The final quarter of the year is a great time to consider year-end planning. One of the primary planning items to consider is converting some or all of your Traditional IRA into a Roth IRA. This is known as a Roth Conversion.

While there are regulatory requirements that dictate contribution eligibility for both Traditional and Roth IRAs, Roth Conversions are available to anyone who owns assets in a Traditional IRA. They can be done at any point in time, in any amount. Conversions typically provide the most benefit to those in lower tax brackets, or who anticipate being in the same or a higher tax bracket during retirement. For example, during your working years, you are in a 37% tax bracket and have accumulated significant IRA assets. You decide to retire at age 62, at which point your tax bracket drops to 22%. This may be an ideal time to consider converting some of your Traditional IRA funds into a Roth IRA.

So, what’s the catch? Converting funds from a Traditional IRA to a Roth IRA requires you to pay ordinary income tax on the amount converted in a given tax year.

The primary benefit of a Roth IRA over a Traditional IRA is tax treatment upon distribution. Assets in both types of accounts will grow tax-free. You may even get a tax deduction for contributions to your Traditional IRA, depending on your income level. When Traditional IRA funds are withdrawn, however, they are taxed to you as ordinary income in the year distributed. Annual distributions (called Required Minimum Distributions, or RMDs) are required from Traditional IRAs beginning in the year you turn 72. Roth IRAs, by contrast, are funded with after-tax money, grow tax-free, and remain tax-free when distributed, whether you use them to fund your living expenses later in life, or leave them as a tax-free inheritance for your heirs. You are never required to take distributions from a Roth IRA during your lifetime.

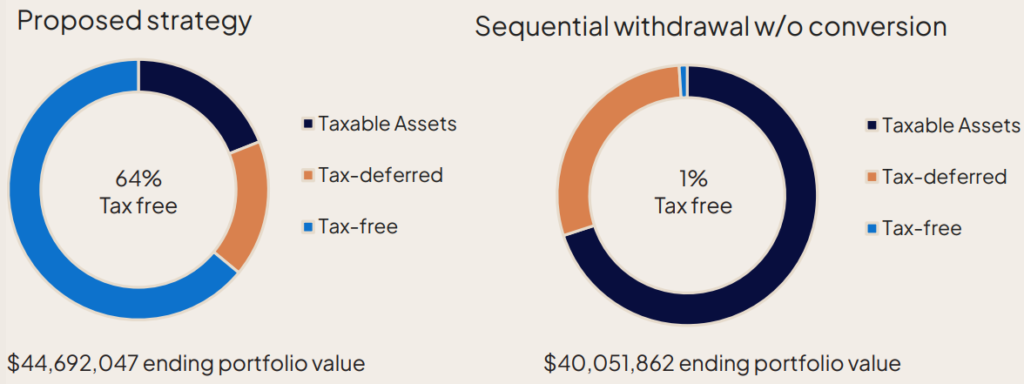

Consider the following example: Clients retire at age 58 and are in the 24% tax bracket. Over the next 14 years (between retirement and age 72 when RMDs begin), they convert enough to “fill up” the 24% tax bracket each year (an average of $160,000 per year in this example). Assuming a 22% terminal tax rate (i.e., tax rate at death), these clients would have about $4.6 million more in tax-free assets at the end of their plan than they would have without the conversions. This means their heirs will receive a larger, and significantly more tax-free, inheritance than they would have without the Roth Conversions.

When converting funds from a Traditional IRA to a Roth IRA, you are still liable for the taxes on the converted amount, but with the right timing you may pay significantly less tax by converting than you would later when RMDs begin (RMDs cannot be converted; they must be deposited into a taxable account once distributed). Often, a good time to consider a conversion is shortly after retirement or a large liquidity event (such as the sale of a business) when your earned income may be quite low, even if your net worth is very large. By properly timing your conversions, you may be able to keep your tax rate lower in future years when RMDs begin as well, since they are calculated based on the year-end value of the Traditional IRA account.

Since Roth Conversions are available in any amount, you can work with your tax professional on an annual basis to evaluate the potential impact of a conversion. Your tax professional will be able to assist with a recommended conversion amount that will be beneficial for you but will not bump you into a higher tax bracket. This amount may change year to year, and conversions are permanent once made, so it is very important to discuss this in detail with your tax advisor during the fourth quarter of the year.

As with most financial items, this is very specific to your own tax situation, and no action should be taken without first consulting your tax professional. But if you have an IRA balance, and your income has dropped due to retirement or a business sale, consider converting some of your Traditional IRA to a Roth IRA before the end of the year. Your Freestone Client Advisor can help with an initial review of your situation.

*Source: RightCapital, Inc. The rate of return is based on a hypothetical financial plan with a target allocation of Right Capital’s growth model, which is a 70/30 equity and fixed income model.

Important Disclosures: Nothing in this document is intended to provide, and you should not rely upon it for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any retirement savings IRS conversion strategies, and you should not make any decisions regarding such strategies based on the information in this document. The intention of this document is educational, and it is intended only to discuss limited aspects of retirement savings plans in general terms. This document is not a comprehensive or complete summary of considerations regarding retirement savings plans or IRS conversions. Each individual is in a different situation and has different items to address, and the options in this document are not appropriate for everyone. Please consult your Freestone client advisor regarding options specific to your needs.