor’s 500 index up 12.0% for the year. Almost 7.8% of the 12.0% total return occurred after the presidential election on November 7, 2016. Interest rates finished the year about where they started, however, we saw a rapid increase in interest rates post-election. Populism continued its sweep throughout the world and resulted in further uncertainty and numerous election-related surprises during the year.

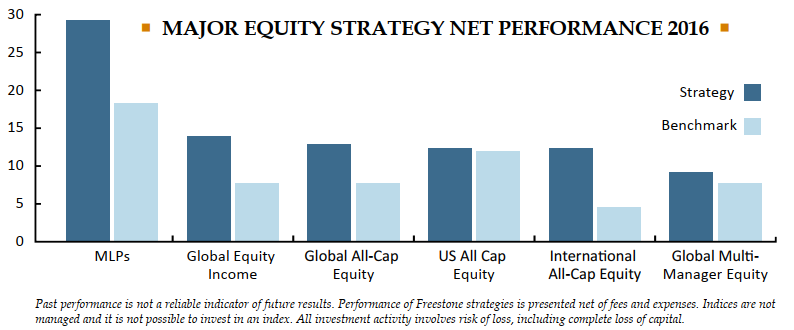

Freestone had an excellent year across nearly all of our investment strategies and, in particular, our stock focused strategies all exceeded their benchmarks, some by a wide margin. Below is a chart showing the performance of our major stock-focused strategies, which we define as strategies for which we prepare quarterly fact sheets, other than fixed income or liquid alternative strategies.

Probabilities, Not Predictions

On Wall Street, year-end is typically a time for review and predictions. Human nature is drawn to predictions even though predicting the future correctly, on a consistent basis, is extremely difficult. Still, the media loves printing articles about what is going to happen in 2017 because this is what draws readers, which is the overriding goal of media. Without readers, the media can’t stay in business.

2016 was a big year for missed predictions. Coming into 2016, most investment strategists predicted that the U.S. stock market would not have a good year, The Federal Reserve was going to increase interest rates more than once, Brexit was expected to be a non-event, and Hillary Clinton was going to be our next President.

Byron Wein, a longtime Wall Street titan and Investment Strategist for Blackrock publishes his “10 Surprises” annually. His goal isn’t 100% accuracy, but instead to be thought provoking. Here are his 10 Surprises for 2017:

1. President Trump moves away from extreme positions.

2. Combination of tax cuts, constructive trade agreements, and reduced regulation result in real growth above 3% for the U.S. economy.

3. The S&P 500 rises to 2,500 (2016 close was 2,238).

4. Yen goes to 130, British pound declines to 1.10, Euro drops below 100 (2016 close: Yen 117, GBP 1.23, EUR 1.05).

5. Inflation moves towards 3%, 10-year treasury yield approaches 4% (2016 close 1.7% and 2.45%, respectively).

6. Populism spreads in Europe. Merkel loses in Germany. Active discussions begin to close the European Union.

7. Reduced energy regulations in U.S. leads to a surge in U.S. oil production, keeping prices of oil below $60/barrel (2016 close: $53.72).

8. President Trump realizes he has been wrong about China and avoids punitive tariffs and develops a more constructive relationship with the world’s second largest economy.

9. Real growth in Japan exceeds 2% and the Japanese stock market leads all developed stock markets in performance.

10. Middle East cools down, lasting ceasefire in Syria and ISIS diminishes as a threat.

Keep in mind that these are surprises, and in most years, less than half actually occur. Good luck on guessing which of the above become reality. We try hard not to make investment decisions on educated guesses. Instead, our approach is to assign probabilities based on history, understanding that this is also an imperfect approach. Below I’ve listed our best guesses for 2017:

- U.S. Stocks: Given current valuation levels, rising interest rates, and a good probability that Trump’s policy changes are going to take longer than investors generally expect to implement, we think the U.S. stock market will have a low single digit return (or worse) in 2017.

- Non-U.S. Stocks: Valuations are lower in nearly all non-U.S. stock markets and many of these markets have already undergone significant corrections. We think these markets should start regressing to the mean after dramatically underperforming U.S. stocks for the last nine years. In addition, the U.S. dollar has appreciated by over 28% since mid-2014 which is helpful to non-U.S. companies and a negative for U.S. companies.

- High Quality U.S. Bonds: Interest rates, while very low, are rising. The ten-year Treasury bond has increased from 1.78% on November 6, 2016 to 2.45% as of year-end. In terms of total rate increase, this amounts to .67% which doesn’t seem like much; however, it is a 38% increase in less than two months, which is massive. We continue to believe that most bonds do not offer a good enough risk-to-reward tradeoff to make them a viable investment unless you stay very short term and understand that they are mainly a cash substitute.

- Real Estate: We believe most real estate around the country is fully priced and the big appreciation is behind us. Rising interest rates imply lower levels of price appreciation as well. We continue to find a few good deals in niche areas (primarily Manufactured Home Communities), but in general, we think the large up cycle in real estate will at least take a pause in 2017.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.