When something hasn’t occurred for a very long time, it is human nature to forget about it. In today’s internet driven, hyper short-term news cycle, our attention spans have become shorter and shorter.

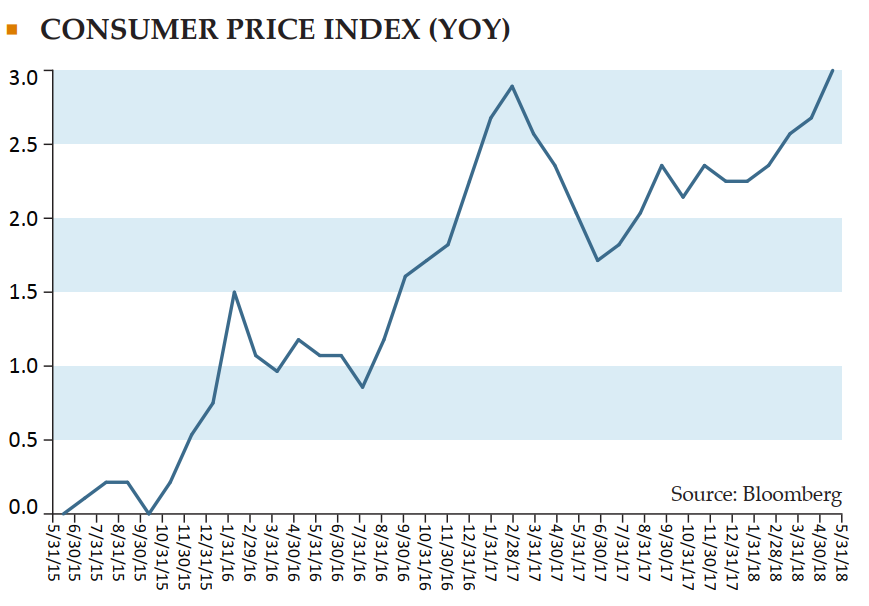

The Federal Reserve has been in a money printing mode since the advent of Quantitative Easing #1 (QE 1) in November of 2008. The idea was to drive interest rates to very low levels in order to stimulate the economy. This was followed by QE 2 and QE 3. A related goal was to prevent deflation and encourage a low level of inflation since this would make paying our debts easier in the future. Fine tuning the effects of this sort of activity is very difficult and the probability of bringing the jet that is the U.S. economy in for a perfectly safe landing seems remote to us. We may now be witnessing the early stages of the outcome of too much liquidity in our financial system. Here is a chart showing the U.S. Consumer Price Index (CPI) over the last three years.

Inflation is a very sneaky thing and because it occurs over long periods of time, in seemingly small increments, most of us are unaware of its presence until we think about the loss of purchasing power over time. In 1980 while attending the UW, I was a part-time real estate agent with a real estate brokerage in North Seattle. You could purchase a nice 3 bedroom, 1.5 bath home by Green Lake for $45,000. Today the same home is priced at $950,000. My tuition at the UW was $250/quarter. Today tuition at the UW is $3,700 a quarter for an in-state resident. In 1980, the average car was $5,400 and a movie ticket was $2.69.

What’s Behind an Inflation Increase?

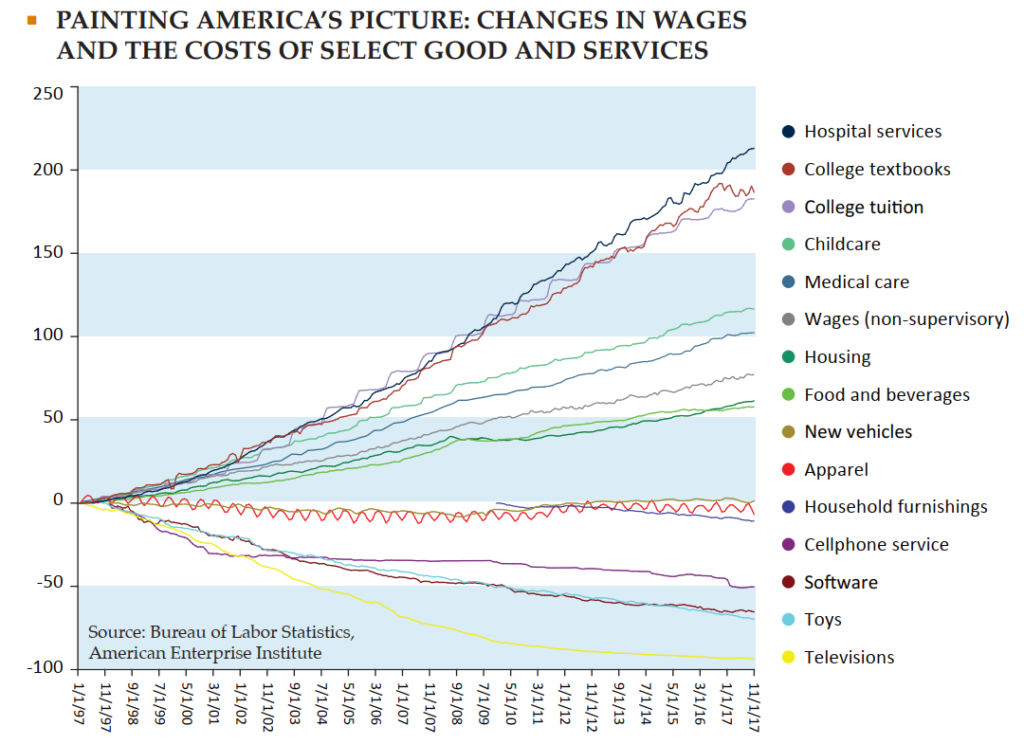

In addition to a Quantitative Easing which increased the supply of money without a commensurate increase in goods and services, President Trump’s trade war with China could be the gasoline on the inflation fire. Tariffs are a form of price increase, and price increases = inflation. The chart below was plugged by its creator, Mark Perry, as the chart of the century. Prices of non-tradeable items like college tuition and hospital stays have soared since 1997 while goods subject to foreign competition have plummeted.

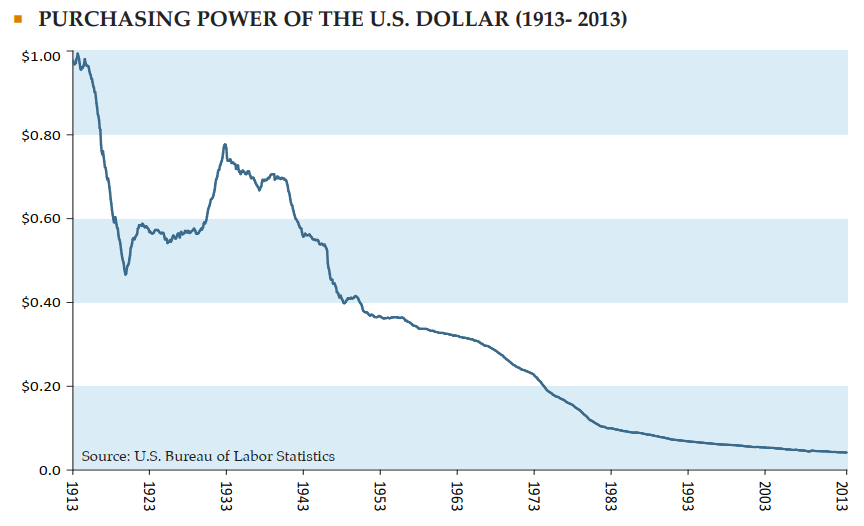

Over the last 100 years, the purchasing power of the U.S. dollar has declined 95%. I would make the argument that what we can now purchase with our 5 cent dollar is much better (iPhone, Flat Screen HD TVs, etc.), but the reality is that we have many clients who live in the Seattle area with a $5 million net worth who feel poor even though they are in the 97th percentile of net worth in the U.S.

What Can We Do About Increasing Inflation?

In the end, we cannot predict the future. We can, however, prepare for a variety of economic outcomes, and the potential for increasing inflation in the future is something we are concerned about. Stocks tend to be a better performer than bonds during high inflation periods. Tangible investments such as real estate, direct ownership in cash flow producing businesses and hard assets such as gold have tended to be better ways to preserve purchasing power during periods of inflation.

Freestone started investing directly in real estate in 2010 and we continue to believe that this is a core investment for clients who can afford the lack of liquidity when owning real estate. We believe our private equity strategies would also fall into the same general category. For clients who can invest for a longer period of time and have enough liquid investments to cover shorter-term cash needs, we think it makes sense to diversify across a broader investment spectrum than just stocks and bonds.

In the end, we won’t know until after the fact if we are headed towards higher secular inflation or if this is just a temporary blip and inflation will end up retracing the recent upward movement. We want you to be prepared for a variety of outcomes though, and higher inflation is one of those outcomes. This is why we invest the way we do.

Important Disclosures: Nothing in this article is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any financial planning or philanthropic giving strategy, and you should not make any financial planning or giving decisions based on the information in this article. The intention of this article is educational and it is intended only to discuss a few limited aspects of philanthropic giving using general examples that are not specific to any specific person. This article is not a comprehensive or complete summary of considerations regarding its subject matter. Each individual is in a different situation and has different items to address, and the options in this article are not appropriate for everyone. Please consult your Freestone client advisor and a lawyer regarding options specific to your needs.