For aging investors, the IRA can prove to become a sizable tax liability as it grows nearing retirement.

IRA assets are not only subject to heavy taxation as part of an estate, but are also potentially exposed to taxation again as income of heirs. Historically, IRAs have not been incentivized as a means of donating to charity, as withdrawals for charitable donation were still taxed as income.

The IRA Charitable Rollover Provision:

When President Obama recently signed the IRA Charitable Rollover Provision into permanent law, he solidified a temporary measure that has been in place since 2006, allowing taxpayers age 70 ½ or older to move up to $100,000 annually from an IRA account directly to charity without having to first recognize the withdrawal as income. Holders of traditional or Roth IRAs are eligible for the exemption, with limits of $100,000 per individual or $200,000 per married couple.

Example:

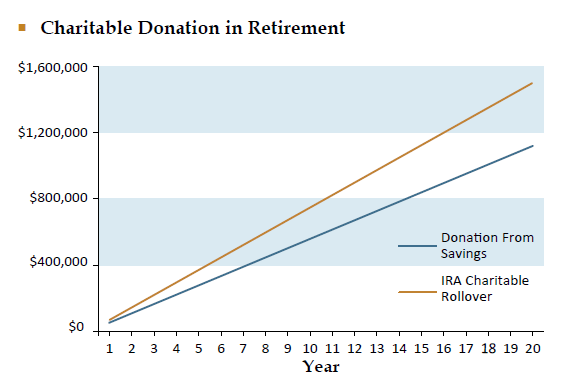

An individual has historically donated $75,000 per year to her preferred charity directly from her savings, but is contemplating donating from her IRA instead of using the IRA Charitable Rollover. Assuming a 25% retirement tax bracket and 20 years of donations, using the IRA Charitable Rollover would result in $375,000 of additional charitable donations at the same cost to the IRA. This also protects the individual from being artificially bumped into a higher tax bracket, and may shield additional income in retirement from excess taxation.

Details of Use:

Certain destinations are ineligible for tax-free transfers of IRA funds. Donations to Donor Advised Funds, Supporting Organizations and private foundations do not qualify for an IRA Charitable Rollover. Designated Funds, Field of Interest Funds, and Unrestricted Funds are all eligible for IRA Charitable Rollover donations.

How Freestone Can Help:

You should contact your Freestone Client Advisor if you make annual donations or have a desire to donate through an existing IRA. Our team can help you evaluate your options for the best avenue for tax-conscious charitable contributions. We work with some great external firms in your area that can coordinate the estate planning or the strategic tax advice that goes along with these decisions. We welcome the opportunity to help you through your philanthropic planning.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.