Wall Street usually begins the year with an exercise in predicting the unpredictable.

It is human nature to try to predict the future even though there is no evidence that the short-term future of the investment markets can be predicted in a consistent manner. We do know, however, that when stocks are selling at high valuations as they are today, future returns are likely to be lower. When bonds are yielding 1%, we know that returns are most likely going to be very low, too.

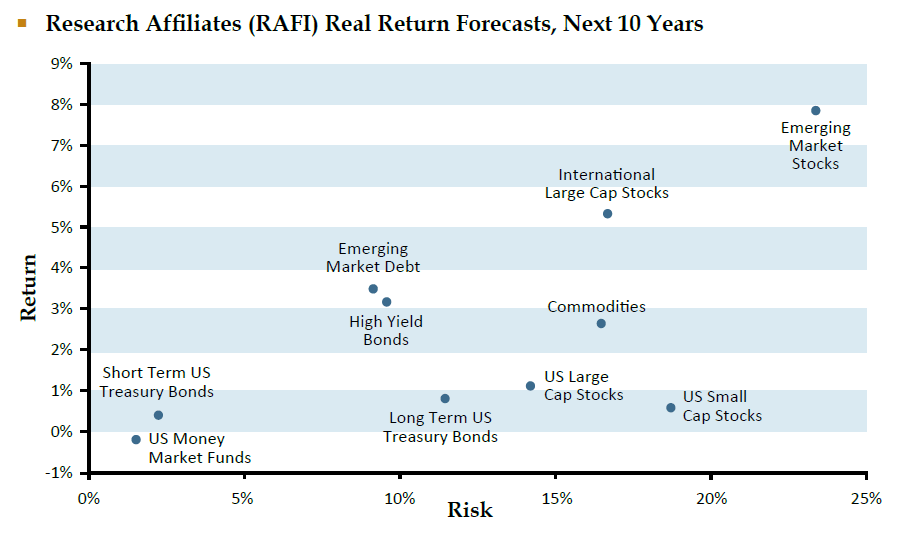

Rob Arnott is the founder of Research Affiliates (RAFI), which is a research driven investment firm that mostly manages various index funds using “smart beta.” He has had a distinguished and successful career as both an academic and an investor. We think RAFI’s funds are mildly interesting, but what we really like is RAFI’s real return forecasts for different asset classes. RAFI’s forecasts have been reasonably accurate in the past and, unfortunately, its return forecasts over the next ten years are relatively low. “Real Return,” as used in the chart below, are returns in excess of inflation. Many inflation estimates are roughly 2.2% annually, so you would need to add 2.2% to the below return forecasts to arrive at the annual total return forecast based on RAFI’s Real Return forecasts.

In most cases, investors require a minimum real return of 4-6% annually to make their financial plans work over the long term. With real return forecasts in most traditional asset classes below this level over the next ten years based on RAFI’s Real Return forecasts, we think it is going to be a challenging time for investors. Keep in mind that for many of our clients, investing is at least a 20 year process and return forecasts can change quickly if we have a bear market.

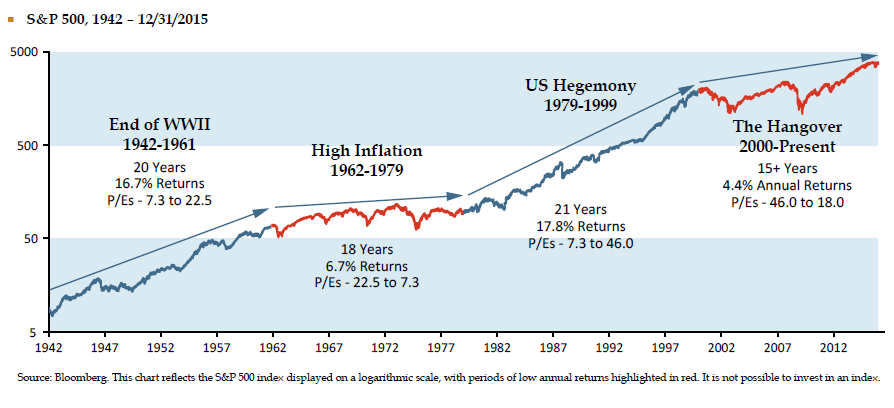

This period of low returns has actually been in place since 2000. The U.S. stock market as measured by the S&P 500 has averaged a 4.4% return (or 2.3% real return in excess of inflation) since 2000.

Returns over the long-term tend to go through cycles. High returns inevitably result in high valuations, which then lead to low returns until valuations return to earth. The low returns set the table for future higher returns. As humans, when an asset class has had high near term performance, we tend to think that the high returns will continue, but it often works in opposite fashion. Currently, many of the traditional asset classes have higher valuations, and in the case of longer term bonds, valuations are in nosebleed territory. This is a primary factor in why future returns are expected to be so low.

When we started Freestone in March of 1999, the U.S. stock market was at record high valuations (similar to today) and we believed that the future returns for U.S. Stocks were going to be low. This turned out to be correct. Here is a quote from our very first client letter in the Spring of 1999:

“Currently the mania du jour is the stock market. Evidence is everywhere that it will end very poorly for those that get caught up in it.”

The major difference between 1999 and today is the yield on the 10 year Treasury bond. In 1999 the yield was 6.4% versus the 2.2% it is today. The higher yield in 1999 allowed the Federal Reserve to reduce interest rates dramatically, which propped up stock prices. The Fed doesn’t have that luxury today.

Our Thoughts: Today’s Low Return Environment

- Maintain overall lower stock market exposure than normal.

- Increase the percentage invested in non-U.S. stocks. We believe future returns will be higher for non-U.S. stocks.

- Increase short term bond exposure as a place to hold cash while waiting for better prices.

- Continue to overweight non-traditional investments.

- Take a long-term view to investing – a low return environment cannot persist forever. At some point in the future, we will enter a period where returns will be much higher than today.

We encourage you to contact a Client Advisor with any questions.

Important Disclosures: This article contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Nothing in this article is intended to provide, and you should not rely on it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment or wealth management strategy, and you should not make any decisions based on the information in this article. While we believe the information in this article is reliable, we do not make any representation or warranty concerning the accuracy of any data in this article and we disclaim any liability arising out of your use of, or reliance on, such information. The information and opinions in this article are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise you of any change in such information in the future. This article speaks only as of the date indicated. Past performance of any investment or wealth management strategy or program is not a reliable indicator of future results. Portions of this article constitute “forward thinking statements” and are subject to a number of significant to a number of significant risks and uncertainties. Any such forward-looking statements should not be relied upon as predictions of future events or results.