Q3 2025: Falling Rates, Soaring AI, and the Long Game for Investors

October 28, 2025

The risk-on rally pressed ahead in the third quarter as equity markets climbed to new all-time highs. A well-telegraphed Federal Reserve rate cut, resilient U.S. growth, and robust corporate earnings helped power gains across global markets. AI-related investments once again stole the spotlight, driving both excitement and concentration risk. Meanwhile, falling interest rates lifted bond prices and supported credit markets as investors chased yield and stability. Together, these forces show a market enjoying powerful tailwinds but also one that demands discipline as cycles evolve.

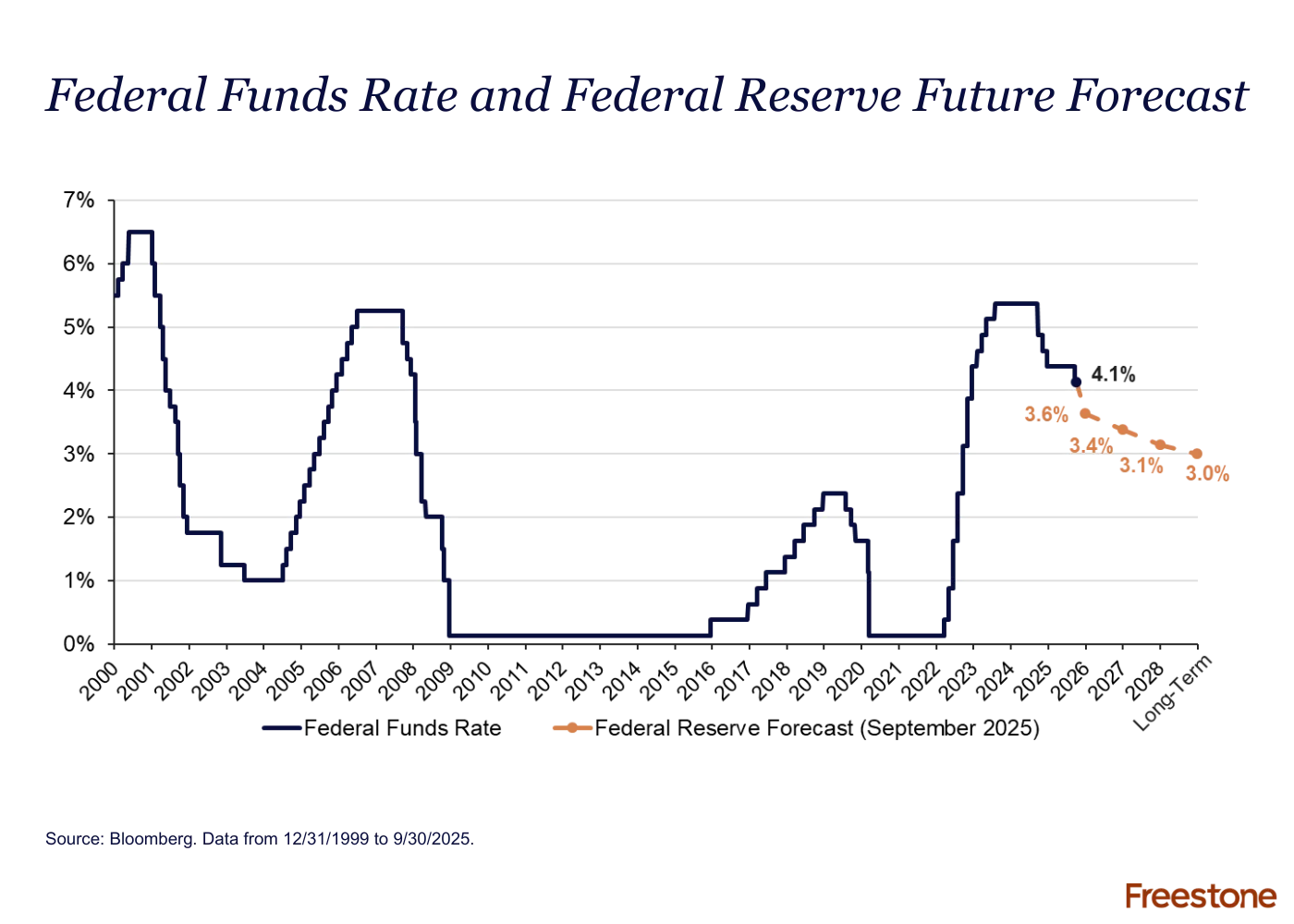

Rethinking the Path of Rate Cuts

The Federal Reserve delivered its first rate cut of 2025 in September, setting the stage for two more 25 basis-point reductions expected in October and December. With GDP expanding at an annualized 3.8% in 2Q and expected to remain above 3% in 3Q, the economy continues to show impressive resilience even as inflation risks linger.

- The Fed’s “dot plot” projects the Fed Funds rate gradually returning toward 3% by 2027–2028, above post-pandemic lows but in line with long-term norms.

- Policymakers anticipate a total of four more cuts over the next 18 months, signaling a steady normalization rather than a rush to zero.

Why it matters: A 3% long-run rate anchors expectations around sustainable growth and inflation. For investors, that means a more balanced environment where both stocks and bonds can offer meaningful returns rather than relying on extraordinary policy support.

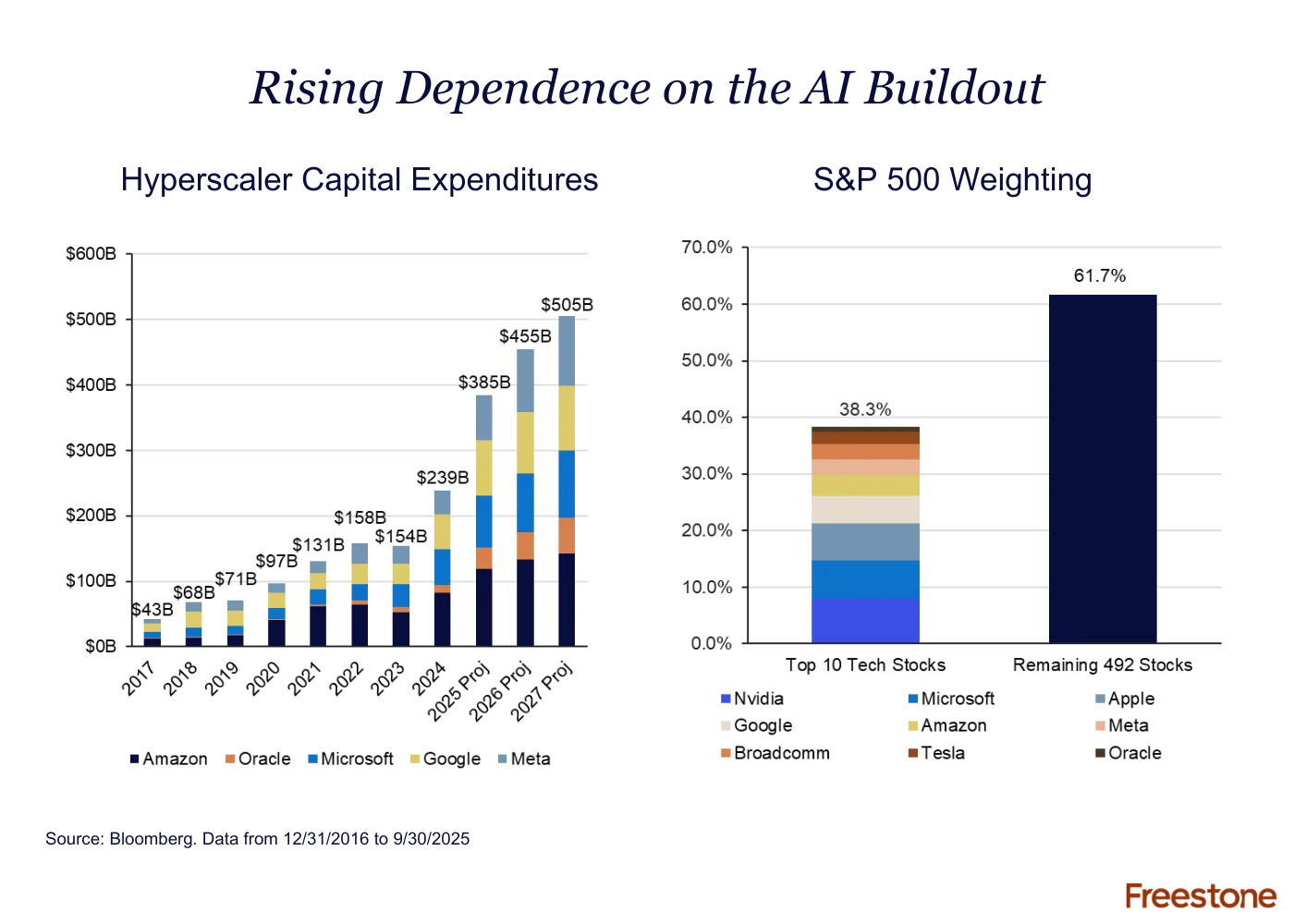

Rising Dependence on the AI Buildout

AI remains the defining investment story of 2025. Capital expenditures among the largest technology firms — Amazon, Microsoft, Google, Meta, Oracle, and others — are accelerating toward $500 billion annually as hyperscalers race to build out data centers, chips, and cloud infrastructure. The top 10 tech companies now make up 38% of the S&P 500’s weighting, leaving markets increasingly dependent on their performance. Even AI leaders like OpenAI’s Sam Altman have hinted that expectations may be running ahead of reality.

- History reminds us that capital cycles follow a familiar pattern: strong profits invite competition, competition fuels capacity, and capacity eventually erodes returns. From 19th-century railroads to 1990s telecom and 2010s shale, periods of rapid investment have often given way to oversupply and thinner margins.

- So far, AI-related spending by the top tech companies appears to be in a healthy phase of the capital cycle, with revenues and margins keeping pace with rising investments to meet customer demand.

Why it matters: Great technologies don’t always make great investments. Capital cycles remind us that too much money chasing the same opportunity raises the odds of disappointment. This means staying selective, focusing on companies with durable advantages, prudent management, and the balance sheets to endure when enthusiasm cools.

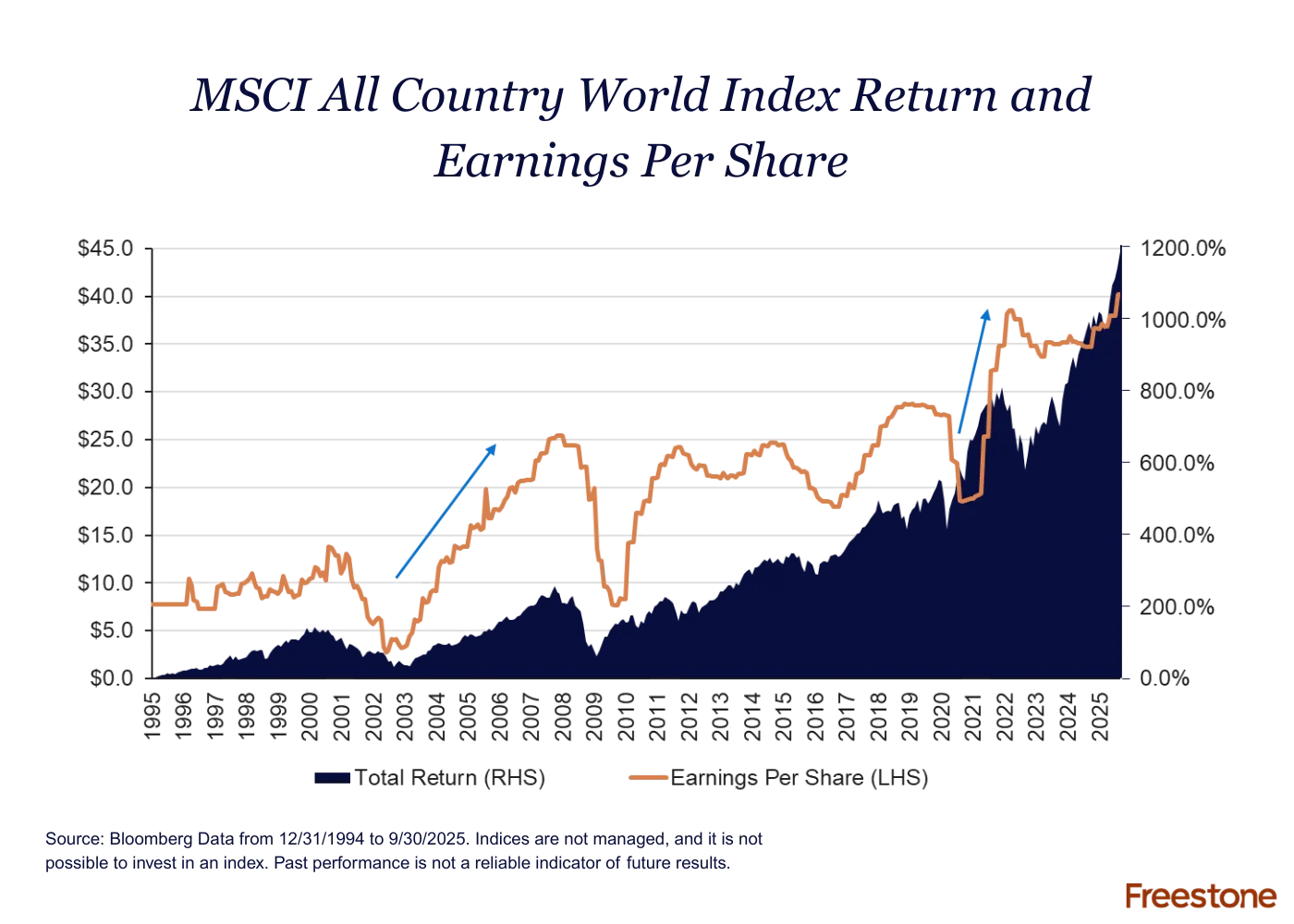

Focusing on Earnings for Long-Term Returns

Despite shifting narratives, one truth continues to anchor equity markets: over time, earnings drive returns.

- Corporate earnings growth has proven resilient through cycles, supported this year by solid consumer spending, stable margins, and a modest boost from AI-related productivity gains.

- While valuations for large-cap technology firms remain elevated, broader market earnings growth continues to reflect durable global demand and improving efficiency across sectors.

Why it matters: Short-term volatility and political noise may dominate headlines, but earnings compound over time. Focusing on businesses with steady profitability, strong balance sheets, and disciplined capital allocation remains the most reliable path to long-term returns.

Keeping Portfolios Grounded

Falling rates are providing a welcome tailwind, corporate earnings remain healthy, and technological innovation is driving genuine economic progress. Yet history reminds us that exuberance can overrun fundamentals. While the AI revolution is real, valuations that price in perfection leave little margin for error. At Freestone, we’re preparing for volatility by emphasizing long-term fundamentals: durable earnings, prudent capital allocation, and diversified portfolios that can thrive across cycles. The AI gold rush may still be on, but lasting wealth is built by those who mine with patience and discipline.

Disclosures: For educational and discussion purposes only. Nothing herein is intended to provide, and it should not be relied upon for, accounting, legal, tax or investment advice or recommendations. We are not making any specific recommendations regarding any security or investment strategy, and you should not make any investing decisions based on the information herein. This document contains general information, opinions and market commentary and is only a summary of certain issues and events that we believe might be of interest generally. Opinions are subject to change without notice. While the information presented is believed to be reliable, no representation or warranty is made concerning the accuracy of any information provided, and we do not undertake any responsibility to update such information or advise you of any change in such information in the future. This document speaks only as of the date indicated. Indices referenced in this document are not managed and it is not possible to invest in an index. Past performance of any investment strategy is not a reliable indicator of future results. Links to third-party articles and/or websites are for general information purposes only, and not endorsed by us and you are encouraged to read and evaluate the privacy and security policies on the specific site you are entering.