As an advisor, it’s common to encounter clients who seek investment opportunities that fall outside of traditional stocks and bonds. Some want increased diversification, or assets non-correlated to market performance; others seek customized solutions that fit an individual situation. Occasional inquiries also span the “crypto curious” or “meme trends” spotted in the media.

In this piece we’ll discuss

- How a hybrid investment approach gives advisors the flexibility, control and freedom to serve their clients their way.

- Why Freestone is uniquely poised to provide unique investment allocations for its HNW and UHNW clients.

If your current firm is like many, the usual response is to offer REITs or mutual funds, but these tend to lack diversification (still being tied to market performance) and are less customizable. Although large wirehouses and national broker-dealers have access to large institutional investments (such as alts), they usually fall short on niche and localized opportunities. Conversely, smaller RIAs or broker-dealers don’t often have the in-house resources or expertise to source contrarian investment opportunities, so advisors are left without compelling investment options for their HNW and UHNW clients. There may also be client-driven investment opportunities that you (or your team) may be ill-equipped to fully evaluate.

A hybrid approach delivers more

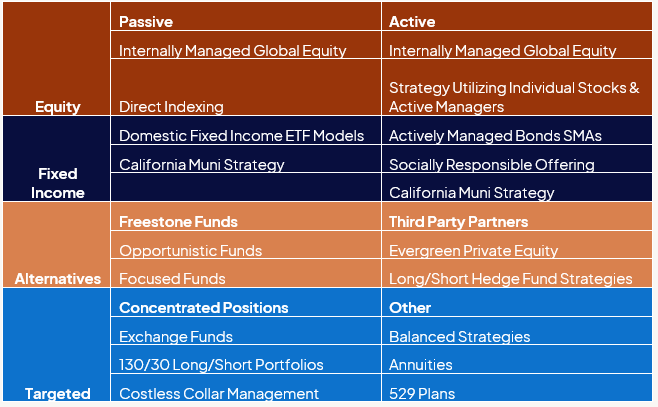

At Freestone, we offer an open architecture/hybrid approach to investments. We source and operate many of our own strategies, and access well-respected, external investment managers to complement our work with additional diversification, insight and expertise. To meet the needs of our HNW and UHNW clients, our advisors can further tailor a unique investment allocation.

The perks of in-house investment team

Comprising Freestone’s 15-member investment team are portfolio managers and analysts that assess investment merits, operational due diligence for additional risk management, and an investment committee that approves investment recommendations and oversees strategies. Our team brings extensive experience across multiple investment fields including (but not limited to) investment banking, hedge funds, private equity, and real estate. With an average of 20 years of expertise each in their respective fields, our in-house team is uniquely qualified to review client-led investment opportunities, providing thoughtful perspectives and analyses.

Clients deserve compelling options

If your clients seek more investment customization to meet their individual needs, Freestone’s hybrid approach offers more opportunities. Our firm sources its own alternative investment offerings, both locally and across the U.S. We’re nimble enough to scout out unique opportunities that other larger firms cannot, due to the size of the investment. We invest as close to the underlying asset as possible for more control and negotiation power, and operate under strict reporting and documentation requirements.

With 17 current alternative funds, we evaluate these opportunities closely as part of our overall investment mix. We source contrarian opportunities with stable, risk-adjusted returns, sticking to the core assets and what we know. Freestone remains focused on wealth preservation and as such, we invest in alternatives that can help mitigate taxes and inflation risks.

The best advisors seek out opportunities; consider this one yours

Freestone continues to focus on the client, creating opportunities for our advisors to do their best and most focused work.If you’re an advisor who puts their clients first, andyou’d like to learn more about how we approach financial planning and other business-related initiatives, we want to hear from you.

Schedule a time with our Director of Recruiting to learn how Freestone could help in the next phase of your career. Schedule a call today.

Like what you read? Sign-up for Freestone Insights for relevant financial planning and investment advice.

Disclosures: The information shown on this page is for discussion purposes only. This page provides general information that is only a summary of certain employment benefits that we believe might be of interest. Information shown on this page is not intended to be relied on for any employment decisions nor is any of this information a guarantee of employment terms. Information shown are subject to change without notice, and we do not undertake any responsibility to update any information herein or advise of any change in such information in the future.