Fending off the short-termism of CNBC and internet media is difficult, but necessary if you are going to be successful building wealth and staying wealthy.

Despite the news media’s love affair with Silicon Valley entrepreneurs becoming billionaires overnight, we have observed from our clients that most wealth is created over long periods of time, usually from ownership in a business. Clients who live in affluent parts of Seattle or California can also attest to wealth accumulation from owning a home in a hot real estate market. The funny thing is that while the wealth accumulation was in progress, our clients were too busy working and/or living their lives to pay much attention to their growing balance sheets. They weren’t watching the value change hourly like we are implored to do with online financial websites and cable TV shows.

I rarely watch CNBC, however, while I am on vacation and my guard is down, I will watch for an hour or so and I have come to the conclusion that watching it is toxic to my long term thinking. The media’s goals are completely different than our financial goals. Media success is measured by number of viewers, and sensational herd-oriented topics attract the most viewers.

How Value Investing Works

Successful value investing revolves around the simple concept of buying low and selling high. In general, I have observed that when asset prices are low (think many oil-related securities today), they will often be accompanied with one or more of the following:

- Negative, credible-sounding news flow; for example, Goldman Sachs’ prediction of <$20 oil

- Investors will be selling everything related to the low priced asset

- There will often be forced selling – some oil companies are currently feeling pressure to sell oil producing assets at depressed prices to pay down debt

- It is difficult to invest because “everyone” is projecting lower prices in the future and you are going against the advice of “experts” in the media

- Asset prices decrease because there are more sellers than buyers

When asset prices are high, one or more of the items I mentioned above will often be in reverse. Now think about a nice house in a good neighborhood in Seattle currently. According to real estate agents, this kind of house is receiving multiple offers and often sells above listing price.

To be a successful value investor, you need to have the courage to buy when the outlook is “poor,” and sell when the outlook is “highly favorable.” This is much harder than it seems. You also need to have a long-term orientation in an increasingly short-term world. This means fending off the media.

In 2010, Freestone started investing in distressed real estate at a time when very few were buying. Now we are selling that real estate, many times to what we believe are willing, aggressive buyers. This is the way it is supposed to work.

The Markets Don’t Care About Our Needs

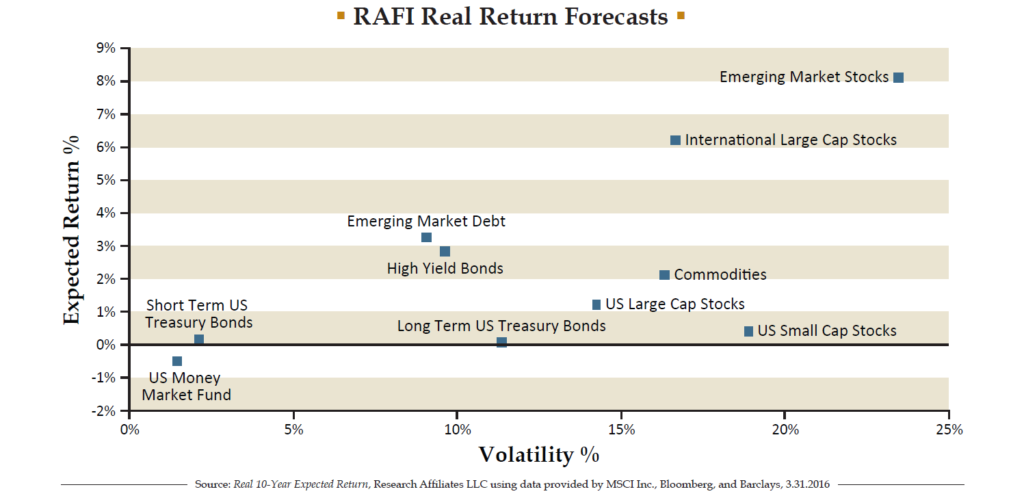

Most of our clients require annual real returns of 4-6% to make their financial plans work. Subtract 1-1.5% for taxes and the remainder is left to fund living expenses. Below is a graph prepared by Research Affiliates (RAFI) which shows its projected real returns (i.e., returns in excess of inflation) for the major asset classes over the next 10 years, assuming 2% annual inflation. We believe that this type of analysis tends to be reasonably accurate over the long term and less accurate over 1-2 year periods. We showed the same graph in last quarter’s newsletter. We believe it is very important.

RAFI projects that many of the traditional areas where our clients are invested (e.g., many bonds, U.S. stocks) all have expected real returns of less than 2%. If this proves to be correct, this projected low return environment points to the following observations:

- If we only invest in traditional asset classes, with heavy weightings in U.S. Stocks and fixed income, most of our clients will not reach their financial goals

- We need to remain invested in International and Emerging markets stocks

- Freestone’s approach of investing in opportunistic, alternative investments can be an important contributor to generating the returns necessary for many of our clients

We are working very hard to identify opportunities that make sense in today’s projected low return environment. At some point in the future, we will enter into a period where expected returns are closer to normal. In the meantime, we are focusing on preserving capital and fending off the short-termism of the media.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.