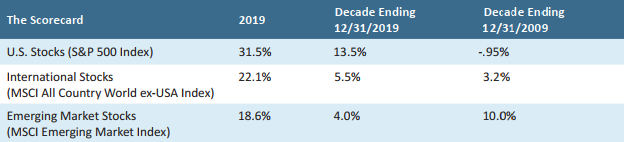

2019 turned out to be a fantastic year for the financial markets as nearly every asset class had strong performance.

Recall that entering 2019, the Federal Reserve had increased interest rates seven times, there was rampant uncertainty about Brexit in Europe and the trade war was impacting revenue growth in both the U.S. and in China. U.S. Stocks measured by the Standard & Poors 500 experienced a peak to trough decline of 15.7% over 16 trading days in December 2018 and Wall Street analysts were busy issuing recession predictions as we entered 2019. This is a great example of why it is so difficult to time the markets.

What Changed?

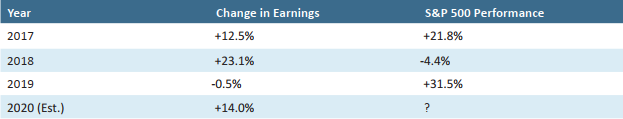

Financial Markets discount the future based on what is knowable at any point in time. In hindsight, the stock market decline in December 2018 was discounting the impact of higher interest rates, a slowing economy from the trade war and uncertainty in Europe from Brexit. Because financial markets look ahead, the correlation between what is actually occurring today and price action tends to be uncorrelated. Here’s an example comparing the earnings growth and the performance of the S&P 500 Index.

Equity Fund Assets

In 2019, instead of continuing to increase interest rates, the Federal Reserve cut rates three times and signaled that they stand ready to reduce rates further if needed. The trade war ended up slowing business some but didn’t have the dire impact that was predicted at the end of 2018. There hasn’t been a true settlement and I don’t expect a meaningful settlement before the election. The uncertainty over Brexit ended with Boris Johnson’s big victory a few weeks ago. One of the reasons 2019 was a great year is that things didn’t turn out as bad as the markets were expecting in late 2018.

Investing Trends During the Last Decade

The last decade was good to great for most financial assets as we dug out from the financial crisis of 2008-09. Some of the biggest trends during the decade were:

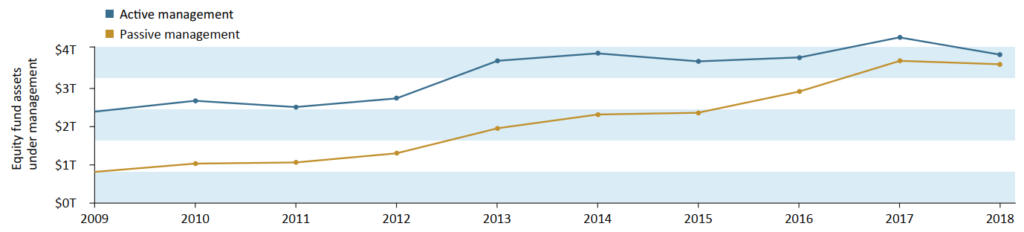

- Growth in Passive Investing (Index Funds)

- Private Equity’s increasing influence

- Shrinkage of public stock availability

Investor money gravitates towards the highest returns and passive index funds have generally outperformed active managers in recent years, especially when you consider after-fee returns. According to Morningstar, assets in passive equity funds increased over four-fold while assets in actively managed funds increased less than two-fold during the last decade. All of the increase in active funds came from market returns. Passive investing now makes up nearly half of the U.S. stock market. At Freestone, we use both passive and active managers in our strategies because we think there are advantages and disadvantages with both approaches.

Private equity is eating up the world. They own the gym, the pet shop, the dentist’s office and may also be selling you electricity. Once a small part of global finance, the industry has quietly amassed a portfolio of over $3.4 trillion with rapid growth during the last decade. Returns of private equity funds likely have been higher than public stock market investments in the past however as we’ve seen numerous times, when a strategy becomes popular and the amount of assets increases significantly, returns tend to suffer. Freestone has been an active participant in the private equity space with our Real estate and series of Advantage funds. We recently sold our private golf clubs to a large private equity sponsor. We continue to think that private equity investing makes sense but in today’s high-priced environment, we are primarily focusing on niches that we believe are either less correlated to the high asset prices or trading at depressed prices, like certain energy assets.

Somewhat related to the boom in private equity has been the steady shrinkage in the availability of U.S. stocks. In 1996, there were over 8,000 U.S. companies with public-traded shares as compared to a little over 4,000 today. I believe some of the reasons behind the shrinkage include:

- Regulation complexity of being a public company

- Buyouts and acquisitions

- Capital available through private equity and debt

- Private companies choosing to stay private

According to Statista, there are approximately 2,000 U.S. Exchange Traded Funds in the U.S. with over $3 trillion in AUM at the end of 2018. In addition, there are 9,600 U.S. based mutual funds with $17.7 trillion. Combined you have 11,600 ETFs and funds, but only 4,400 public companies.

Looking Ahead

We expect 2020 to be a decent year for stocks and real estate.The economy is performing reasonably well, and election years are generally strong stock market years. We recognize that we are now ten years into an economic recovery and are overdue for a return to a more normal business cycle but think that will occur sometime after 2020.