Among other things, Spring is the season for income taxes and, in general, many clients have been a little shocked by the size of their tax bills this year.

On the one hand, paying a lot of taxes is much better than the alternative, but I would feel better if I believed the taxes that I am paying were being spent intelligently. Here are some reasons why your tax bill may have been so high in 2014:

- The stock market started rebounding in 2009 and continued rallying through the end of 2014. The first couple of years were spent recovering the money lost during the 2008 bear market so taxes were low. 2014 was a year where there was a lot of capital gain built up and, in general, realized taxable gains increased across both our stocks and real estate for our investors.

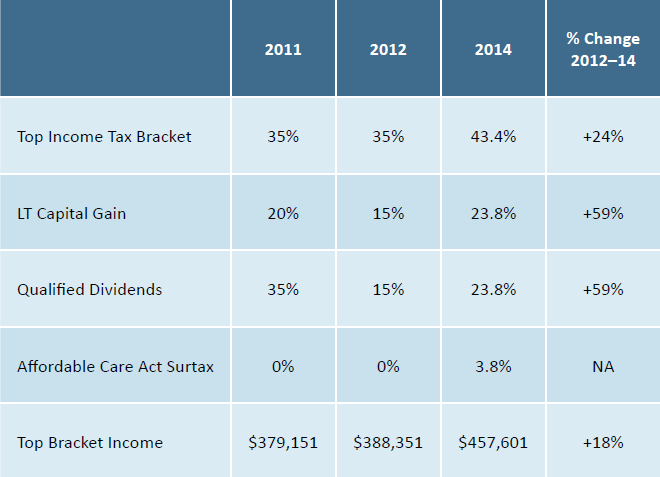

- For taxpayers in high tax brackets (you!), Federal Income Tax Rates have had a sneaky and dramatic increase. Here is a table showing the tax rate changes. Note the massive increase in the LT Capital Gain and Dividend tax rates and the 3.8% Affordable Care Act surtax. (According to the Tax Foundation, the top 10% of taxpayers paid over 70% of total income taxes in 2010, the last date that data was available.

For taxpayers who live in states with income taxes, there was further pain from increases in state income tax rates for high income residents. For example, California increased taxes by 29% in 2013 with the top rate increasing from 12.3% to 13.3%. When you combine the 13.3% state tax plus the 43.4% top federal rate, a California taxpayer will pay 56.7% in total taxes once the top bracket is hit.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.