There are many ways an individual can donate; whether by directly contributing to institutions, establishing trusts or foundations, or through opening donor-advised funds.

With the S&P 500 up 200% since March of 2009, there are many investors with significant unrealized long-term gains within their stock portfolios. This could be an interesting time to capture these all-time highs in your portfolio through charitable donations. This article details the increasingly popular donor-advised fund, as it offers flexibility, low costs and customizable ways to implement charitable wishes.

How Donor Advised Funds Work:

A donor-advised fund can be opened on a custodial platform with an irrevocable donation of $5,000 or more. The donor takes an immediate tax deduction for the contribution, while avoiding capital gains tax on the appreciated assets. Additionally, any growth in the account is generally tax-free, increasing the value of what the donor is able to gift to selected charities. Acceptable donations include: publicly traded stocks, bonds, mutual fund shares, restricted stock, and IPO stock. In some cases real estate, artwork or collectibles, and other alternative assets are acceptable. Once the donation is made, the individual can recommend grants to IRS-approved 501(c)(3) charities at any time.

Example:

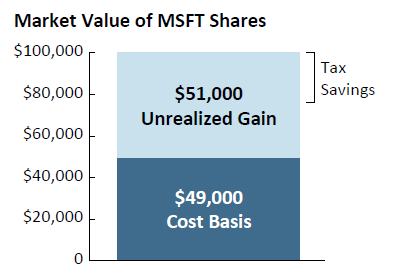

An individual was granted 2,200 shares of Microsoft for $49,000 in 2010 that is now worth $100,000 today. The individual and her or his spouse have a higher than normal income of $300,000, and they normally donate an average of $20,000 a year. By opening a donor advised fund, the individual will be able to donate the full $100,000 in one year, taking the full deduction in 2015, without paying any capital gains tax. The tax savings, at an estimated 20% rate, should be over $10,000, all while lowering overall income taxes for the year, which were previously expected to be higher than normal. This individual can now manage the account for the next 5 years’ worth of gifting.

Using Donor-Advised Funds in Other Planning Areas:

Estate planning is an important part of an individual’s overall financial health, as it pertains to the desired distribution of assets in life and in death. Unfortunately, this important aspect is often overlooked. Individuals delay finalizing their estate plans due to uncertainty surrounding which charities they want as their ultimate beneficiary in wills or charitable trusts. By listing a donor-advised fund as the legal beneficiary, individuals are able to simplify the estate planning process by updating the list of desired charities through their account, rather than engaging attorneys to update wills or trusts. Donor-advised funds often come with a consulting component where a dedicated team can help make donations to charities within specific categories of interest.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.