2017 marks my 36th year in the investment business and I’ve been through three major bull markets in my career.

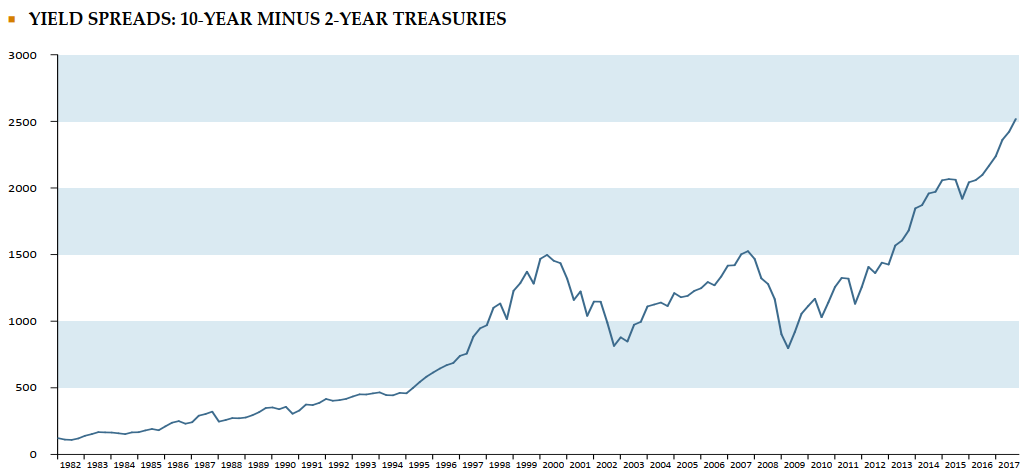

The first, from 1982 to early 2000, was the greatest bull market in history both in duration and in magnitude with the Standard & Poor’s 500 rising from 113 on 9/25/1981 to 1,527 on 3/24/2000. This is a whopping 13.5x increase over an eighteen and a half year run. Many of my early clients thought I was really smart and at 25 years of age, I thought I was really smart, too. The stock market peaked when it became clear that the internet was really going to be a big thing and there was rampant investor euphoria. Investors loved stocks! When the dot-com bubble burst, the Standard & Poor’s 500 declined to 777 over the subsequent eighteen months, a 49% decline. The darlings of the rally, internet stocks, suffered declines in excess of 90% in some cases and many internet companies no longer exist (e.g., Pets.com, Webvan, Books-a-Million). Even large, dominant companies like Cisco declined 86%.

My second bull market started in October 2002 and the Standard & Poor’s 500 rallied from 777 to 1,565. The peak came in October 2007, fueled by promiscuous real estate financing, declining interest rates and investor belief that the Fed would not allow the stock market to decline. This ended poorly with the Financial Crisis of 2008-09. The Standard & Poor’s 500 declined 57%, hitting bottom in March of 2009. Prior to the decline, investors were in love with stocks, many refinanced their houses to invest in the stock market. Financial stocks were especially popular during the bull market and many disappeared when the bubble burst. (e.g., Washington Mutual, Countrywide Credit, Lehman Brothers).

My third bull market started in March of 2009 and is still going. Investors were stung so badly during the Financial Crisis, that this has been a hand-wringing rally. Financial media has constantly made pronouncements that the bull market is over. Investors have generally been under-invested in stocks, and many investors have had one foot out the door during this bull market. The big winners have been some of the large tech companies that have figured out how to use their scale and leverage to dominate their markets as well as expand into new markets. Facebook, Amazon, Netflix and Google (the FANGs) are notable examples. Indexing has also been very popular and the stocks that have the largest weighting in the popular indices are trading at a premium to non-index stocks, fueled by each new dollar contributed to index funds as capital disproportionately flows to the largest companies in the index. We don’t know when and how the current bull market will end. History tells us that it will, and most likely, the popular stocks during the rally will have significant declines. Valuations are high in the U.S., but compared to the currently very low interest rates, stock prices are not as high as they have been at prior peaks. So this bull market could go on for longer than you would think. At 57, I believe I am a lot smarter than I was at 25, but I’ve learned over the last 30+ years that timing the market is very difficult to get consistently right.

What We Are Thinking About Now

At Freestone, we believe the right approach is to look at the markets from a probability view. When asset prices are historically very high, we tend to be careful and when prices are very low, we tend to be more aggressive. This isn’t market timing, it is common investment sense. Eighteen months ago, we started recommending increasing allocations to non-U.S. stocks because they were less expensive than U.S. stocks, the U.S. dollar had experienced a significant rally, and many of the foreign stock markets had experienced significant declines. This has worked thus far as non-U.S. stocks, as measured by the MSCI ACWI ex USA, have outperformed U.S. stocks, as measured by the Standard & Poor’s 500, year-to-date. We’ve also recommended that clients increase their investments in cash-flow producing real estate as a substitute for more traditional bonds. As long as interest rates remain historically low, we continue to think that this is a good idea.

We appear to be experiencing more rapid societal change currently and it is difficult to see how this is going to end. From the view of an investor, however, many of the most important concepts don’t change much. Focus on less popular areas because prices are better, stay calm when others are panicking, and understand that investing for most of our clients is a marathon, not a sprint.

Important Disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or philanthropic giving strategy, and you should not make any financial planning or giving decisions based on the information in this article. The intention of this article is educational and it is intended only to discuss a few limited aspects of philanthropic giving using general examples that are not specific to any specific person. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is in a different situation and has different items to address, and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor and a lawyer regarding options specific to your needs.